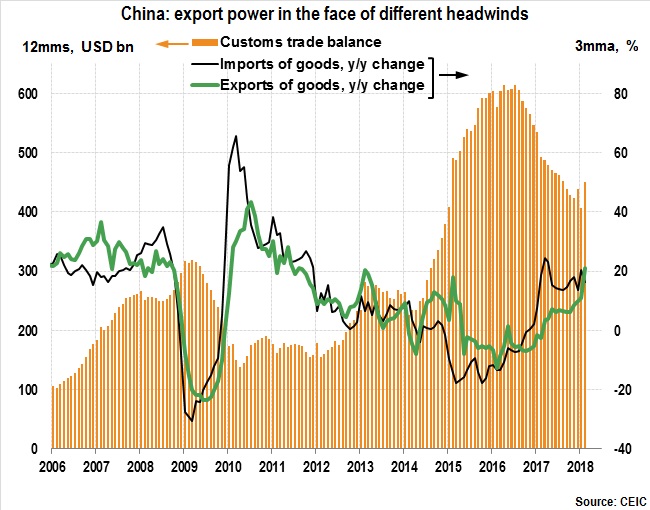

In 2017, export growth turned positive again after two years of contraction, mostly thanks to stronger global demand. Meanwhile, China’s world market share declined slightly for the second consecutive year, reaching 13.0% of total world export value in the 12-month period to November 2017, down from 14.0% in 2015. This decline is the blatant sign of a structural change.

Exports represented 18% of GDP in 2017, down from over 30% in the mid-2000s, and their average annual growth slowed to 6% in value in 2011-2017 from 30% in 2003-2008. This weaker expansion has stemmed from internal factors (rising production costs) and external factors (lower global demand). These factors will persist in the future. Moreover, export prospects are now darkened by increasing trade tensions with the US: the direct macroeconomic impact of tariff hikes on China should remain moderate, but some firms could be hurt and effects should extend to other Asian countries through regional supply chains.

by Christine PELTIER