Not only has it been a rough week for U.S. stocks, but the iShares China Large-Cap (NYSE:FXI) has taken a beating as well, as fears of increased tariffs on Chinese goods were realized today. The exchange-traded fund (ETF) is threatening its first five-day losing streak of 2019, and its worst week since February 2018. What's more, FXI options have been active this week, with put open interest now at an annual high.

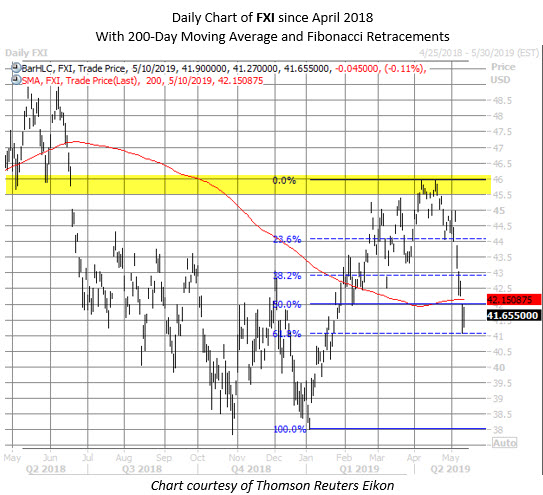

FXI shares were last seen 0.1% lower at $41.65, set for their lowest close since January. The ETF rocketed higher to start 2019, and just last month was bumping up against the formerly supportive $46 area. Now, shares of the fund are pacing for a second straight close beneath their 200-day moving average, and are testing the waters around $41 -- a 61.8% Fibonacci retracement of the aforementioned January-to-April rally. For the week, FXI has surrendered more than 7%, set for its steepest weekly drop in more than a year.

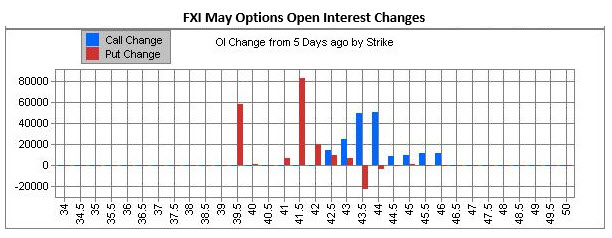

As alluded to earlier, FXI options have been in demand this week. Over the past five sessions, the fund saw about 1.1 million calls and 953,000 puts cross the tape. The now near-the-money May 41.50 put saw the biggest surge in open interest, with more than 83,000 contracts added in this time frame. A healthy portion of the puts traded on the ask side, pointing to freshly bought bearish positions. The out-of-the-money May 39.50 put was also popular, with nearly 60,000 contracts added to open interest in the past week. Now, total put open interest among all series stands at more than 2.22 million contracts -- the highest point in at least a year.

On the call side, the May 43.50 and 44 strikes saw the biggest influx of new positions, with almost 59,000 and 51,000 contracts, respectively, added in the past week. "Vanilla" traders who bought the calls to open expect the China-focused ETF to recover and rebound north of the respective strikes by the close on Friday, May 17, when front-month options expire. Total call open interest among all series now stands at just over 2.1 million contracts, though that's in just the 86th percentile of its annual range.