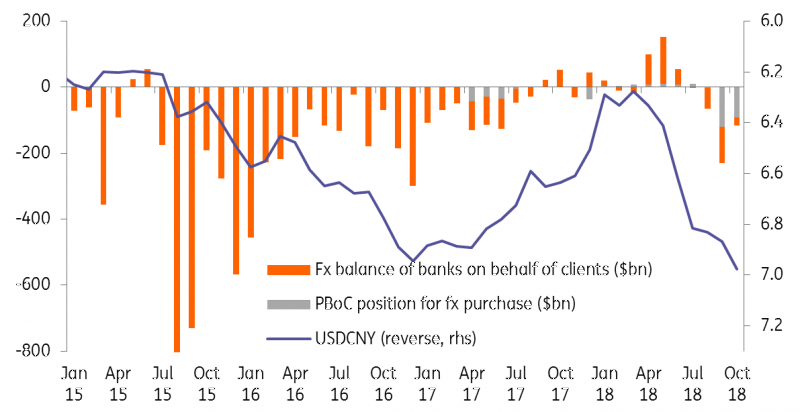

The People's Bank of China spent $91.58 billion on foreign-exchange purchases in October. We believe this means the central bank wants USD/CNY to cross the 7.0 mark, but without any market hiccups

China's central bank spends second largest amount on forex purchases in 2018

In October, the Chinese central bank spent $91.58 billion on forex purchases, which is the second largest amount in 2018. However, this was less than the biggest forex purchase in September, which was $119.39 billion.

This data has always been eye-catching, especially during the yuan's depreciation, because it implies the central bank has spent money in the market to stop or slow down the depreciation by buying dollars. And we don't completely rule out this possibility.

Given the speed of the monthly yuan depreciation in October, which was 1.56%, up from 0.55% in September, we believe the central bank might have bought dollars to intervene as the speed of the depreciation indicates more intervention.

China defending USD/CNY at 7.0?

Will the central bank intervene again in the coming months?

We don't think anyone can answer this question, not even the central bank.

- It seems the central bank is allowing the yuan to be more responsive to news, data and ad hoc information, which means the yuan is more flexible. This should imply the central bank doesn't intervene frequently.

- But the central bank could be intervening with a target. This is more interesting because the market then wants to know what the 'target' is. Is USD/CNY at 7.0 a target or is there a line below that?

We think the central bank could be targeting small ranges that would lead USD/CNY to cross 7.0. For example, 6.91- 6.95 might be a target range for a certain period, then a weaker yuan range of 6.95 - 7.00 for later, so that eventually, USD/CNY crosses 7.0 without surprising the market.

Therefore, we don't agree that the People's Bank of China won't allow USD/CNY to cross the 7.0 handle.

We believe USD/CNY will depreciate when trade war tension escalates, and crossing 7.0 looks increasingly likely.

The central bank is more likely to be managing market sentiment by making sure the exchange rate doesn't surprise the market. The scale of interventions will become smaller as the exchange rate approaches 7.0 so that foreign exchange reserves only fall mildly.

For now, we maintain our forecast at 7.0 by the end of this year.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”