Investing.com’s stocks of the week

China grew at the slowest rate in 13 years in 2012 with an annual rate of 7.8% it wsa confirmed last night. Figures did show that the 4th quarter rebounded to 7.9% which will be encouraging moving into 2013. While most of the rebound was courtesy of an increase in spending by the government which had begun in the summer in an effort to avoid the much-feared “hard landing”. Looser monetary policy also allowed the housing market to continue expanding while a pick-up in global trade made the last quarter of the year a good one for the country’s exports.

China is not out of the woods yet however. Weakness in consumption spending had to replaced by government infrastructure but the new leadership in China has started to crack down on regional spending projects for fear of more dangerous debt dynamics. If consumption spending does not rebound then 2013 will not be as easy as some expect.

Overnight the S&P 500 closed at yet another 5 year high with the combination of strong global data, further dovish comments from Fed officials and an absence of a political storm, yet, over the US debt ceiling. Yesterday’s particularly strong data from the US came in the form of US housing starts that smashed to a four and half year high.

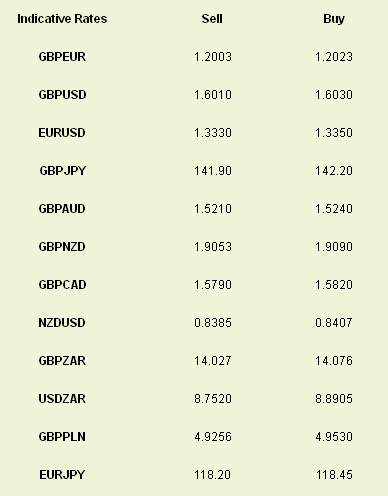

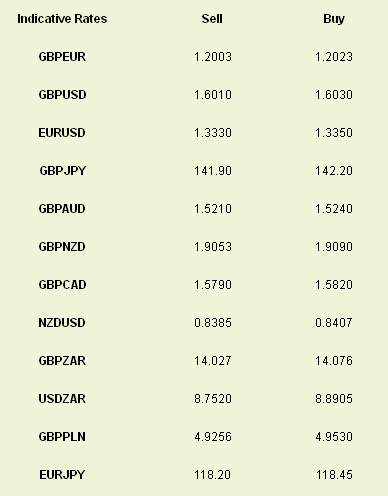

Sterling came in for an absolute pasting yesterday as investors positioned themselves for today’s retail sales numbers. In the wider sense we know that UK growth is likely to be poor through 2013 while the government’s deficit reduction is not hitting its self-assigned targets. The remedy for the former will involve further QE from the Bank of England although recent current account deficit figures suggest that the manufacturing/export turnaround is further away than ever. Add in the political pressure of an almost certain ratings downgrade and the uncertainty around the UK’s place within the EU and it’s easy to wonder why GBP hasn’t fallen more.

The lessening of the UK as a safe haven for investors from the Eurozone crisis has also hurt sterling but should provide support for GBP through 2013 as fears across the continent once again boil-up. The fact is also that the UK economy will perform a lot better than that of the Eurozone through 2013/14. As such, we view this move as a short-term trend and not the beginning of a GBP collapse.

In the short term, sterling does look focused on GBPEUR targets of 1.19 and 1.59 in GBPUSD.

China is not out of the woods yet however. Weakness in consumption spending had to replaced by government infrastructure but the new leadership in China has started to crack down on regional spending projects for fear of more dangerous debt dynamics. If consumption spending does not rebound then 2013 will not be as easy as some expect.

Overnight the S&P 500 closed at yet another 5 year high with the combination of strong global data, further dovish comments from Fed officials and an absence of a political storm, yet, over the US debt ceiling. Yesterday’s particularly strong data from the US came in the form of US housing starts that smashed to a four and half year high.

Sterling came in for an absolute pasting yesterday as investors positioned themselves for today’s retail sales numbers. In the wider sense we know that UK growth is likely to be poor through 2013 while the government’s deficit reduction is not hitting its self-assigned targets. The remedy for the former will involve further QE from the Bank of England although recent current account deficit figures suggest that the manufacturing/export turnaround is further away than ever. Add in the political pressure of an almost certain ratings downgrade and the uncertainty around the UK’s place within the EU and it’s easy to wonder why GBP hasn’t fallen more.

The lessening of the UK as a safe haven for investors from the Eurozone crisis has also hurt sterling but should provide support for GBP through 2013 as fears across the continent once again boil-up. The fact is also that the UK economy will perform a lot better than that of the Eurozone through 2013/14. As such, we view this move as a short-term trend and not the beginning of a GBP collapse.

In the short term, sterling does look focused on GBPEUR targets of 1.19 and 1.59 in GBPUSD.