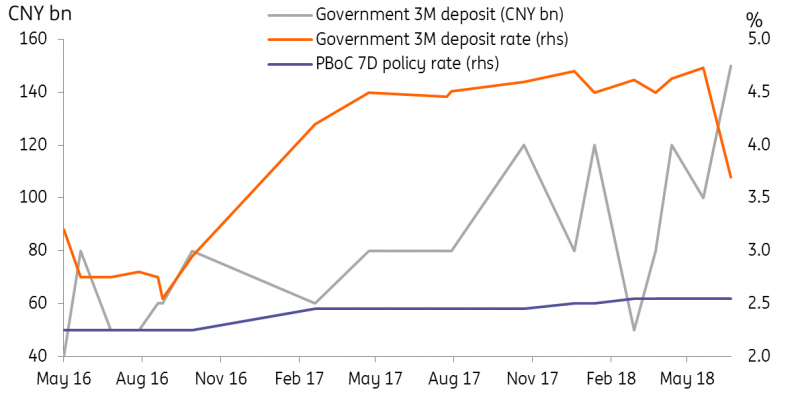

The auction of government deposits at commercial banks reveals that the central bank is cutting interest rates, but not through its seven-day policy rate.

Central bank guided government deposit rate lower

The central bank (People's Bank of China) guided auction rates on 91-day government deposits at commercial banks lower to 3.7% from 4.73% on 15 June.

We believe that this rate cut through a different channel than the PBoC seven-day (7D) policy rate means the central bank would like to see lower interest rates but doesn't want to send an obvious signal that it is loosening policy because financial deleveraging reform should still be ongoing.

The move has likely been triggered by the lower GDP growth rate of 6.7% in 2Q18 from 6.8% in 1Q18.

Though this is not a usual tool used by the PBoC, it's not the first time the bank has cut rates in this way. We saw this in June 2016 when GDP growth fell to 6.7% in 1Q16 from 6.8% in 4Q15.

Interest rate is set to fall from lower government deposit rate

Further stimulus from fiscal and monetary policy coming to cushion trade war impact

We expect the PBoC to cut its reserve requirement ratio (RRR) at the beginning of each quarter from now to 1Q19. This may extend further out if the trade war escalates.

Still, the marginal impact from monetary policy will not be enough to support the economy in this trade war. The central bank has commented that the Ministry of Finance should implement more aggressive fiscal stimulus. It's rare for the PBoC to make such a comment. The central bank has sent a strong signal to the market that further stimulus from both fiscal and monetary policy, is more likely than before.

We expect fiscal stimulus to come mostly in the form of investment pools for high-tech R&D to foster future growth. Tax relief would be a supplementary boost as the impact is more short-lived.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”