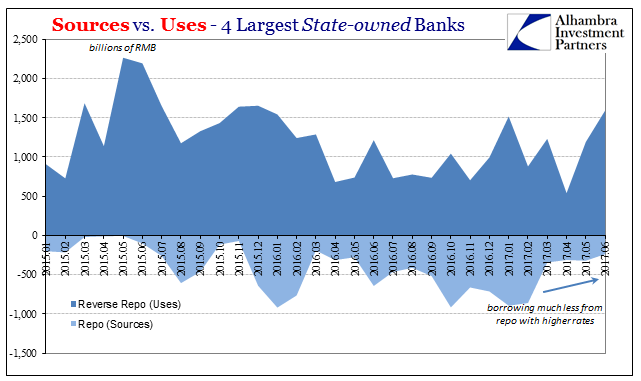

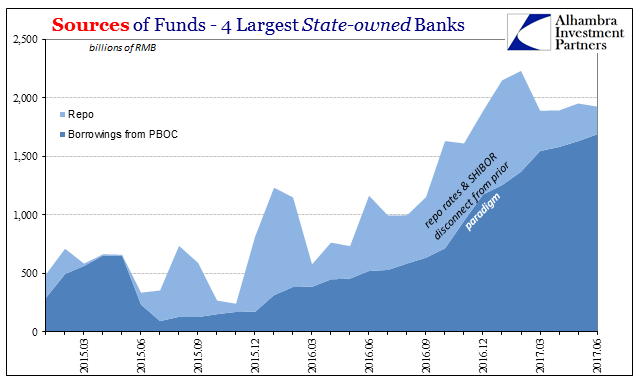

Updated statistics from the People’s Bank of China shed some light on changing money conditions in RMB. The Big 4 State-owned banks have been the primary liquidity conduit for all policies and activities going back to 2014. These institutions had been since the middle of 2016 increasingly squeezed as to excess funding available to be forwarded into money markets. This despite enormous borrowing at the central bank’s various windows (primarily the MLF).

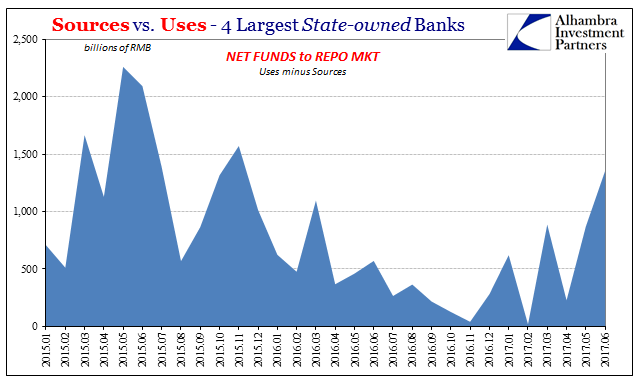

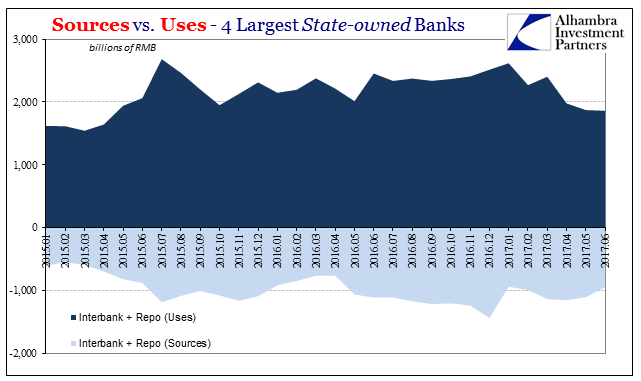

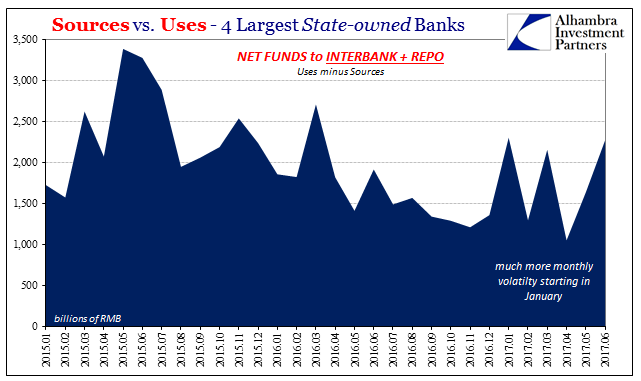

In June, however, the Big banks dramatically scaled back their repo borrowing, while at the same time redistributed a much larger amount of RMB back into repo through reverse repurchases. The net change was a dramatic increase in available funds (at higher rates).

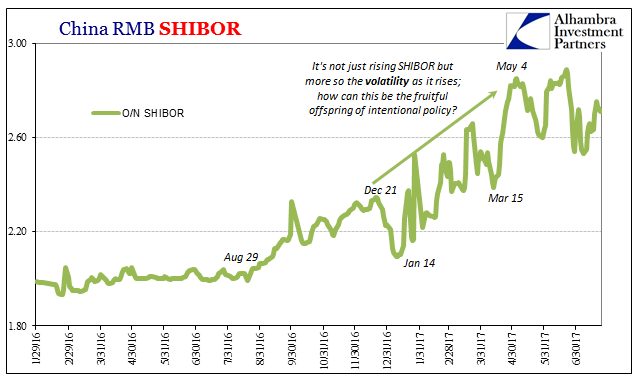

That likely accounts for what has been a difference in trajectory of both secured and unsecured money rates (for an explanation why anyone should care about China repo and SHIBOR, go here) going back to into May (which was also favorable in this way).

The funding for this sudden excess, however, didn’t come from the central bank. Borrowings from the PBOC remained subdued in June. The increase in borrowed reserves was for the third straight month less than the impressive rate prevailing late last year and early this year.

The funding didn’t come from unsecured interbank arrangements, either. Like repo, China’s big banks have been reducing their footprint in both of these wholesale channels as rates rise – leaving more RMB for everyone else.

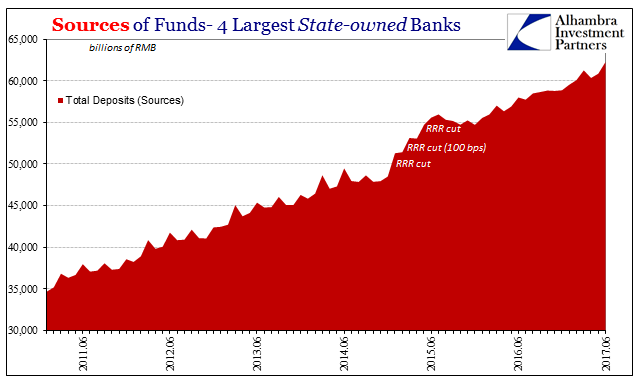

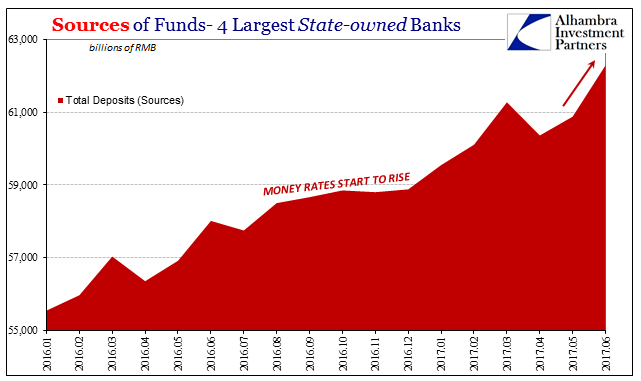

If it wasn’t wholesale or the PBOC, where did China’s largest banks get their increased funding? The answer is, partially, in the most traditional of ways: customer deposits.

June was a very good month for the money multiplier, which in China actually applies in a meaningful way. Total deposits rose by RMB 1.4 trillion, while total interbank sources fell by RMB 187 billion. That left a chunk of unused funds for money markets, largely because the banks did not otherwise lend out against those deposits. Total loans were only RMB 300 billion more in June than May.

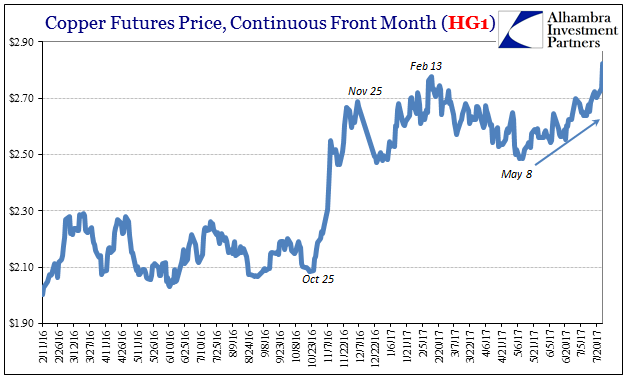

Money rates in July have so far held lower, suggesting that some of these factors remained in effect this month as well as being applied last month. Whether or not that includes a reluctance to lend remains to be seen, as well as what that might mean, or perhaps that was just a one-month hiatus ahead of mid-year regulatory checks. Combined with an appreciating CNY, you can understand perhaps why copper investors are itching to bet on some level of further upside.