China's State Council has unveiled a number of measures to boost growth. But don't celebrate too soon. Most of the fiscal spending has been planned and is already in the pipeline. A loosening of monetary policy is a more obvious benefit to the economy in the short-term.

Fiscal stimulus is small

While the State Council has announced CNY2628 billion (USD386 billion) in fiscal stimulus, only a small portion of this is new i.e. real stimulus, rather than just planned spending. Of the CNY65 billion (USD9.6 billion) announced to foster R&D, only a fraction is new. The good news, however, is that the government wants to spend money earlier than planned.

According to our estimate, China's nominal GDP in 2018 could reach CNY86514 billion (USD12.7 trillion). That means the fiscal spending laid out by the State Council is around 3% of GDP. But spending could be higher than that if the government were to bring forward some of its infrastructure projects and other plans.

We expect more aggressive fiscal spending will be announced later if and when the trade war escalates and believe this year's stimulus could be around 4.5% GDP.

Monetary policy is more punctual

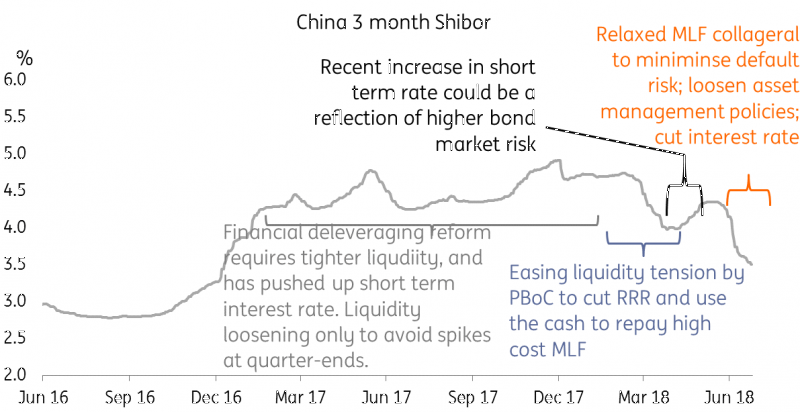

The People's Bank of China, China's Banking and Insurance Regulatory Commission and China's Securities Regulatory Commission have relaxed asset management policies. This is important to give breathing room to the corporate debt market. Tight asset management policies released at the end of April this year have squeezed corporate credit as well as increased the number of corporate defaults and pushed up short-end interest rates.

Now, the policies have been relaxed. Though this will slow the progress of shrinking shadow banking activities, it gives breathing room to corporates and the financial system, which is necessary when the government foresees an economic downturn from a trade war. The relaxation could help increase liquidity further (note that the central bank has already injected more liquidity into the system), credit risk could come down and default cases are likely to shrink.

The PBoC has also silently cut interest rates, which have guided short-end rates lower.

We expect even more fiscal stimulus

The stimulatory effect of monetary policy is short-term. But China needs long-term stimulus in the event of a trade war, as this could have a more protracted, damaging impact on the economy.

Stimulus in the areas of R&D and technology infrastructure should have a larger marginal impact on longer-term growth than putting money into transportation infrastructure, which is near the standard or even at a higher standard than developed economies.

We expect the next round of fiscal stimulus to benefit exports directly, and at the same time expand R&D investment pools, even if that means piling up government debt. At such an unusual time, the Chinese government will likely apply unusual measures to shield itself from an economic slowdown sparked by a trade war.

We still expect USD/CNY to reach 7.0 by end of 2018

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”