China's industrial profit growth slowed in October, with just 13 out of 41 sectors (including the consumer goods group) posting improved profits on a monthly basis. But businesses could enjoy better profitability in 2019 if China were to cut import tariffs on more goods.

Slower profit growth a widespread phenomenon in manufacturing

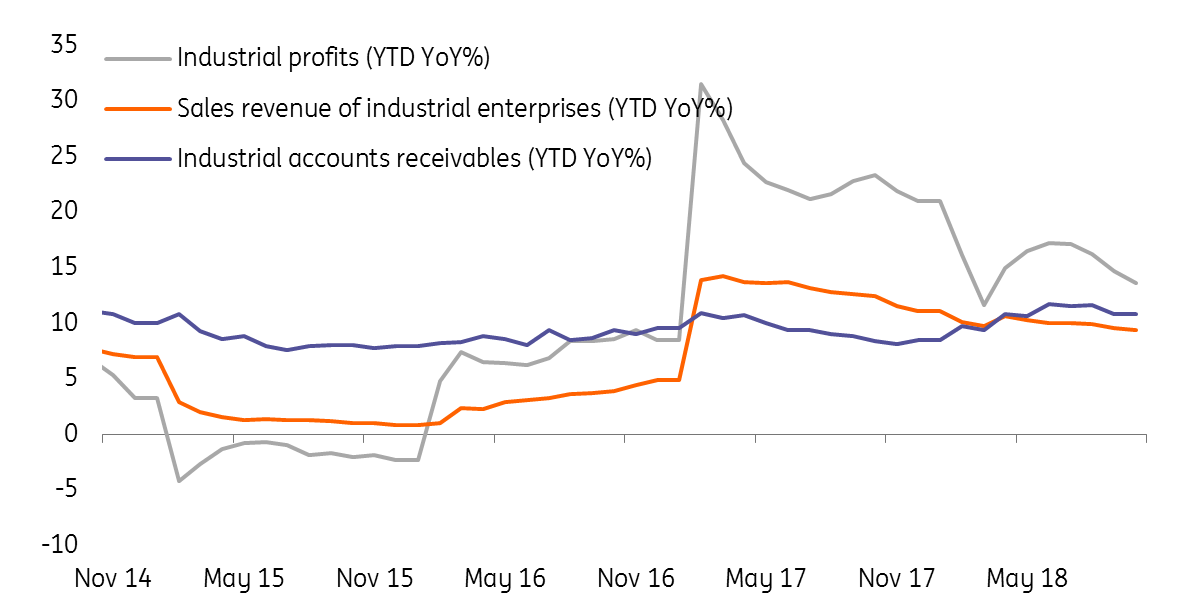

Industrial profit growth slowed to 3.6% year-on-year in October from 4.1% in the previous month. This puts the year-to-date growth at 13.6% YoY in October, a slowdown from 14.7% YoY growth as of September. Comparing the two growth rate measures, it would seem the profit squeeze among Chinese manufacturers has been severe.

On a monthly basis, there was a widespread slowdown. Lower commodity prices, like ferrous metals and crude oil, could be blamed for shrinking profits at mining companies and energy drillers. There may also be expectations of lower demand for commodities due to a slowing economy.

Not everything is unprofitable, consumer goods held up well

There are some bright spots. Profits from manufacturing consumer goods held up quite well in the last month. Textile and garments, food production, computers, telecommunication, and other electronics were among the 13 sectors which enjoyed monthly profit growth.

We see this profit growth coming from:

- Lower raw material and energy prices.

- Steady demand for consumer goods, both from domestic and foreign economies.

Profit squeeze came from high account receivables and slower sales revenue

China cutting tariffs could help lower production costs in 2019

Looking forward, production costs could be lower if China were to cut tariffs on more imports. This would offset higher tariffs on imports from the US, at least to some extent.

That's not to say an escalation of the US-China trade war won't hurt profits of Chinese manufacturers. It will, especially in terms of exports and related supply chain manufacturers. But if China were to cut import tariffs, more businesses will survive.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”