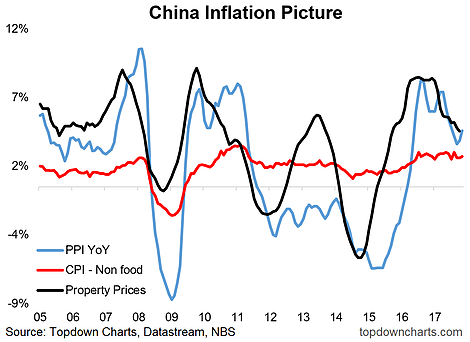

Just released Chinese inflation data for May showed a slight rebound in the pace of producer price inflation, and a basically steady pace of consumer price inflation. But looking at the bigger picture (something I like to do), the chart shows a clear sensitivity of PPI and CPI to property prices.

This is for good reason as the property market is still a major driver of economic activity in China. Indeed, if I were to pick only one piece of data to watch for China it would be property prices. As outlined previously, my base case for the Chinese property market outlook is for a further slowdown in the second half of the year. Among other things, this will likely mean a slower pace of inflation in the months and quarters ahead.