Considering all that has occurred in global markets over the past week you would be forgiven for having missed an important figure from China’s recent GDP results. Suspiciously, China’s Bureau of National Statistics, who is responsible for compiling the official GDP figures, seemingly delayed the release of the Q1 data, despite the headline annual result becoming public on Friday. Therefore, being the suspicious contrarian that I am, the result deserved a significant review.

Despite the subterfuge over their release, the seasonally adjusted quarterly results contained some concerning numbers. It would appear that growth has largely moderated within the PRC throughout the first quarter, coming in at just 1.1%, the slowest GDP number since late 2010. In fact, on an annualised basis, that result does little to warm the hearts of the bulls as it implies GDP growth of just 6.3% which is a significant distance from the “official” figure.

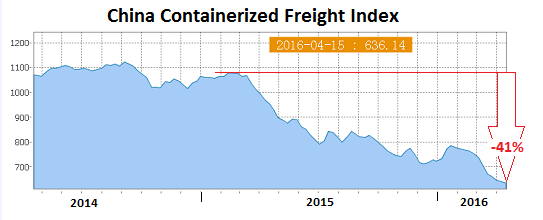

However, there are plenty of reasons to even doubt the veracity of that figure given the level of manipulation that commonly occurs within Chinese GDP reporting. Some of the best gauges of industrial and manufacturing activity that we have are all at dire levels. In particular, Chinese containerised sea freight has completely collapsed to levels not seen since the height of the global contraction. Given the importance that manufacturing and exports pose to the Chinese economic future it is concerning indeed to see such a strongly bearish trend within those indicators.

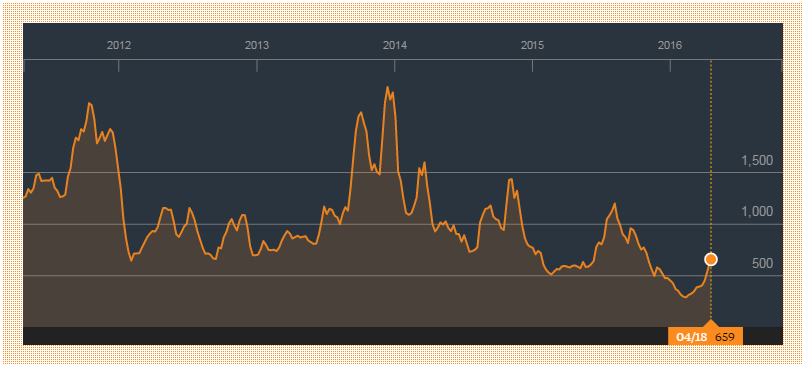

The Shanghai Containerized Freight Index (SCFI) largely tracks spot rates within the shipping market for containers departing the Chinese export hub. A quick look at the graph shows a definite trend predicated to the downside, with the index down over 58% since February last year. This result seems to tally, both with the collapse in the Baltic Dry Index, and the excess capacity evident within the shipping industry as a whole. Rates for shipping are dropping relatively steadily and coupled with the BDI result imply that there has been a significant collapse in the amount of container shipping being demanded out of China.

Subsequently, it is really no surprise that the Chinese GDP figures are pointing to diminished demand within the first quarter of 2016. In fact, this economic slowdown is largely in line with the ongoing turmoil within domestic debt markets as corporate bond yields spike and uncertainty abounds. In addition, given the constant downward revisions of global growth from the IMF, it should come as no surprise that the Asian powerhouse has not escaped a slowdown.

Baltic Dry Index (Source: Bloomberg)

However, the question remains as to the extent of a domestic slowdown in China given the unreliability of much of the reported data. To answer that question, one needs only to look at the country’s GDP diversity with secondary industry representing nearly 44% of GDP receipts. Subsequently, despite the pivot towards the service sector, manufacturing and industry still represent a statistically significant component of GDP growth.

It therefore makes little sense that such a sharp contraction within an industry sector that contributes nearly 44% of all GDP would have little impact upon the “official” figures. I firmly believe that the collapse in containerised cargo, sharp contraction in the Baltic Dry Index, and the fall in electricity consumption are all endemic of a country that is facing some sharp economic challenges in the months ahead. Ultimately, China should come clean now on the extent of the domestic slowdown lest a collapse in the corporate debt markets become the first show across the bow which could lead to a global recession in 2016.