China industrial profits fell in April. Details show that industries that showed falling profits are those experiencing structural changes, including from the technology war. Stimulus measures will speed up to offset technology war damage.We expect the yuan to appreciate and so calm the A share market.

China industrial profits shrank in April

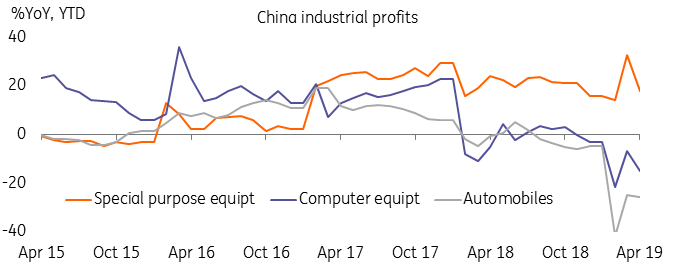

Industrial profits fell 3.4% YoY YTD in April. The fall in profits has continued since November 2018, except for in March (13.9%YoY YTD). We believe this falling profit trend will continue for most of 2019.

Structural changes are the reason behind profit changes

Examining the details by industry over several months, we find that the falls in profits in some sectors are structural.

- Automobiles has seen a fall in profits of 25.9% YoY YTD, in an industry that is disrupted by technology. Ride hailing apps mean less demand for private cars. If this meets with an economic downturn (possible in 2019) then the sector will experience an even bigger shrinkage in its profits.

- Damage from the trade war and the technology war between China and US could further extend to other economies, so putting the high-tech industry's profits as risk. Computer, telecommunication and other electronic equipment manufacturers has seen a 15.3% YoY YTD fall in profits. This category is often linked with the production of chemicals and products, which saw a 16.0% YoY profit fall in April. The technology war is brewing even faster in May 2019, and could continue for the rest of the year. We therefore expect the technology war to put pressure on industrial profits for the whole of 2019.

The technology war is brewing even faster in May 2019, and could continue for the rest of the year. We therefore expect the technology war to put pressure on industrial profits for the whole of 2019.

Stimulus measures supporting some manufacturers

Stimulus measures and therefore infrastructure projects support manufacturing.

Infrastructure projects are mostly in metro line construction. We see that this category had profit growth of 67.6% YoY YTD in April, suggesting stimulus measures have been in place.

As this is the early stage of infrastructure project construction, these projects also benefit the upstream miners. This was reflected in the profit growth of ferrous metal mining at 185.2% YoY YTD in April and also led to profit growth of 17.9% in specialised equipment, which can be used in mining.

Different sectors suffer from different levels of profit change

We expect stimulus measures to speed up to stabilise GDP growth

With falling business opportunities from other countries in the technolgoy sector, industrial profits in May 2019 could drop to 5.0% YoY YTD. Looking forward, industrial profits face drags on the economy from lower tehcnology exports, countering pulls from stimulus measures. Overall, we still expect profit shrinkage for 2019.

With China's technology manufacturers facing intensifying headwinds from other economies, the domestic economy needs to grow faster to offset some of these headwinds. We expect construction of infrastructure projects to speed up, and liquidity easing to match the funding needs from infrastructure projects so that GDP growth can reach at least 6.0% in 2019.

Yuan to appreciate

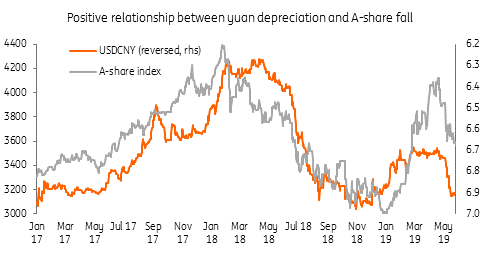

We also believe that USD/CNY and USD/CNH will continue to stabilise, with gradual slight appreciation, so that the yuan market can shake off substantial pressure from investors betting on yuan depreciation.

Another reason for our call for an appreciating yuan is that when the yuan is stable the onshore asset market is also stablev- important during a technology war that can affect asset markets worldwide because of the interlinked global supply chain.

Based on the above reasons, we believe that the yuan can appreciate back to the 6.75 level, a level seen back in the first week of May, by the end of 2Q19.

Stabilising yuan helps stabilisng the Chinese onshore stock market

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more