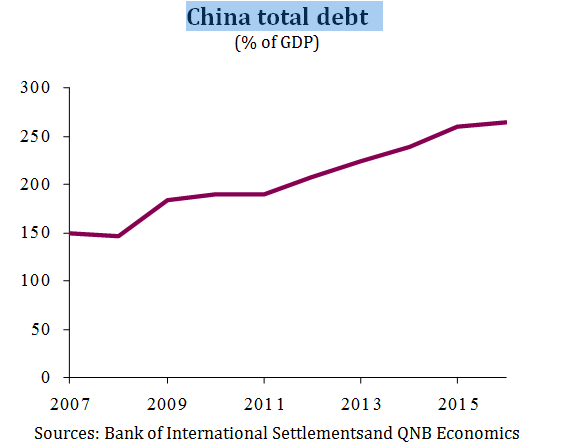

On May 24th, the rating agency Moody’s downgraded China’s credit rating for the first time since 1989 on concerns over risingdebt andslowing economic growth. Despite the downgrade, China comfortably maintains its high investment-grade status and the impact of the downgrade on financial markets has been limited. But the surprise move brings back into focus the long-term risks posed by rapid debt accumulation on the Chinese economy. The authorities have been enactingmeasuresto curtail risks andthis should help growth continue to moderate at an orderly pace in 2017.But absent more significant progress on reforms, China’s debt mountain risks causing growth to sharply decline in the future.

China total debt (% of GDP)

Sources: Bank of International Settlementsand QNB Economics

China’s debt has increased to a massive level. Total debt stood at over 250% of GDP in 2016, of which, around 160% was held by the corporate sector or state-owned entities (SOEs).In the aftermath of the financial crisis, the authorities engaged in a corporate credit boom to finance infrastructure, industrial and real estate projects in a bid to counteract falling external demand for exports, which was until then the engine of growth. Moreover, the authorities provided implicit loan guarantees and interest rate subsidies to further incentivise lending in order to sustain short-term growth. However, this process created significant overcapacity across sectors.

The impact of this rapid accumulation of debt on the economy has the potential to be extremely negative and imperil long-term growth. There are three main avenues through which this could occur. First, overcapacity would depress sales and lower profits which would potentially cause layoffs, weakening consumption and spilling over into other sectors of the economy. Second, a higher debt burden would make it more difficult for SOEs to service their debt, as well asbattertheir profit positions. This could raise non-performing loans and impact banks’ balance sheets, potentially forcing government intervention and sparking retrenchmentin consumption and investment. Third, expectations of lower profit growth or an inability to service debt would spook institution investors and lead to capital flight in search of higher return in other markets. The yuan, in turn, would weaken and China’s external debt burden would increase further propagating the impact of higher debt.

Over the past two years, all three of these factors have been realised but not to the extent that has triggered a protracted loss of confidence or a sharp growth slowdown as some had feared. Profit growth has declined in overcapacity sectors such as coal and steel, official impaired loans have increased from 1.0% of total loans in 2011 to 1.7% at end 2016 (although the actual level of impaired loans is likely to be much higher) and China witnessed the first consecutive years of capital outflows in 2015-2016 since 1999-2000.

In recognising these risks, the Chinese authorities have increased their focus on ensuring financial stability. Throughout 2016 and early in 2017, the People’s Bank of China has tightened its monetary policy stance, capital controls and regulatory oversight. The authorities are working to target reductions in overcapacity sectors such as coal, steel and housing alongside existing efforts to identify delinquent SOEs for restructuring or privatisation.While such measures are encouraging and should help prevent debt from causing in sharp fall in growth in 2017, the authorities have also taken steps backwards. Overall debt increased in the economy in 2016, mainly due fiscal easing to support growth. Hence, prioritising financial stability over growth remains a challenge.

In short, China witnessed an unprecedented credit boom that propelled its growth in the aftermath of the financial crisis. In order to ensure that the massive build-up of debt does not create a major financial crisis, policymakers will have to demonstrate more progress on reforms that prevent further increases in debt. Additionally, China must confront the trade-off between financial stability and growth. Maintaining elevated growth rates requires policy stimuli,which increase the debt burden. To mitigate long-term risks through substantial deleveraging, the authorities will have to become more comfortable with lower growth rates than they currently are.