- PBoC devalues yuan 2%

- Commodity currencies take a beating on China action

- Emerging Central Banks expected to follow suit

- How will the U.S respond?

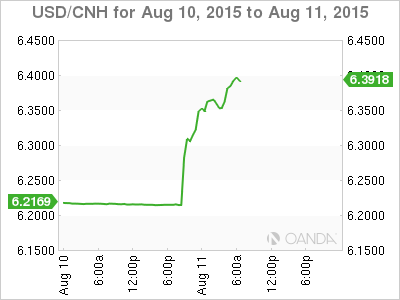

The forex market was expected to be a relative snooze fest, at least until Thursday’s U.S retail sales print. However, investors can thank Chinese authorities and the People’s Bank of China (PBoC) for making it a lot more interesting. Beijing has now officially waded into the currency wars overnight by devaluing the Yuan by -2% and sending the USD sharply higher across the board. The PBoC’s actions have officially opened Pandora’s box.

Already, Monday’s broad based rally in global equities accompanied by a weaker USD and a strong rebound in commodities has been stumped by the Yuan’s devaluation. After last weekend’s weaker trade data, Chinese authorities were expected to be proactive. The market was certainly looking for an aggressive responsive from China, maybe one or two rate cuts or some adjustment to the RRR for local banks, but a currency devaluation to boost exports?

China to do “whatever it takes”

To date, the parity rate has barely moved outright this year, even though the dollar has appreciated against most currencies, making Chinese exports more expensive in most regions. The People’s Bank of China (PBoC) will now be expected to heed market levels when it sets its parity rate. It’s a tough ask for Chinese authorities as they cannot afford to alarm domestic and foreign investors as they leave themselves open to capital outflows. Currency manipulation needs to be massaged to avoid “fight or flight.”

Overnight, the PBoC has manually manipulated the fix, moving it up +2% and in line with the offshore rate. Instead of setting a daily exchange rate, the PBoC will use the market rate at the end of the day to determine the next day’s official rate. Technically, this could make yuan trading a lot more volatile, potentially fluctuating +/-2% intraday, depending on daily trade and capital flows. Their actions have clearly blind-sided the market and have all the asset classes running amuck early Tuesday.

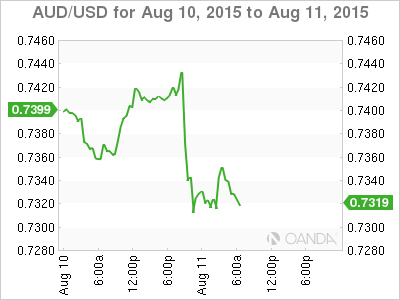

Commodity Currencies take a beating

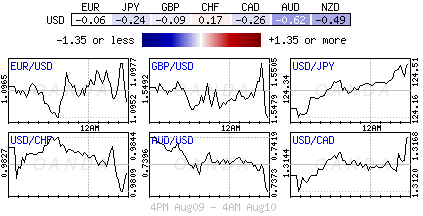

The USD is higher across the board, but mostly against the commodity sensitive currencies (AUD, CAD and NZD). Regional bourses are seeing red, while metals’ prices come under pressure. In times of uncertainty, it’s not a surprise to see U.S Treasuries catch a bid (10’s trade below +2.20%) while emerging market currencies trade lower.

As the markets head stateside, investors will be expecting a U.S response. Despite the PBoC declaring that the CNY depreciation should not be seen as a trend, but a “once-off measure,” the U.S Treasury will most likely declare China a manipulator again. However, investors will probably be more concerned about China’s holdings of U.S debt, and will this have any implications on the timing of Fed’s rate liftoff, which could be as early as next month.

A weaker yuan will threaten other emerging economies in the region that compete with Chinese exports. Investors should expect other Asian currencies to come under more pressure as other regional Central Banks will be required follow suit and manipulate their own currencies to stay competitive.

With today’s revaluation, Chinese authorities are recognizing that the yuan has appreciated excessively in real effective terms, especially given the sharp depreciation of the EUR and JPY. July’s soft trade date was probably the last straw and the motive to reboot the world’s second largest economy by currency manipulation. It’s in China’s best interest not to let the yuan depreciate or appreciate too aggressively, and reason enough to expect last night’s move to be a “once-off.” Effectively, it makes the yuan exchange rate more market determined, which could help China at the upcoming Special Drawing Rights review in three month’s time.