With the US Federal Reserve delivering a steady drip-feed of interest-rate rises, most emerging markets (EMs) are tightening monetary policy in response. A notable exception to the EM trend is China. China’s central bank, the People’s Bank of China (PBoC), which still tightly manages its currency, the CNY, against the USD, had been nudging up its short-term interest rates in response to moves by the US Federal Reserve. But after the Fed’s latest 25bp rate rise in mid-June, the PBoC conspicuously failed to follow suit.

This easing signal, which helped trigger a 3.4% record monthly drop in the CNY, has been reinforced by news that the PBoC will lower reserve requirements for most banks by 50bp. The cut releases CNY700 billion (c.1% of GDP) of extra liquidity into the banking system. This move follows an earlier 1% reduction in reserve requirements in April. While the April move could be at least partly explained as a technical adjustment (offsetting reduced liquidity provision from other sources), the latest cut smacks more of a deliberate policy easing.

The background to these recent easing steps is the delicate balancing act that the Chinese policy makers have been attempting to pull off for much of the last two years. After years of debt-fueled economic growth that risks longer-term financial stability the longer it continues, the authorities have been trying to rein in excessive credit growth and cut debt levels.

At the same time, the authorities know that they cannot tighten policy too much in pursuit of de-leveraging in case economic growth slows too much. 6%+ GDP growth remains a political necessity. Given these competing, even contradictory, objectives, the authorities have mostly used regulatory controls to try to rein in the riskiest off balance-sheet or ‘shadow’ lending activity. By keeping banks’ liquidity on the tight side, market interest-rates have also been guided gently higher for much of the last two years to help slow, but not stall, overall credit growth.

Getting this balance right is inevitably tricky, if not near impossible. Few, if any, countries have managed to successfully de-leverage following multi-year credit booms and avoid a painful economic hard landing. China’s latest data show the difficulty of the task and explain why the authorities now seem to be reversing course and starting to ease policy.

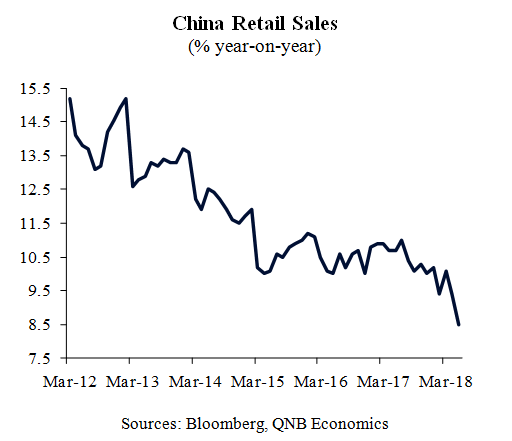

China Retail Sales (% year-on-year)

Sources: Bloomberg, QNB Economics

On the one hand, there is no doubt that the battle against excessive credit growth is finally being won. Total social financing, the economy’s broadest measure of credit growth, slumped in May as shadow-banking activity contracted by a record amount. On the other, the latest activity data show disconcerting weakness, signalling that the economic cost of the de-leveraging campaign is becoming too high to sustain just as it shows signs of working! Both retail sales and fixed asset investment growth registered their slowest growth in over a decade in May. Up just 8.5% y/y, the weakness of retail sales is most worrying, suggesting that the economy’s backbone of solid consumer demand is buckling.

Worryingly, these signs of softer domestic demand were materializing before the opening shots in the unfolding trade war between the US and China had been fired. Although China’s economy is rebalancing towards consumption-led growth, the export sector is still critical. In particular, external demand was a key swing factor for the Chinese economy in 2017 with net trade adding 0.6pp to GDP’s 6.9% y/y growth; its largest contribution since the global financial crisis.The mounting threat to the export sector from a trade war with the US therefore further complicates the central bank’s difficult balancing act, tilting the balance more towards the need to sustain economic growth.

With the economy showing clear signs of wobbling in May and trade war clouds massing on the horizon, it is no surprise that the PBoC is now starting to reverse course and tacking towards easier policy despite the still unfinished business of the de-leveraging campaign. The authorities remain predictably tight lipped about the need for policy loosening and, publicly at least, are not yet ready to signal a decisive policy shift. Market interest rates are however delivering a clear verdict. 3-month interbank rates have tumbled around 80bp since the end of March while 2-year interest-rate swap rates, another guide to the stance of monetary policy, have slipped by around 45bp over the same period.

Two factors will be critical in determining how the PBoC’s high-wire act evolves in the coming months. The first is whether the slowdown in domestic demand, especially on the consumer side, gathers further pace before support from recent policy easing takes effect. The June retail sales data, released on July 16th, will provide a key update. The second is, of course, the key unknown of whether the nascent trade war between China and the US significantly escalates.

Our base case is that the gentle shift in China’s policy stance now under way will continue and succeed in placing a floor under GDP growth. We expect further cuts in reserve requirements to boost banks’ liquidity and the PBoC to continue to stand pat in the face of future US rate rises. This modest easing measures should spur some further CNY weakness versus the USD, but stop short of a substantial devaluation.

However, if the downside risks to domestic demand and China’s export sector materialize, the authorities’ de-leveraging campaign would then be decisively abandoned and a more full-throated easing of monetary policy,not to mention fiscal policy, quickly delivered. While a more aggressive policy easing would undoubtedly succeed in shoring up GDP growth in the short, it would risk more decisive CNY weakness and, with the de-leveraging ambition abandoned, China’s longer-term financial stability. Uncertainty is inevitably high but the ‘known known’, is that China, having been a source of stability for the global economy in recent years, is rapidly becoming a key risk factor.