Mixed data from China

The Chinese economy is still in troubled waters as the effects of the PBoC’s massive stimulus are taking time to translate into the real economy. Yesterday’s CPI report showed that inflationary pressures are not picking up as they printed at 1.3%y/y versus 1.5% consensus and 1.6% previous reading, signaling that there is some room for further monetary easing from the Chinese central bank; especially considering the fact that the PBoC has an inflation target of 4%. Moreover, when you have a look at the data released earlier this morning, it would seem that we have not reached the bottom yet. Industrial production continued to slide in October, for the third month in a row, and rose 5.6%, while economists were looking for an expansion of 5.8%. However, retail sales came in slightly above expectations, printing at 11%y/y versus 10.9% median forecast. USD/CNY rose to 6.3660 upon the release of the data, while the fixing was set higher to 6.3414 from 6.3602 a day earlier. Since the PBoC does not seem prone to devaluating the yuan using the fixing, as it is trying to establish a reserve-currency status, it mechanically increases the probability that the bank would use more traditional tools to further support the Chinese economy. We therefore expect further cuts in the RRR and the 1-year lending rate.

Eurozone: between financial and political uncertainties

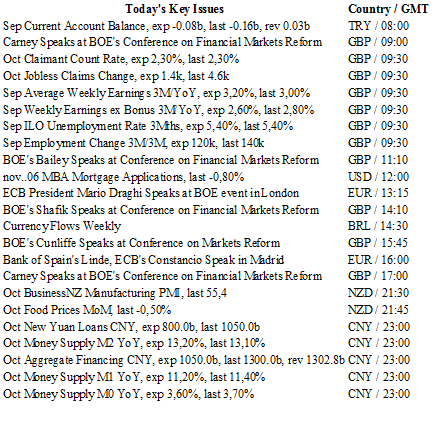

ECB president Mario Draghi will speak today at the Bank of England. It is reasonable to think that the overall tone will remain dovish. By the way, Draghi has dropped multiple hints over the last month that the pace of the quantitative easing program will be increased and that it will end up after September 2016 if needed. Markets have now already priced in uncertainties about the central bank’s program. Next Eurozone data will be closely regarded to appraise the true efficiency about the program

However, this meeting will also be well scrutinized, as the single currency struggles with internal political issues. In Portugal, the anti-euro leftist has been banned by Cavaco Silva to create their own government under the fact that the European Union should be more important than democracy. In Spain, Catalunia is really willing to push for independence.

The truth is that the Eurozone is not only facing financial issues but also political issues that could damage its existence. The refugee crisis is one very good example of that. Whereas the free circulation of people is one of the primary rule amongst European countries, the protection of the countries’ sovereignty looks far much more important. A barrier between Austria and Slovenia is a perfect illustration.

As a result Eurozone government bonds yield higher and this diminishes the efficient of the ECB quantitative easing program. Hence, the Portugal’s 10-Year bond reached its highest level since July. We remain clearly bearish on the EUR/USD.

SNB stands ready for action

FX markets are not really helping the Swiss national bank’s problem with an overvalued CHF. While the CHF depreciates against the USD it gains against the EUR. However, for the SNB it’s the CHF position vis-a-vis the EUR which matters most. Finding itself entrenched amid current Swiss economic conditions which are broadly deteriorating and deflations, the SNB needs the CHF in a competitive position with its largest trading partner. Recent marginal improvements in data were driven by CHF deprecation which has not reversed. ECB President Mario Draghi’s dovish comments clearly signal that December will open the discussion for QE expansion. However, actually actions are highly probable. We anticipate not only lengthened asset purchases but further cuts to the deposit rate. Lower interest rates in Europe will have a direct effect on capital flows into Switzerland. In September, the SNB held off acting, leaving sight deposits rate at -0.75%, despite dropping the inflation forecast, choosing instead to stand ready to react to the ECB's potential policy actions. The SNB has two primary tools to handle further ECB easing and CHF strength. The banks can further reduce interest rates (first tightening current deposit rates loopholes) and/or direct currency intervention. While they will never fully abandon currency purchases, the likelihood of significant FX intervention remains a low probability as the SNB balance sheet has expanded into unsettling territory. Swiss policy makers have been vocal in recent weeks highlighting the importance of negative interest rates on sight deposit as a policy tool. On November 3, the SNB president mentioned negative interest rates as a primary monetary policy strategy to 'dampen upward pressure on the Swiss franc.' The Swiss economy remains fragile indicating that the SNB will defend the CHF from further overvaluation against the Euro. Given the Bank’s track record of inflicting as much damage on CHF longs as possible, heading into December, CHF traders should be wary of potential aggressive action.

The Risk Today

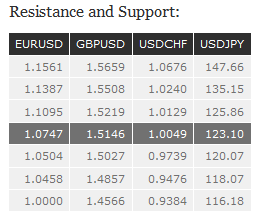

EUR/USD has set a new hourly support at 1.0675 (10/11/2015 low). Hourly resistance lies at 1.0897 (05/11/2015 high). The technical structure is clearly negative. Stronger resistance stands at 1.1095 (28/10/2015 high). Nonetheless we still expected a retracement of the pair above 1.0800 as it seems there are still some buying interest pressures. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is still increasing. Hourly support can be found at 1.5027 (06/11/2015 low). Hourly resistance stands at 1.5219 (05/11/2015 high). Expected monitoring of the resistance at 1.5219. The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY weakens. Hourly resistance lies at 123.60 (09/11/2015 high). Nonetheless the short-term technical structure favours a further rise. Strong support lies at 120.80 (22/10/2015 low). Expected rise of the pair. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF is still holding above 1.0000, confirming buying interest. The technical structure is showing a consolidation. Hourly support is given at 0.9944 (06/11/2015 low). Expected to further consolidate. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.