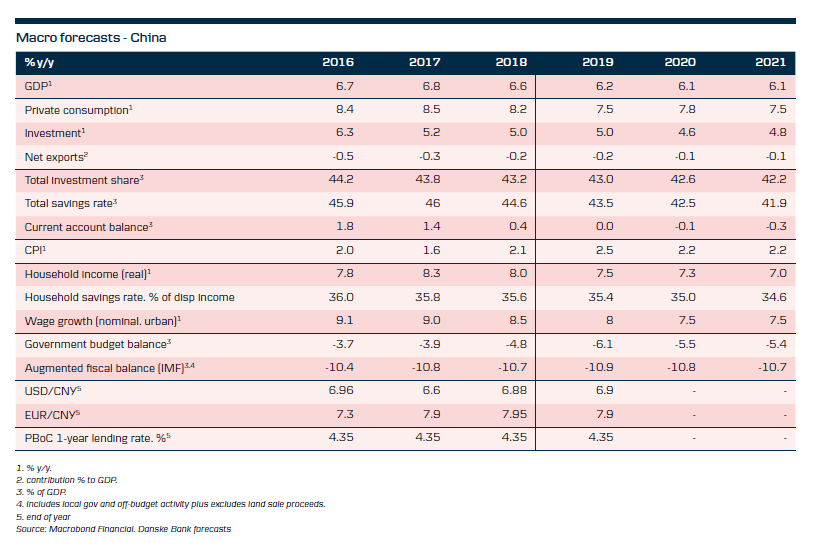

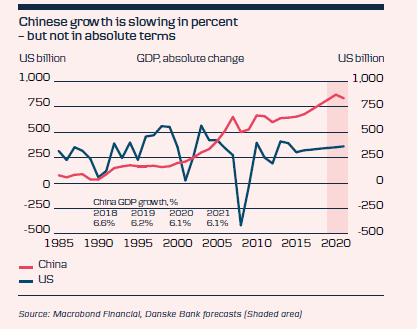

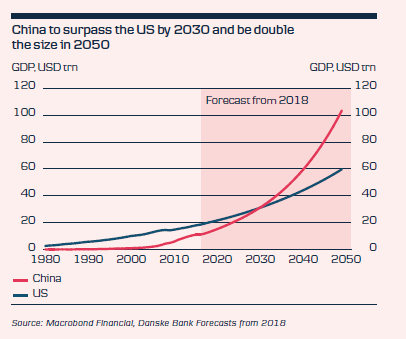

- Growth recovery to be delayed by further trade war escalation. However, stimulus is set to cushion the drag from higher uncertainty. We look for growth to fall to 6.2% in 2019 from 6.6% in 2018. In 2020 we expect the economy to grow 6.1%.

- We look for a trade deal in H2, which should pave the way for a recovery in Q4. Uncertainty is elevated, though, and an all-out trade war that runs into 2020 would delay any lift to growth.

- We expect more policy stimulus with a further cut in the RRR and subsidies for consumer goods. USD/CNY to rise to 7.10 over the next quarter.

- China is set to face some headwinds from production moving to other Asian countries and US export controls in tech. China's likely response will be more focus on self-reliance, even more investments in the tech industry and new efforts to create a better business environment for foreign companies in order to attract FDI.

- China has stepped up measures to support the private sector and continues to highlight 'reform and opening'. We expect China to stay on a catching-up path and to surpass the US economy by 2030.

Recovery delayed but stimulus set to cushion the drag

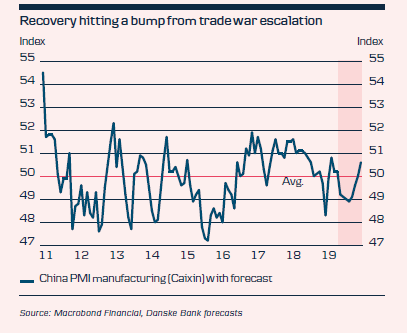

In the early months of 2019, signs of a bottom in the Chinese business cycle emerged. PMI manufacturing rebounded and higher metal markets supported the view of a lift to activity. However, the outlook turned darker in early May, when the US-China trade talks took a dramatic turn for the worse. US President Donald Trump shifted back to his ‘maximum pressure’ strategy and increased tariffs from 10% to 25% on USD- 200bn of Chinese goods and started the process of adding 25% tariffs on the rest of imports from China of USD300bn. Uncertainty has thus increased significantly, which we expect to put a break on the brewing recovery (see top chart). However, it is still our baseline scenario that we reach a deal during H2 and have pencilled it into our forecast in late Q3 (see below). If this proves correct, we should merely see a postponement of the recovery to Q4. However, we also stress that a deal is far from certain and there is a risk that Trump goes the whole way and adds tariffs on all Chinese goods and delays a Chinese recovery into 2020.

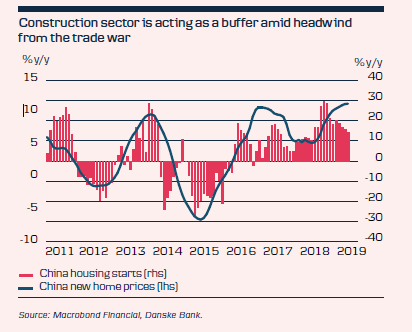

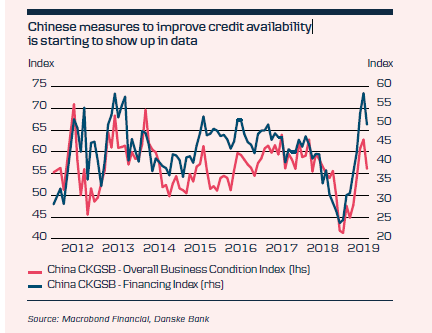

There will be some mitigating factors for the Chinese economy in the midst of all the uncertainty. First, China added stimulus to both consumers and companies last year, which is increasingly having an effect. The stimulus covered both tax cuts and monetary and credit easing. Second, the construction sector is supported by a low level of inventories. Hence, the monetary easing that is set to push up home sales should quickly translate into even more robust construction spending.

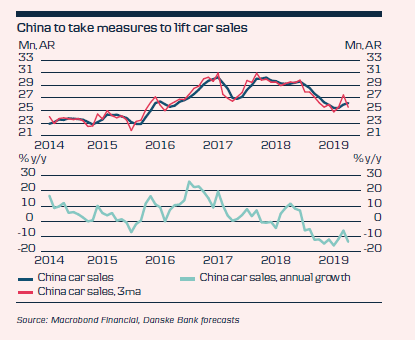

Private consumption, corporate investments and exports, on the other hand, have all suffered from the trade war. Car sales, for example, are at their lowest levels in three years. However, we believe China will add more stimulus in the form of subsidies for purchases of cars and home appliances as well as further monetary easing through one or more cuts in the Reserve Requirement Ratio (RRR). China will also continue to do targeted lending through its liquidity measures to the banks, which is conditioned on loans to the real economy.

Even if China fends off some of the short-term drag, there will likely be long-term negative effects from companies moving more production from China to other Asian countries such as Vietnam, Bangladesh and Malaysia. The recent US ban on exporting products to Huawei has also shown that China is likely to face less access to US technological products in the future, which will make it less attractive as a production or assembly base for high-tech products. On the other hand, it is increasing China’s efforts even more to develop its own technology sector and Chinese President Xi Jinping has repeated the need for ‘indigenous innovation’.

The CNY started to weaken again versus the USD when the trade war re-ignited. We expect further depreciation to 7.10 in 3 months, as monetary easing and growth worries will add to the downside pressure on the currency. On the other side of a trade deal, we look for the CNY to strengthen again to 6.8 in 12 months.

Trade deal in H2 our baseline but uncertainty is high

Both the US and China are currently digging in and showing no signs of a willingness to compromise. However, we believe this will eventually change as a failure to break the deadlock, in our view, will lead to a bigger market sell-off as fears of a full-blown trade war grow. Trump has previously proven to be sensitive to sell-offs in the equity markets and China may try to test his tolerance for pain if he refuses to meet them half way in.

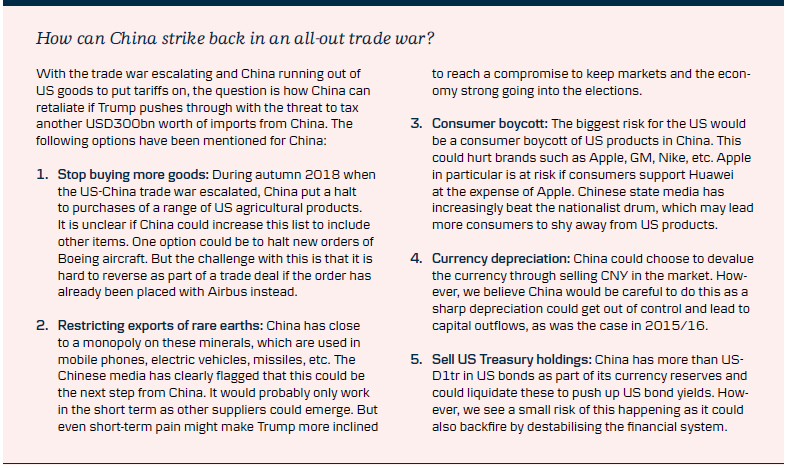

The first test of how far we are from a deal is a meeting between Trump and Xi Jinping at the G20 meeting in late June. It can go two ways: Either they find compromise and get talks back on track or they fail to find a solution and the war of attrition continues. In this case, markets are likely to sell off sharply, especially if Trump decides to follow through on his threat to impose tariffs on all Chinese goods. We see a 50-50 risk of this happening. If we go down that path, China’s next steps may be restrictions on rare earth exports to the US and a boycott of US goods by more consumers. This would have a clear negative effect on both the US and Chinese economies and markets. In our view this would get the two sides to eventually make a deal later in H2 (our working assumption is late Q3).

China steps up efforts to support private sector

China’s economic strategy is to put more focus on ‘quality over quantity’ and facilitate a further transition away from infrastructure investments and low-end manufacturing towards private consumption, the service sector and high-end manufacturing. With 600m people still living in rural areas and GDP per capita at 15% of the US level, China still has a long way to go. But in some high-tech areas, China is now at the frontier of technology. For example, when it comes to the development of 5G technology, e-commerce and digital payments.

China’s polices also focus on increased efficiency in the stateowned sector, closing ‘zombie’ companies, fighting financial risks, eliminating poverty, reducing inequality across regions and incomes and fighting pollution. China also has a challenge with a significant ageing of the population. Heavy investment in robots is partly seen as one solution to this problem.

Xi Jinping last year stressed support for the private sector as concerns mounted that he will increasingly prioritise the state sector at the expense of the private sector. Xi Jinping wrote an open letter to private entrepreneurs saying, “Any words or acts to negate or weaken the private economy are wrong…it is always a policy of the Central Committee of the Communist Party to support private business development, and this will be unwavering”. This message was repeated at the annual National People’s Congress in March by Premier Li Keqiang, where he said that “We will work to energise market entities and improve the business environment” and “we will uphold the ‘two irresolutions’ principle and encourage, support and guide the development of the non-public sector”.

Over the past year, China took steps to lower costs for private companies by cutting taxes and social contributions. It also ordered state-owned banks to increase private sector credit by 30% y/y, as the private sector in particular has been hit by the crack-down on shadow banking. IMF said this month that "progress on structural reforms has led to a further opening up of the economy and a greater role for market forces" but also that "SOE reform should continue and help achieve competitive neutrality by hardening SOE budget constraints and removing their implicit guarantees" (SOE is State Owned Enterprise).