U.S. Dollar Trading (USD) mild risk aversion persisted throughout the day as China lowered its GDP target to 7.5% vs. 8% in 2012 and we had some negative news out of Europe regarding Greece private sector bond participation in the new bailout plan. US data was strong with February Services PMI at 57.3 vs. 56.1 forecast. Stocks in the US finished slightly lower but well off the lows of the session and the Dollar was steady against most of the majors. Looking ahead, no major US data tonight.

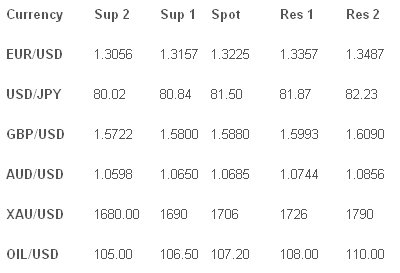

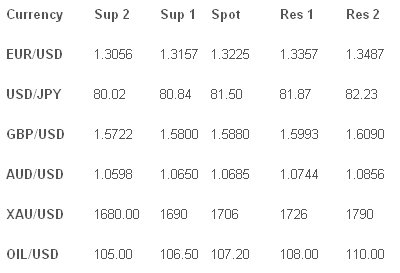

The Euro (EUR) the EUR/USD dipped to day lows in the European session 1.3160 before reversing with the recovery in US stocks but the move higher was mild and resistance was stiff above 1.3225. Support was seen coming from the EUR/JPY cross which bounced off Y107 and is very important for the majors recent direction. The Sterling (GBP) dipped into European session but was supported under 1.5800 on two attempts before rallying above 1.58500. The EUR/GBP has been under pressure and the GBP buying through this cross has been a constant source of support in last week. The market is looking to resume its uptrend with or without the Euro and so the EUR/GBP is being closely watched for signs of GBP independence. Looking ahead, EU Q4 GDP forecast at -0.3% Q/Q. Also, UK Halifax House Prices are forecast at 0.3% vs. 0.6% previously.

The Japanese Yen (JPY)

Oil & Gold (XAU) Gold fell back to $1700 and has lost a lot of its attraction recently as QE3 expectations are wound back. OIL/USD failed to rally on the weekend Iran/Israel posturing with some suggesting fatigue on the Iran story. Support was seen at $105.50 before recovering to $107 in volatile trade.

Pairs to watch

AUD/USD RBA to support?

XAU/USD $1700 under pressure

TECHNICAL COMMENTARY

The Euro (EUR) the EUR/USD dipped to day lows in the European session 1.3160 before reversing with the recovery in US stocks but the move higher was mild and resistance was stiff above 1.3225. Support was seen coming from the EUR/JPY cross which bounced off Y107 and is very important for the majors recent direction. The Sterling (GBP) dipped into European session but was supported under 1.5800 on two attempts before rallying above 1.58500. The EUR/GBP has been under pressure and the GBP buying through this cross has been a constant source of support in last week. The market is looking to resume its uptrend with or without the Euro and so the EUR/GBP is being closely watched for signs of GBP independence. Looking ahead, EU Q4 GDP forecast at -0.3% Q/Q. Also, UK Halifax House Prices are forecast at 0.3% vs. 0.6% previously.

The Japanese Yen (JPY)

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

USD/JPY was stable near the Y81.50 but the week ahead is packed with risk events that should test the recent rally with important US data. Only a break below Y80 would change the upside bias with most traders and analysts now comfortable with the uptrend idea and new levels. Crosses are all under review with talk the carry trade demand could resume through high yielders such as the AUD/JPY and ZAR/JPY. Australian Dollar (AUD) the Aussie fell on the China news with the two countries fates interlinked and any Chinese data being traded through the AUD/USD of late. The RBA is today with a hold expected given recent stronger Aussie jobs data. Looking ahead, RBA Rate announcement forecast to hold at 4.25%.Oil & Gold (XAU) Gold fell back to $1700 and has lost a lot of its attraction recently as QE3 expectations are wound back. OIL/USD failed to rally on the weekend Iran/Israel posturing with some suggesting fatigue on the Iran story. Support was seen at $105.50 before recovering to $107 in volatile trade.

Pairs to watch

AUD/USD RBA to support?

XAU/USD $1700 under pressure

TECHNICAL COMMENTARY

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.