China Aviation Oil Singapore Corp Ltd (SI:CNAO) has made good progress in the first half of the year, benefiting from favourable volume growth offset to a degree by FX and the non-recurrence of positive stock valuation. Trading conditions look more challenging in the second half with the jet fuel market having moved into backwardation since early July. We are thus taking a much more cautious view on the second half and have reduced our forecasts accordingly. It is important to recognise that cash generation has been far stronger than expected and should remain favourable in H2 as inventory is released and the main associate dividend is received. Thus, our fair value actually increases to US$1.55 (S$2.11) per share from US$1.45 (S$2.04) as a result.

Steady H1 progress

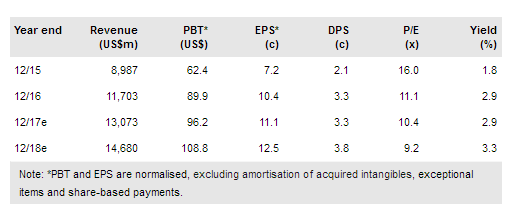

The core trading volumes expanded positively as revenues increased 55% in H1, or by US$2.5bn to US$7.0bn. The gross margin fell 14bps to 0.37% but gross profit was up almost 13% at US$26.0m. The main associate, SPIA, the largest contributor to group net income, experienced a flatter than expected first half. Trading volumes were strong but the absence of stock profit and the 5% decline in the renminbi against the US dollar offset this. Overall, the associates’ contribution fell by 1% to US$33.2m. Interest income rose as net cash balances increased ahead of expectations, but overall EPS progression of 4.5% was steady.

To read the entire report Please click on the pdf File Below: