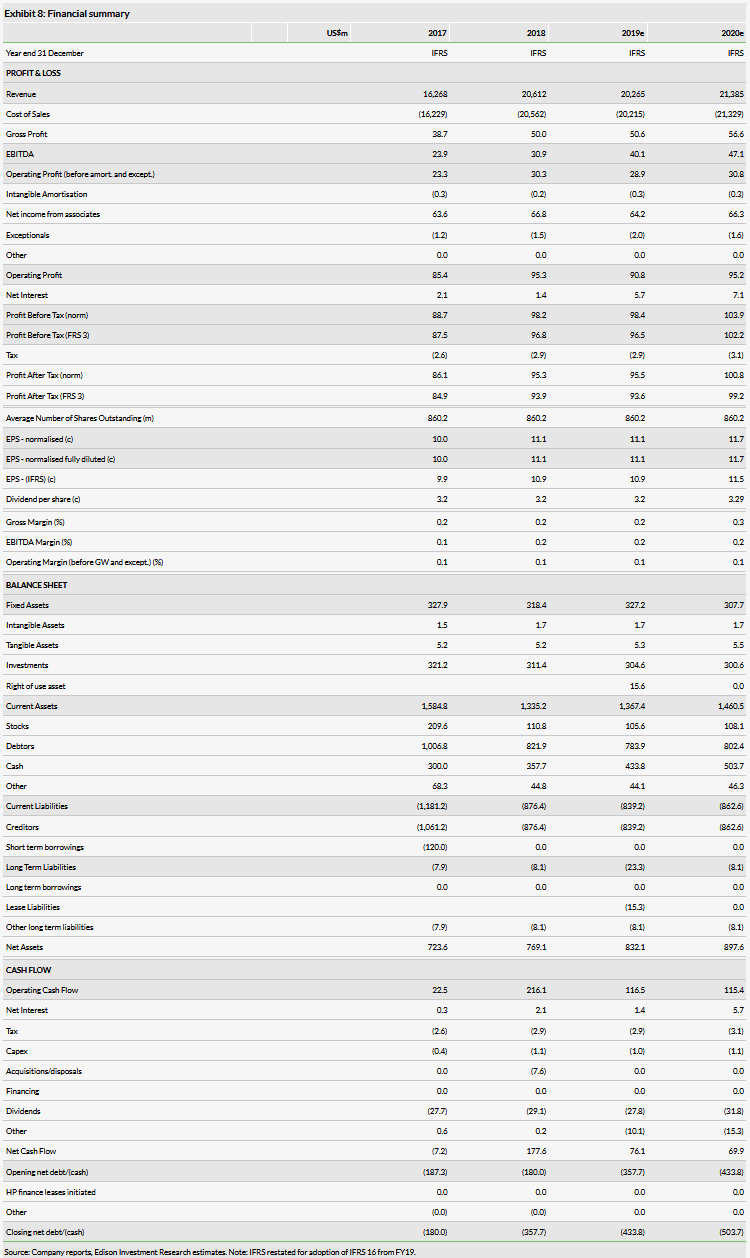

Having delivered a record performance in FY18, China Aviation Oil (Singapore) Corporation (CAO) faces a year of more subdued progress. Confronted by more difficult markets in 2019, the management team appears to have adopted a more risk averse stance in oil trading, curtailing some of the optimisation strategies. Trade disputes are also affecting supply volumes and margins to the US. The core trading activity challenges are compounded by policy adjustments affecting growth at Shanghai Pudong airport, the main group associate. The result is a slower growth trajectory, as is reflected in H119 results. Nevertheless, CAO remains a proxy for the rapid growth of the Chinese air transport market.

Tough markets and trade wars

The delivery of record FY18 results was hard earned in unhelpful market conditions where prices remained in backwardation for long periods, with future product prices below spot. The result was a natural constraint on contract optimisation strategies and liquidation of stored product inventories. The situation has been tightened by last year’s management succession from the parent CNAF, with the incoming CEO further strengthening internal risk control. In FY19 these factors combined with US China trade friction are impairing the growth of the core trading operations.

SPIA faces limited growth through FY20

Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA) is the largest associate company of the group and contributes most of the associates’ and the group’s profitability. Its operations rely on traffic growth at Shanghai Pudong International Airport, where passenger numbers grew 6% to 74 million passengers in 2018. SPIA’s contribution was reduced by adverse movements in the translation rate of Chinese renminbi to US dollars. With capacity expected to expand to an average of 80 million in FY20, expected growth is somewhat slower than has been experienced in recent years, and growth constraints appear to be compounded by a central policy encouraging more domestic leisure travel in China. As a result, we are looking at more limited growth through 2020 for CAO as a whole, although we expect cash flows to remain healthy and support the healthy dividend payout.

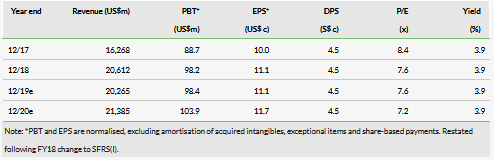

Valuation: Cash strength under rated

CAO’s rating (FY19e P/E 7.6x) is at a substantial discount to World Fuel Services. Our DCF-based valuations assessing associates’ dividend streams in three ways has also grown, with increased gross cash. Our fair value for CAO stands at US$1.52/share (S$2.11) (previously US$1.39 (S$1.82)).

Business description

China Aviation Oil (Singapore) Corporation (CAO) is the largest physical jet fuel supplier and trader in Asia. It holds the sole import licence for bonded jet fuel into China, and has nascent businesses in the US and Europe. Of its five associates, the most important is SPIA, which supplies all jet fuel to Shanghai Pudong Airport.

H119 trading performance

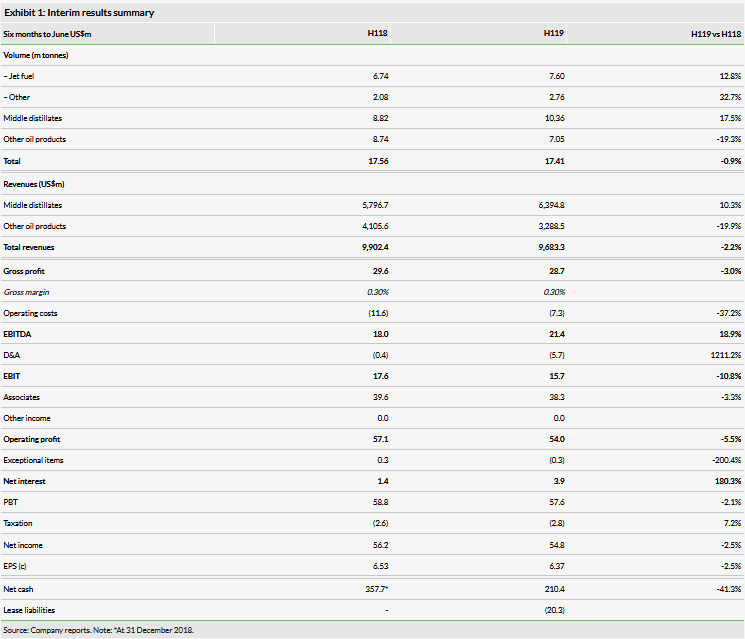

Following the record performance in FY18, the company delivered a robust performance in H119 despite challenging market conditions and the impact of US-China trade tensions. The company has adopted the equivalent of IFRS 16 in 2019 accounts and the impact of the accounting for operating lease liabilities was reflected in the half year accounts. Volumes in H119 were constrained by the impact of trade obstacles on certain product flows, as well as a more risk-averse approach to trading. In addition, the continued fluctuation in oil and product prices, combined with markets in backwardation for long periods, led to a fall in gross margins. In associates, the storage operation OKYC in South Korea saw profitability fall as inventories were liquidated, and SPIA saw profits step back modestly in H119 due to lower Q119 average jet fuel prices than in the comparative period, with an improved performance in Q219.

Highlights for H119 were:

Total H119 volumes decreased by 0.9% y-o-y to 17.41m tonnes (H118: 17.56mt). Jet Fuel volumes grew strongly, up by 12.8% y-o-y to 7.60mt, with an even more impressive performance from other middle distillates (gas oil) volumes, which increased 32.7% to 2.76mt (H118: 2.08mt). Other oil products saw volumes drop 19.3% to 7.05mt (H118: 8.74mt).

Reported revenue in H119 fell 2.2% to US$9.68bn (H118: US$9.90bn) reflecting the additional impact of lower oil product prices.

Reported H119 gross profit fell 3.0% to US$28.7m (H118: US$29.6m). Gross profit margin held steady at 0.30% for H119 compared to H118. Trading improved significantly in Q2 compared to Q1, with higher gains derived from trading and optimisation activities although these remained lower for the first half overall than in the prior year. Q219 saw an increase of US$0.7m in gross profit to US$17.1 compared to Q218.

The contribution from associates was down 3.3% at US$38.3m, with SPIA only down 1.1% at US$34.2m after an improved Q219 contribution compared to both Q119 and to Q218. The losses at the other associates largely reflected lower profitability for the storage operations of OKYC in South Korea including some foreign exchange losses.

PBT in H119 was US$57.6m (H118: US$58.8m); the decline of 2.1% reflected a fall of 3.5% in Q119 compared to Q118 and just 0.8% y-o-y in Q219. The contribution from associates was 70%, marginally down on H118.

H119 net income was 2.5% lower at US$54.8m (H118: US$56.2m), mirrored by the decline in reported EPS to US$0.0637 (H118: US$0.0653).

Gross cash balances of US$210.4m were reduced by US$147.3m during the half year largely due to higher working capital requirements for the trading activities. We expect these to unwind in H219 leaving year end net cash higher than at the start of the year, as ever boosted by the receipt of the FY18 dividends from SPIA and the other associates received in H219 (in H218 the FY17 dividend received was US$67.4m).

Net asset value per share increased to US$0.9222 from US$0.8942 at the end of FY18.

Adoption of IFRS16

The company has adopted the equivalent of IFRS 16 in its 2019 accounts and the impact of the accounting for operating lease liabilities was reflected in the half year accounts. It had little impact on the net profitability (we estimate around US$0.4m), but within the income statement the depreciation of the right of use asset increased depreciation and amortisation and was largely compensated for by a commensurate fall in administrative and operating expenses, which inflates EBITDA but produces a similar EBIT contribution. The high level of depreciation of around US$2.5m per quarter reflects the fact the leases are expected to end in 2020, and at present are unlikely to be replaced by a similar long-term transaction. We believe the liabilities primarily relate to the lease of storage facilities. There was also a modest US$0.3m increase in financial interest expenses relating to the notional interest on the c US$20m of lease liabilities added to the balance sheet.

Outlook

While our FY19 revenue estimate is now only slightly lower (-2%) than our out of date previously published numbers, our PBT estimate is reduced by 6%. It reflects the more challenging market conditions over the last 18 months, despite which CAO delivered a record performance in FY18 in the face of the impact on margins of backwardation markets and fluctuating oil prices. In addition, we expect more constrained growth from the main associate, SPIA, than we had previously anticipated. We expect moderate growth to resume in FY20.

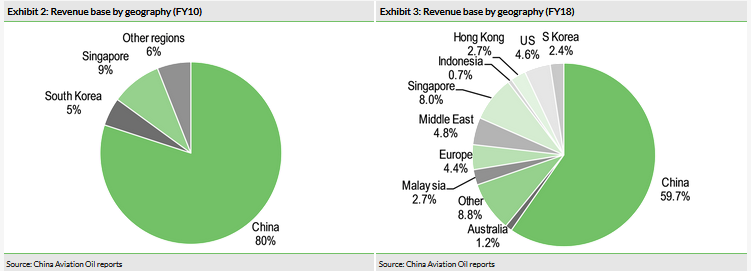

CAO remains a proxy for China’s air transport growth

CAO remains the sole supplier of imported jet fuel into China for civil aviation, and is the largest trader of physical jet fuel supply in Asia-Pacific. CAO supplies jet fuel to over 17 international airports across mainland China, including major international hubs such as Beijing Capital International Airport, Shanghai Pudong and Hongqiao International Airports, and Guangzhou Baiyun International Airport. In the last decade the company has made significant progress in internationalising its trading and supply operations as well as diversifying into other oil products. In FY18 international trading and supply accounted for 40% of revenues, compared to just 20% in 2010 and CAO now supplies fuel to 51 airports in 20 countries outside China. CAO continues to seek to expand its integrated global supply chain and benefits from sizeable and growing cash contributions from its five associates. The Chinese government owns a 51% stake through China National Aviation Fuel Group Corporation (CNAF) and BP (LON:BP) owns 20%, but CAO provides direct exposure for free float shareholders to Chinese air transport growth through its listing in Singapore.

As 90% of the company’s trade contracts relate to actual physical supply of product to customers and, given the cost-plus nature of the bonded jet fuel supply into China, the risk of speculative losses is somewhat diminished. CAO has done an impressive job of risk management over the last 13 years. The structure has allowed the group to formulate trade optimisation strategies, but these work better in contango markets (where the spot price is lower than the forward price). CAO trades higher volumes when the market is in contango. The reverse is true in backwardation markets (spot price is higher than the forward price), where the risk of holding inventory for any period manifests itself, and orders are procured as close to when they are needed as possible. As a result, the gross margin can fluctuate in the core oil trading business.

As the jet fuel market was in backwardation for long periods in 2018, margins were impinged. The current year has seen a continuation of the fluctuating price movements between contango and backwardation spreads in various territories as various supply and demand dynamics and resultant product flows have played out in different territories.

The majority of profitability and cash flow for CAO is contributed by Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA) and its annual dividend payments. CAO holds a 33% stake. It is one of six associates that own and operate fuel supply infrastructure such as storage, pipelines and airport refuelling facilities in various territories. SPIA is responsible for the whole refuelling infrastructure at Shanghai Pudong International, which has grown rapidly to become China’s second busiest airport behind Beijing International. SPIA is by far the largest associate and its H119 profit contribution of US$34.2m (H118: US$34.6m) accounted for 90% of the associates total and just under 60% of group profitability. The dividend from the previous year’s trading is normally received in the final quarter. In 2018 the payment received from SPIA was US$65.9m compared to a total associates’ dividend income of US$67.4m.

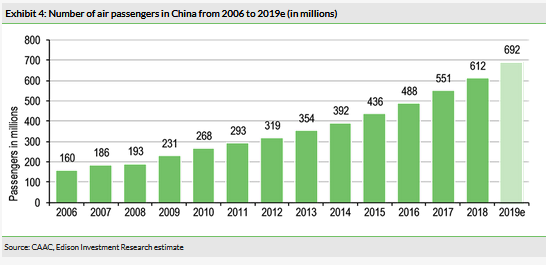

Chinese air transport growth remains very healthy

Chinese air traffic continues to grow strongly, although a greater emphasis appears to be being placed on encouraging internal tourism rather than international leisure travel. Civil Aviation Administration of China (CAAC) data show that overall Chinese air travel, measured in revenue passenger kilometres (RPKs – the number of fare paying passengers × distance flown), grew by 12.6% in 2018 (2017: 13.8%). On a domestic basis, Chinese domestic air travel increased by 12.1% in 2018 (13.3% in 2017). The domestic Chinese market is 2.7x the size of the international Chinese market. International travel is growing at a faster percentage rate, although in absolute number terms the increase in both passenger volumes and RPKs is far higher for domestic markets. Increasing wealth is helping to increase the propensity to travel, and outbound tourism has been growing rapidly as well. CAO has exposure to Chinese domestic travel through its investment in SPIA, which refuels all aircraft, and is the key jet fuel supplier to all of China’s international airports. However, its exclusive fuel supply rights are for the fast-growing Chinese international market.

We estimate RPK growth for China of 13% in 2019 and a similar rate of growth in 2020, implying a traffic multiplier of over 2x expected GDP growth of 6.1% (OECD forecast). We continue to view this as a key growth driver for CAO supply volumes although revenues will also be influenced by prices. We feel this remains sensible, as RPKs should grow faster than passenger volume growth due to the beneficial mix of long-haul international traffic compared to domestic traffic despite the policy shift. CAAC data shows that in 2018 passenger numbers grew 10.9% to 612 million, of which 64 million flew internationally, up 14.8% on the prior year. Year to date through May, the last published data, the international passenger number growth rate had accelerated to 16.5%. However, international RPK growth was 13.3%, which was more in line with CAO’s jet fuel volume growth of 12.8% for H119.

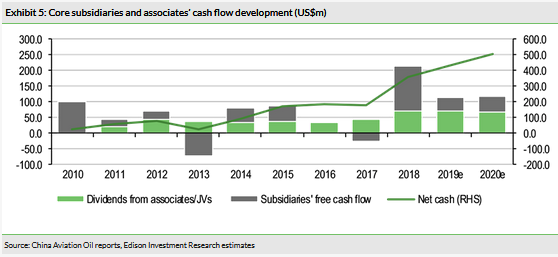

Deployment of cash expected to augment growth

CAO has a strong balance sheet and is essentially a cash-generative company, as it demonstrated last year with a substantial inflow. The additional support provided by the sizeable and growing cash dividends from associates also acts as a buffer against undue oil market volatility. CAO ended CY18 with net cash balances of c US$358m.

The balance sheet supports the expansionary strategy based on organic growth and international M&A to supplement rapid growth of Chinese air transport markets, further enhancing performance, facilitated by the strong balance sheet. CAO’s ambition to become one of the largest transportation fuel providers in the world remains at its core. The US$7.6m purchase in 2018 of Navires Aviation Ltd in the UK (renamed China Aviation Fuel (Europe) Ltd (CAFEU)) is evidence of this, extending airport refuelling to four European airports.

In the face of less favourable market conditions, the company appears to have adopted a stricter, more risk averse stance, which has led to some volume reductions outside of core jet fuel supply and trading. The trade war between the US and China is also having an impact on the trading of product volumes into the US, as it has been delaying US-bound cargoes from Chinese refineries.

While the rate of organic growth may diminish at the core trading operations, we expect continued growth in cash balances aided by healthy dividend payments from the associates, primarily SPIA. The deployment of this cash in procuring additional infrastructure assets to build CAO’s global supply chain network should enhance returns, which in turn should generate an increase in dividends for shareholders in line with a 30% payout ratio from net income.

At the end of FY18, gross cash represented US$0.42 (S$0.58) per share, and we estimate this will grow to US$0.59 (S$0.81) per share by FY20 year end.

Valuation

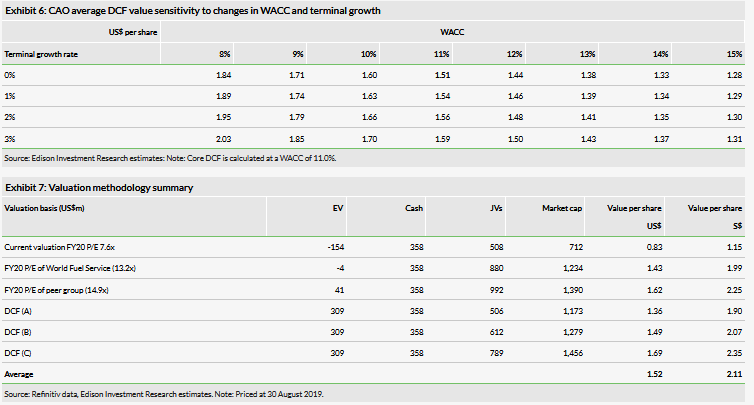

We use cash based and peer group comparisons to assess fair value. CAO (on an FY19e P/E of 7.6x) now appears to be trading at a substantial P/E discount to its closest peer, World Fuel Services in the US (FY20e P/E ratio: 13.2x), following a period of share price underperformance. CAO also trades at a significant discount to a wider air transport peer group (FY20e P/E ratio: 14.9x).

The core CAO operations can be valued on a DCF basis given the relative stability provided by being a physical jet fuel supplier as well as a trader. The paper trading of oil contracts is limited to 10% of total trade volume, with 90% backed by physical contracts, substantially de-risking the activity. In addition, the cost plus per barrel nature of the sole source import supply contract to China provides further stability as well as a gross margin premium return compared to normal trading activity. Using our calculated WACC of 11.0% implies a core CAO valuation (including US$358m FY18 year-end net cash) of US$0.78 (S$1.07) per share, to which must be added a value for the associates and joint ventures.

In FY18, the associate and joint venture entities generated 70% of net income and $67m of free cash flow. Valuing the sustainable growth of the associates’ cash stream appropriately is therefore important. Applying net income at the group FY20 P/E multiple of 7.6x is overly conservative in our view given peer multiples and growth rates (DCF A in Exhibit 7). Thus, we consider two more cash-based valuations of the dividend stream to provide a composite value, which currently stands at US$0.74 (S$0.78) per share. DCF B values the dividend as a perpetuity at WACC, and DCF C values the dividend as DCF with a 5% growth rate for the forecast period of six years and then as a perpetuity at WACC in the terminal value. Our total DCF-based estimate of fair value for CAO (average of DCFs A, B and C) overall is thus currently US$1.51 (S$2.10) per share, a modest premium to the current share price.

Our DCF based valuations, which value the large associates dividend stream in three different ways, have fallen, due to the higher applied WACC of 11% (as there is no debt), although cash streams have grown as operational performance improved and the payout ratios returned to very high levels while investment requirements are subdued.

Our overall fair value for CAO stand at US$1.52/share (S$2.11), compared to US$1.39 (S$1.82) previously, and is based on the average of our various peer- and cash-based valuation methodologies, largely reflecting the better than expected cash performance achieved in 2018. While growth may have slowed, cash generation is likely to remain strong, suggesting continued potential for the shares.

Sensitivities: Risk management for volatile markets

Given price fluctuations for oil products, the volatile nature of fuel supply markets and the inherent risks in trading activities, albeit well managed utilising sophisticated strategies, the consistent achievement of growth expectations in any territory is challenging. However, the ability of a shift in government policies to interfere and disrupt markets is very real. The current trade friction between the US and China is an example of how trading can be affected. Investors should be aware of several issues that could influence the performance of the company and the share price. Most are high level, but some relate to the nature of the business and government policy. Management has implemented a rigorous risk management regime since the derivatives speculation scandal that damaged the company over a decade ago.

Oil price and other macro issues: while the trading operations tend to be inherently risky, a movement in oil prices is generally a managed event through trading policy, risk control and hedging. In addition, markets trading in backwardation lead to selling down of stocks affecting storage operations, utilisation of stocks to optimise supply strategies and the associated profitability of storage facilities. Foreign exchange exposure exists as CAO is based in Singapore, accounts in US dollars and has a large associate income from China. The principal exposure is to the US dollar versus the Chinese renminbi.

Technical issues: the 20% stake owned by BP (LON:BP) appears to be a strategic investment, but there are a host of examples where apparently committed involvement has been quickly undone. BP has been working with CAO for over a decade, allowing it to develop its own risk management policies, which would endure even if BP were no longer a shareholder. Although a technical overhang, if BP were to sell its stake it could improve liquidity. In addition, the company has a controlling state-owned shareholder, which means the minority free float stakeholders have little control on strategic or financial decisions made by the company. In this regard, however, we would note the progressive earnings-related payout ratio, enhanced in 2018, as a sign of consideration for minority shareholders.

Political and regulatory risks: CAO’s main business operates in a centrally planned economy, where changes to policy and regulation can be far reaching and imposed quite rapidly. The state clearly regards aviation as a key element of its economic growth plan. China is exploring changes to its jet fuel market to a more demand-driven competitive pricing regime by 2020. CAO currently supplies its imported jet fuel on a cost-plus, fixed-price barrel basis, which could be altered if such a regime were introduced. However, CNAF, CAO’s parent company, which grants CAO its jet fuel import licence, owns the refuelling assets and infrastructure at all of China’s airports, providing a very high barrier to entry for any new competitors. In addition, the growth of the transportation fuel market in China could lead to demand for more import licences to be awarded. The US administration’s policies have an impact on global trade flows and industrial output, which has affected imported supply of oil products.

Company-specific risks: a large part of the company’s activity is oil trading, which carries significant risk as the company seeks to fulfil its contracted physical supply obligations. Risk factors can be categorised as market, credit, operational and enterprise. Risk can be to the upside as well as to the downside, although hedging operations are designed to mitigate the volatility and scale. Since 2006, with the help of BP (LON:BP), a robust risk management structure has been formulated, constructed and implemented, with a multi-tiered boardroom to operational-level system of checks, balances and accountability.