China’s economy over the past several decades has been the growing at a double digit pace. Recently the rate of growth is slowing below those levels as signs of point to perhaps a more serious slowdown. Recent statistics on industrial growth have fallen much more than expected. Property speculation has created what many describe as a bubble.

The Peoples Bank of China (PBOC) has increased bank reserve requirements to stem speculation. It has worked and perhaps worked too well. Property prices in 47 of 70 localities dropped from reports issued last just this morning. Further auto sales, a previous hot sector of consumer strength, now shows dealers stuck with inventory they can’t sell.

Recently, the PBOC has reversed course on bank reserve requirements signaling its own worries about the state of the economy. It just shows that centrally managed economies can overdo their actions one way or another.

The leading and most popular ETF from China has been iShares FTSE China 25 ETF (FXI). Assets under Management (AUM) are $5.5 billion and average daily trading volume is nearly 18 million shares. The fund was launched in October 2004.The expense ratio is .72%. Holdings are much more concentrated as the name implies. As of May 17, 2012 the YTD return was -4.82% and one year return was -23.40%. Also, there are leveraged long or short ETFs that are associated with how the index trades.

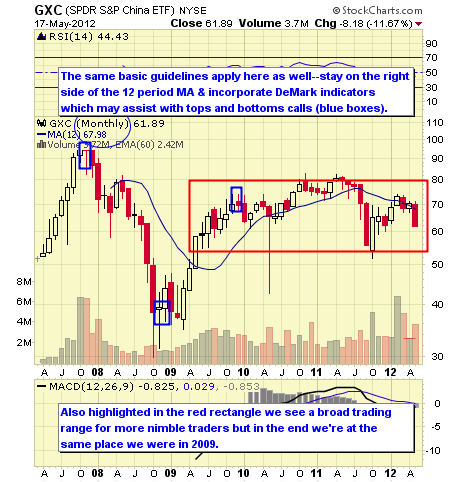

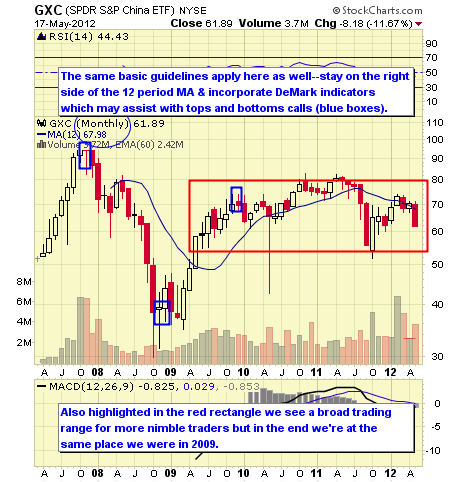

The SPDR S&P China ETF (GXC) many believe provides a better and broader view of the Chinese market. The fund was launched in March 2007. The expense ratio is lower at .59%. AUM equal $850 million and average daily trading volume is over 200 thousand shares.

As of May 17, 2012 the YTD return was -.66% and one year return was -21.39%.

Perhaps the best ETF for investors to focus on China directly is the Market Vectors China ETF (PEK) which for now is linked to a derivative agreement with Credit Suisse for the China CSI 300 Index. The index is composed of A-Shares trading in Shenzen and Shanghai.

Foreign direct ownership in the shares is currently limited and the sponsor awaits a license from the government to invest directly. When that happens then this should become the leading ETF investment.

Disclosure: No current position in any of the featured ETFs.

The Peoples Bank of China (PBOC) has increased bank reserve requirements to stem speculation. It has worked and perhaps worked too well. Property prices in 47 of 70 localities dropped from reports issued last just this morning. Further auto sales, a previous hot sector of consumer strength, now shows dealers stuck with inventory they can’t sell.

Recently, the PBOC has reversed course on bank reserve requirements signaling its own worries about the state of the economy. It just shows that centrally managed economies can overdo their actions one way or another.

The leading and most popular ETF from China has been iShares FTSE China 25 ETF (FXI). Assets under Management (AUM) are $5.5 billion and average daily trading volume is nearly 18 million shares. The fund was launched in October 2004.The expense ratio is .72%. Holdings are much more concentrated as the name implies. As of May 17, 2012 the YTD return was -4.82% and one year return was -23.40%. Also, there are leveraged long or short ETFs that are associated with how the index trades.

The SPDR S&P China ETF (GXC) many believe provides a better and broader view of the Chinese market. The fund was launched in March 2007. The expense ratio is lower at .59%. AUM equal $850 million and average daily trading volume is over 200 thousand shares.

As of May 17, 2012 the YTD return was -.66% and one year return was -21.39%.

Perhaps the best ETF for investors to focus on China directly is the Market Vectors China ETF (PEK) which for now is linked to a derivative agreement with Credit Suisse for the China CSI 300 Index. The index is composed of A-Shares trading in Shenzen and Shanghai.

Foreign direct ownership in the shares is currently limited and the sponsor awaits a license from the government to invest directly. When that happens then this should become the leading ETF investment.

Disclosure: No current position in any of the featured ETFs.