Like many countries, China attempted to rein in its debt growth over the past couple years, but ultimately gave up and is now back to piling on even more debt. Bloomberg reports –

For almost two years, the question has lingered over China’s market-roiling crackdown on financial leverage: How much pain can the country’s policy makers stomach?

Evidence is mounting that their limit has been reached. From bank loans to trust-product issuance to margin-trading accounts at stock brokerages, leverage in China is rising nearly everywhere you look.

While seasonal effects explain some of the gains, analysts say the trend has staying power as authorities shift their focus from containing the nation’s $34 trillion debt pile to shoring up the weakest economic expansion since 2009. The government’s evolving stance was underscored by President Xi Jinping’s call for stable growth late last week, while on Monday the banking regulator said the deleveraging push had reached its target.

“Deleveraging is dead,” said Alicia Garcia Herrero, chief Asia Pacific economist at Natixis SA in Hong Kong.

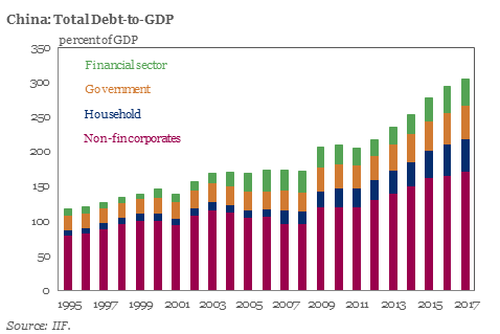

As I’ve been warning, China has been experiencing a powerful credit bubble over the past decade (see the chart below). China’s leaders inflated the credit bubble in order to supercharge economic growth during and after the global financial crisis in 2008/2009. China’s credit-driven economy has become one of the main growth engines of the global economy, which has scary implications because it’s even more evidence that the global economic recovery is predicated on debt.

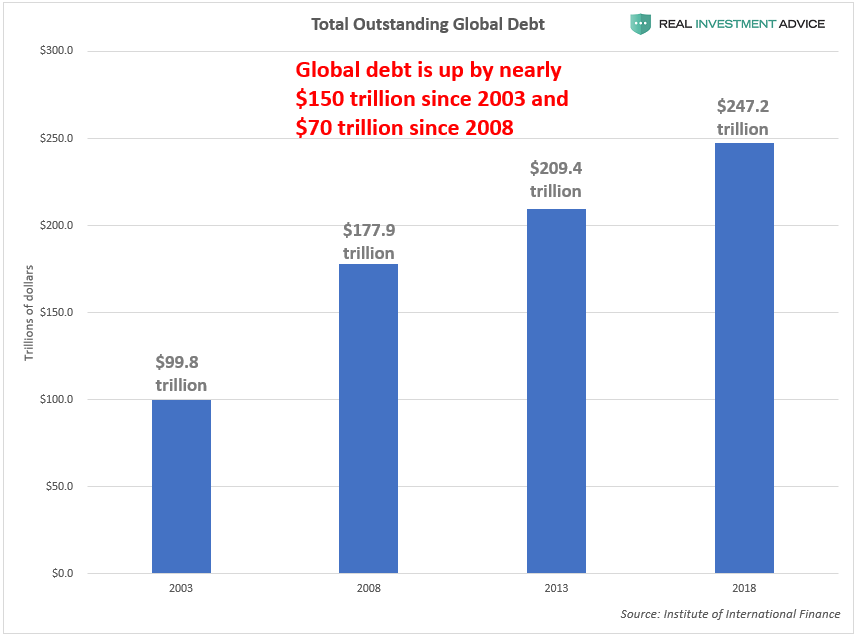

China’s aggressive credit expansion is a major contributor to the global debt explosion over the past couple decades. Global debt has increased by $150 trillion since 2003 and $70 trillion since 2008:

China’s credit bubble is very similar to Japan’s economic bubble in the late-1980s. For many years, Japan’s economic growth seemed unstoppable and many people believed that Japan would overtake Western economies in short order. Of course, Japan’s growth miracle came to a screeching halt in the early-1990s when the country’s bubble burst. By ramping up debt so aggressively (which borrows economic growth from the future), China is following in the same footsteps as Japan and will soon experience the downsides of debt-fueled growth.