If the Chinese yuan were to weaken after China GDP data, short AUD/USD?

China 1Q GDP may reflect its waning domestic demand

China 1Q GDP report is due tomorrow and the result is likely to point towards a relatively strong overseas demand and softer domestic demand. This may offer some sentiments to the market that weaker currencies in the region may help support growth and in return send the dollar higher.

The economy is expected to have tuned out all the background noises and power ahead in the first quarter. According to the market consensus, China’s growth maintained at 6.8% which is the same rates in the previous two quarters. This is well above the target of 6.5% growth this year. The report is due for release tomorrow at 10am Singapore/HK/BJ timing, alongside with retail sales and industrial production data for March. The statistics bureau will also begin its monthly release of a survey-based unemployment rate, which is similar to indexes for other major economies like the US and Europe. What investors need to pay attention to is whether PBOC will start to refer to this indicator as its key policy-decision tool.

China’s new lending for March undershot expectations which suggests domestic demand is slowing. A moderate rise bucked a seasonal tendency to rebound strongly, raising prospects of a larger-than-expected drag on growth from deleveraging. Furthermore, components of shadow lending slumped, reflecting the government’s efforts to tamp down financial risk. Strong growth in bank lending was being offset and this shown continued progress in bringing off-balance sheet financing back on to the books.

Headwinds are likely to strengthen in coming months as property and infrastructure activity weakened through manufacturing investment, resilient consumption and strong external demand which will cushion the impact. Moreover, there will be pressure on growth by campaigns whose aim is to curb financial risk and pollution, which are factors that make economic policy overall less favorable to growth.

Hopes for the trade dispute to be settled were boosted last week when Xi reiterated that he pledges to open sectors from banking to auto manufacturing in a speech at the Boao Forum for Asia. He also expanded on proposals to increase imports, lower foreign-ownership limits on manufacturing and expand intellectual property rights.

Our Picks

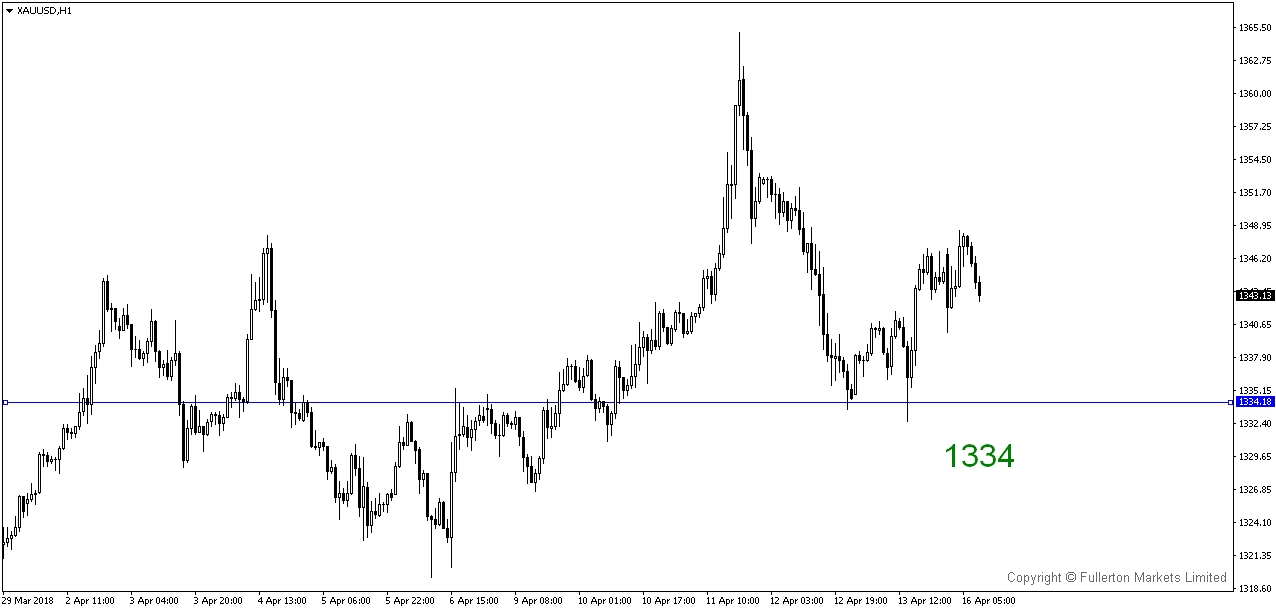

XAU/USD (Gold) – Slightly Bearish.

We expect price to move towards 1334.

EUR/USD – Slightly bearish.

This pair may drop towards 1.2250 amid dovish ECB statements last week.

USD/JPY – Slightly bullish.

This pair may rise towards 108.25 amid US-China trade tension easing.

Fullerton Markets Research Team

Your Committed Trading Partner