China's most recent foreign reserves show net inflows. How is this possible with the ongoing trade and technology war? Will net capital inflows affect the yuan exchange rate?

Foreign reserves on the rise

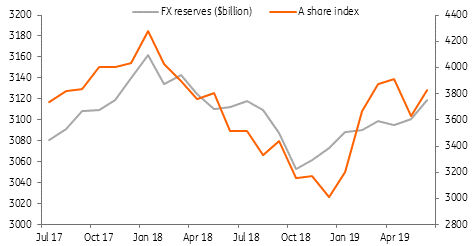

China's foreign reserves have only edged down slightly in one month this year (April). In June, reserves increased by another US$18.23 billion to US$3119.23 billion, the largest monthly increase this year.

Inflows have been stronger than outflows

China has been very closely monitoring capital outflow transactions, which helps explain the low net outflows in 2019. But this is only one side of the story.

Another is the weak dollar: This increases the USD holdings of other currencies and therefore raises the value of China's foreign reserves. This could be increased further as China has shifted to greater non-USD holdings in its FX reserves this year.

A more important factor is the inclusion of China assets in global benchmark indices.

- A-shares inclusion into MSCI, which attracts passive funds to load up A-shares.

- FTSE Russell kicked off the first phase of A-share inclusion in late June.

- Onshore bond inclusions into Bloomberg's Aggregate Index, is similar to A-shares inclusion into MSCI.

- Then Chinese regulators increased RQFII quotas (renminbi qualified foreign institutional investment quotas) for foreign investors to invest directly into the onshore market.

The IMF estimated that equity and bond funds, passive and active, will create inflows of as much as $450 billion into China in 2019-2020, which is equivalent to 3% to 4% of GDP.

These actions make net inflows rather than net outflows more likely to happen for the rest of 2019, and possibly on into 2020.

The IMF estimated that equity and bond funds, passive and active, will create inflows by as much as $450 billion to China in 2019-2020, which is equivalent to 3% to 4% of GDP

How will continuous net inflows affect the yuan exchange rate?

In a free-floating exchange rate mechanism, continuous net inflows into China should lead to yuan appreciation. But the yuan mechanism does not operate like this.

The yuan has a daily fixing rate that determines the yuan path each day. And the central bank has window guidance on the fixing rate every day. That means that the yuan exchange rate is not under a free float. Net inflows need not result in an appreciating currency.

China foreign reserves and foreign inflows into A-share index

We expect the yuan to be stable

So what should the central bank do with the yuan when there are net inflows and at the same time the economy is facing a trade war and, perhaps as importantly, a technology war?

Well, precisely because of these reasons, the central bank will most likely keep the yuan stable. A stable yuan means that the authorities can focus on dealing with the trade and technology war, and not get distracted by currency volatility and capital flows. A stable currency is also arguably a less provocative currency policy during delicate trade negotiations.

We, therefore, continue to believe that the USD/CNY and USD/CNH rates will continue to be range-bound between 6.90-6.95. Our expectation is 6.95 for end 3Q and 6.90 for end 4Q.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more