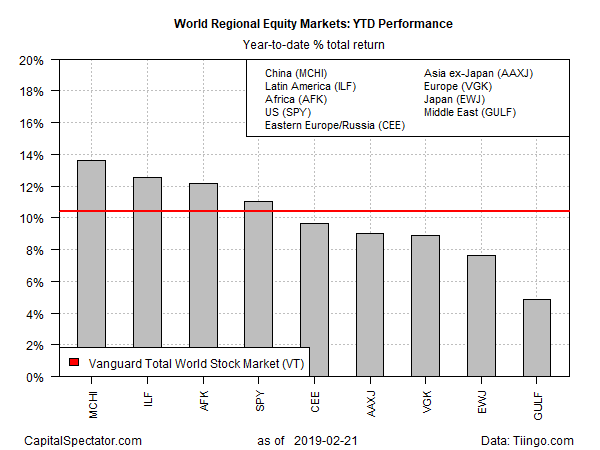

Across-the-board gains continue to mark this year’s results for global equity markets, based on a set of exchange-traded funds that track the world’s major regions and countries. At the top of the performance list so far in 2019: stocks in China, Latin America and Africa.

The strongest increase year-to-date is currently held by iShares MSCI China (NASDAQ:MCHI), which is up 13.6% through yesterday’s close (Feb. 21). After suffering a sharp loss in 2018, the ETF has rallied this year and on Thursday closed above its 200-day moving average for a second straight day.

One factor that appears to be supporting Chinese stocks lately: upbeat reports in recent days that Sino-U.S. trade talks may soon lead to a solution for resolving the trade war between the world’s largest economies. President Trump is scheduled to meet with China’s top trade negotiator today (Feb. 22), an encounter that may produce a preliminary deal on a new round of tariffs that the U.S. is planning to impose next month.

The second-strongest gain year-to-date is currently held by an ETF focused on Latin America. After a rough 2018 that took a hefty bite out of iShares Latin America 40 (NYSE:ILF), the ETF is up 12.6% this year. In third place: VanEck Vectors Africa (NYSE:AFK), which has also rebounded in 2019 and is currently posting a 12.1% return.

The U.S. equity market is the fourth-strongest performer in this ranking. SPDR S&P 500 (NYSE:SPY) is ahead by a solid 11.0% for 2019 – just slightly ahead of global equity market overall, based on the 10.4% year-to-date gain for Vanguard Total World Stock (NYSE:VT).

The weakest year-to-date performer in the major region/country lineup: equity markets in the Middle East. After a strong run in 2018, WisdomTree Middle East Dividend (NASDAQ:GULF) has become a relative laggard this year. At Thursday’s close, GULF was up 4.9% for 2019.

Foreign markets edged higher in Friday’s trading, buoyed by expectations that the U.S.-China trade war may be set to ease.

“Given that enough headway seems to have been made to warrant a meeting between Trump and the Chinese negotiator today, it appears more likely that the U.S. will not raise the levies, which should help high-beta currencies and equities push higher,” predicts Konstantinos Anthis, head of research at ADSS, a forex broker in Abu Dhabi.