Market movers today

Markets will continue to focus on the renewed trade uncertainty caused by Trump's recent tweets . For more see comments below

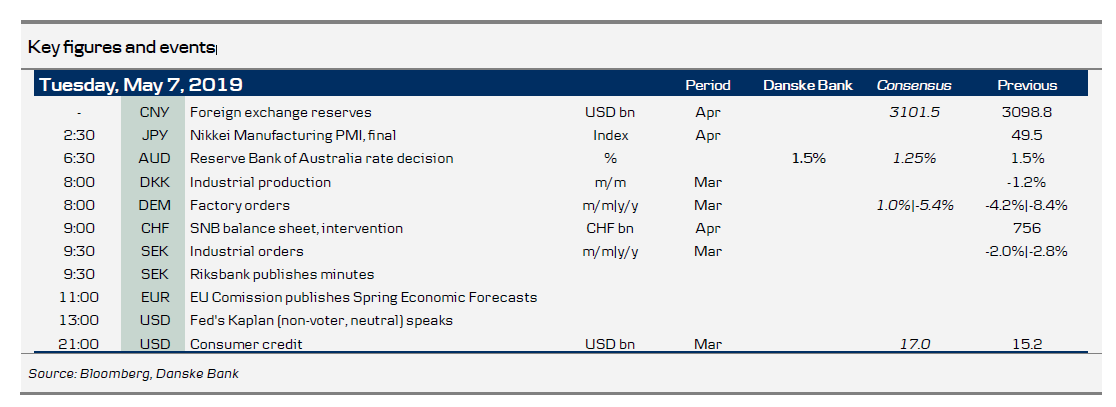

In Sweden , the Riksbank minutes from the April meeting are published this morning at 09:30 CEST. Production data for March is also due out. For more details see page 2.

In Europe , the spring economic forecasts from the EU Commission are published at 11:00 CEST. Particular focus will be on fiscal policy and projections for Italy.

In the UK , cross-party negotiations continue over Brexit. The historical lack of trust between the Conservative and Labour parties and the large divisions on Brexit within both parties continue to complicate things.

In Germany , factory orders in March are due out at 08:00 CEST.

Selected market news

Yesterday, Trump continued his series of hawkish trade tweets , as he said the US is losing USD500bn on trade with China, adding "we're not going to be doing that any more".

Market sentiment rebounded slightly yesterday as hopes of an imminent trade deal were revived after China confirmed that trade talks would move on this week despite the US raising tariffs . The US Trade Representative told reporters that China's top negotiator Liu He was still coming to Washington for trade talks starting Thursday (instead of Wednesday) and confirmed that tariffs would go rise on Friday 12:01am, see CNBC .

US Treasury Secretary Steven Mnuchin said the tariffs would be reconsidered if the trade talks get back on track . Markets (and we) initially feared that the tariff increase would derail the trade talks and China would stay away this week. According to Lighthizer, the US team saw an erosion of commitments from China that led to the decision to increase tariffs. According to Mnuchin, the Chinese wanted to renegotiate elements that had already been finalised and the US is not prepared to do that. Apparently, China is not willing to change its laws as part of a deal, but to some extent that probably reflects that China has already implemented some of the things the US wants. The new foreign investment law, among other things, bans technology transfer, raises IPR protection and declares that Chinese and foreign firms should be treated equally.

It is still up in the air how the road to a trade deal will be. But we believe a deal will be reached by the end of Q2. The last bits left in the trade talks are also the most difficult. But one way or the other, we expect the two sides to find a solution, as the alternative of no deal would be very unattractive for countries.

The Australian central bank left its cash rate unchanged at 1.5% this morning, in line with our expectation but against consensus of a cut. The central bank recognises that there is still spare capacity in the economy and that it is "paying close attention to the developments in the labour market". The Australian dollar rose on the announcement.

Scandi markets

In Sweden, today brings the production value index (PVI), which together with the indicator for household consumption (due for release on Friday) is the last input to our GDP indicator, which currently hints at a growth rate of 1.2% y/y for Q1 19. As for the PVI, it is a notoriously volatile series, but the trend has nevertheless been negative for the last year. On top of that, we look forward to scrutinising the minutes from last week’s Riksbank monetary policy meeting, where we will pay extra attention to how the “neutrals”, as opposed to notoriously dovish Jansson and long-term hawks Ohlsson and Flodén, on the board were motivated in their dovish turn.

Fixed income markets

Italy came under pressure yesterday on the back of a risk-off move in global bond markets, where Treasuries and Bunds rallied.

If the EU Commission raises its forecast for Italian GDP growth, we could see a modest positive reaction in Italian government bonds.

Austria is tapping in the 4Y and 10Y segments today. This should not have much market impact. The US will sell 3Y bonds. We expect to see good demand at the auction given the uncertainty in the market.

Tomorrow, the Danish Debt Office will launch a new 2Y benchmark DGB 11/22. It plans to sell up to DKK5bn at the auction on Wednesday. We expect demand will come mainly from domestic investors who need the bonds for the LCR portfolios. See more in our auction preview.

FX markets

Markets shrugged off the new trade-related uncertainty in the US session. The initial volatility spike and risk-off spot moves across vix, S&P500, yen, yen vol and many other market indicators was seemingly seen as a buy-the-dip, reversing some of the initial reaction. We have highlighted the increased uncertainty from these new developments and hence view yesterday’s reversal in pricing as rather complacent. Though markets might be trying to call the bluff of Trump, we are less certain. As such, we expect elevated volatility in USD/JPY and related China-linked currencies. Tracking if China sends delegates to the US and if Trump really implements these new tariffs on Friday are so far the two main drivers of risk to watch. See also FX Strategy: Keep faith in trade - but brace for USD/JPY move, 6 May 2019.

The SEK remains on a slippery slope, which was manifested yesterday in the break of EUR/SEK 10.729 (29 August 2018 high). Today, the minutes from the Riksbank’s latest policy meeting are due to be published and these will be dovish to the extent that they need to justify a dovish decision. Although the decision already sent rates and the SEK clearly lower, we would not be surprised to see a further negative reaction in the krona today.

Board members’ comments on the exchange rate will be of particular interest.

The Riksbank minutes alongside developments on trade developments will also set the tone for the NOK. If trade fears diminish, this would open up for attractive EUR/NOK selling opportunities but we think it is too early at this stage given recent headlines.