Talking Points:

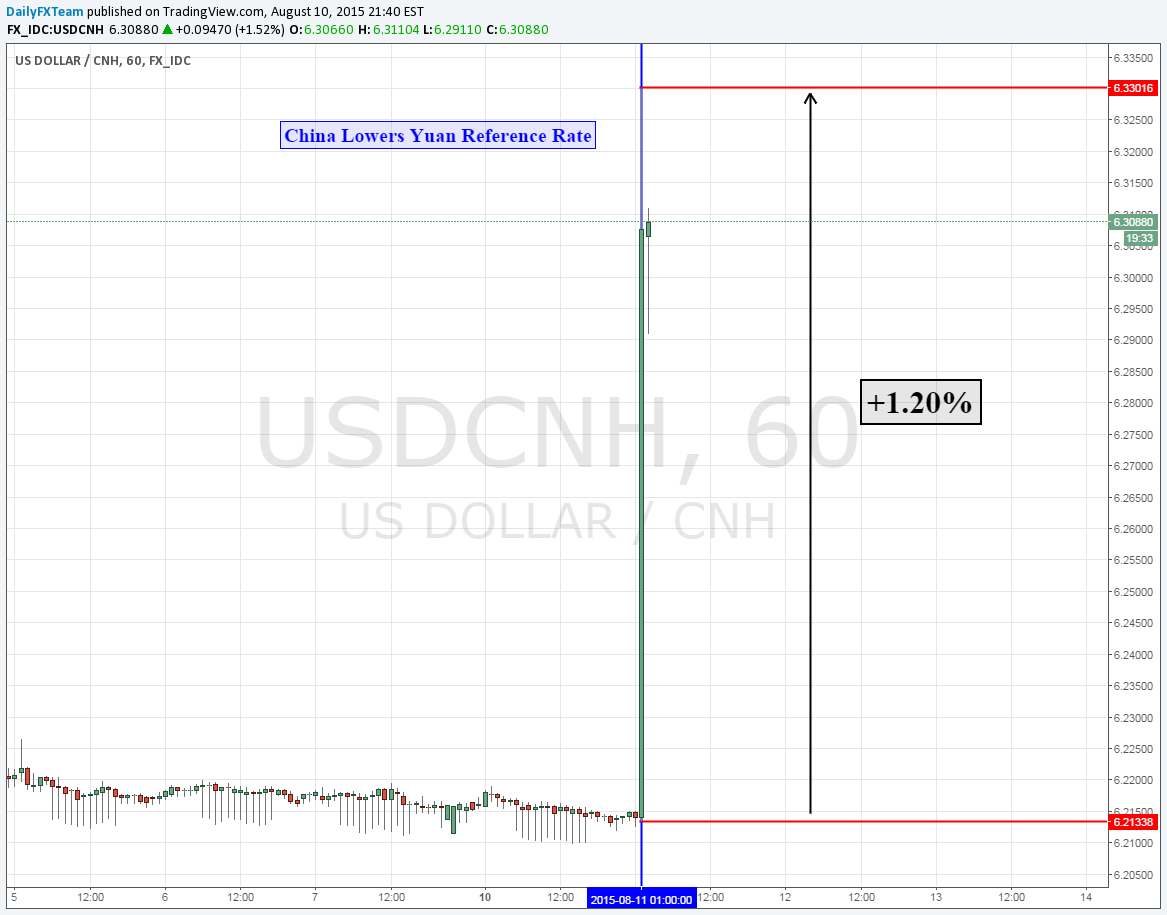

- USD/CNY declines more than 1.2 percent in morning trade

- PBOC lowers the Yuan reference rate by a record high

- A spillover effect can be seen in the AUD/USD

The Offshore Chinese Yuan fell more than 1.20 percent versus its US counterpart (USD/CNY) in morning trade. The move lower came after the People’s Bank of China lowered the Yuan reference rate by 1.85%. This is the largest decline in the reference rate to date. PBOC said that the decline in the reference rate was a one-off adjustment to the Yuan effective FX rate being stronger than other currencies. In addition, the central bank said the decline in the reference rate is also meant to keep the Yuan stable at a reasonable, equilibrium level.

Over the weekend, China’s exports fell to 8.3 percent (YoY) in July marking the largest drop in four months. China is the largest exporter nation in the world. A weaker currency tends to help a nation whose main source of revenue derives from exporting. Today’s record drop in the Yuan reference rate could potentially boost foreign demand for goods in China.

In addition, a spillover effect can be seen in the AUD/USD exchange rate as it fell more than 1.30 percent after the PBOC announcement. In its quarterly monetary policy statement, the RBA said that risks from China are tilted to the downside due to some uncertainty about its growth. Weakness in exports and the sudden record-breaking decline in the Yuan reference underpin RBA's uncertainty about China. Indeed, Australian front-end and 10-Year government bond yields declined signaling that the markets are becoming more expectant of possible near-term RBA rate cuts.