Resource pressure is a constant. As we continue to track the nearly delusional energy “debate” in the United States about whether we will continue to burn coal and whether natural gas is a panacea, China continues to struggle with the sufficient acquisition and deployment of resources to support economic growth.

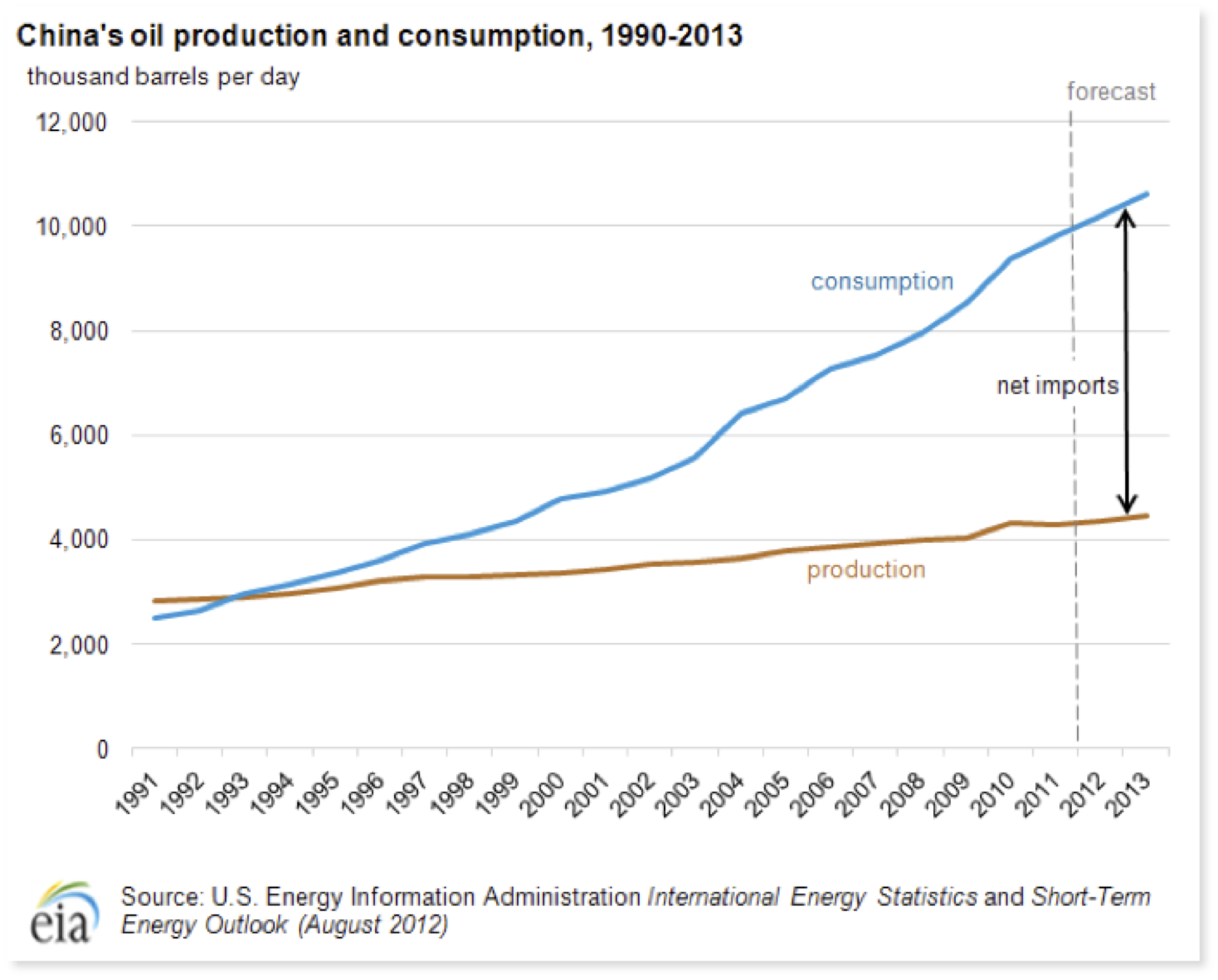

China has an environment versus growth problem. Already China is the #1 importer of oil in the world. That‘s right. China imports more oil than the United States. By itself that comment is meaningless because it reflects greater US oil production, substitution by natural gas, and significant and increasing energy efficiency gains.

The United States can hold energy consumption growth below GDP growth with efficiency gains and because of the greater percentage of service relative to the economy. China cannot.

Chinese oil consumption will continue to rise. China, however, has an emerging and growing middle class that wants to buy a car, as is typical when annual GDP per capital hits $10,000-20,000 per year. We don’t need to see U.S. ownership rates – the population is 4X so even getting to half the ownership rate over time means twice as many cars.

Besides trail, buses, domestic aviation and trucks China is putting over 1 million cars every month onto its expanding road and highway network.

Which strains other sources of energy supply and water!

We find our best opportunities when we identify a huge gap between public perception and underlying reality.

Even by conservative estimates, the upside potential for this trend is 400%. There is literally a $21 billion opportunity here. And the three specific companies I’ve outlined in a report The 400% Energy Opportunity Wall Street Won’t Tell You could all show gains between 500%-800% or even more.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

China's Environment Versus Growth Problem

Published 11/27/2013, 01:51 AM

Updated 07/09/2023, 06:31 AM

China's Environment Versus Growth Problem

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.