The Children’s Place, Inc. (NASDAQ:PLCE) reported mixed second-quarter fiscal 2019 results, wherein earnings beat estimates but sales lagged. However, its earnings and sales declined year over year. Further, the company slashed its earnings view for fiscal 2019 on expectations of increased promotional activity in the sector in the second half of fiscal 2019 and adverse impacts of the recently enacted tariffs.

Though its bottom line beat estimates in the quarter, investors were not pleased with soft sales, resulting from weak traffic and increased promotions, and a bleak view for fiscal 2019. Consequently, shares of the company dipped roughly 2.5% on Aug 21.

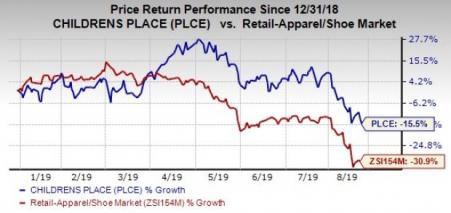

We note that shares of this Zacks Rank #3 (Hold) company have slipped 15.5% year to date, significantly outperforming the industry’s decline of 30.9%.

Let’s Delve Deeper

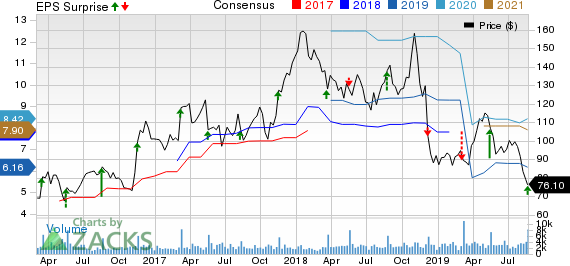

The children's specialty apparel retailer reported adjusted earnings of 19 cents a share, outpacing the Zacks Consensus Estimate of 17 cents, but fell significantly from the year-ago period’s figure of 70 cents. This marked the company’s second straight earnings beat, after reporting misses in the preceding two quarters.

Children’s Place generated net sales of $420.5 million that missed the Zacks Consensus Estimate of $434.1 million, after reporting a beat in the preceding quarter. Notably, the company delivered negative sales surprise in two of the last four quarters. Moreover, its top line moved down 6.3% on a year-over-year basis. The decrease in net sales can be attributed to a 3.8% decline in comparable retail sales against 13.2% increase last year.

Comparable retail sales slid 4.2% in the United States but were slightly positive in Canada. Moreover, e-commerce penetration improved 240 basis points to 29% of net sales in the quarter under review.

Further, the company’s sales reflected impacts of softer-than-expected traffic across the sector, which led to increased promotions to clear inventory toward the end of the quarter. Soft sales also resulted from lower demand as customers stocked up during the liquidation events of Gymboree and Crazy 8 in the fiscal first quarter. Sales comparisons were also affected by the absence of strong weather-driven demand that occurred in early second-quarter fiscal 2018.

Though the company’s seasonal carryover inventory declined in a double-digit at the end of the fiscal second quarter, management anticipates witnessing increased promotional activity across the market in the second half of fiscal 2019.

Coming back to the reported quarter’s results, adjusted gross profit was $138.8 million, down 10.3% year over year. Meanwhile, adjusted gross margin contracted 150 basis points (bps) to 33%, owing to deleveraging of fixed expenses. The increased fixed expenses stemmed from a fall in comparable retail sales and adverse impacts of increased e-commerce penetration, which is a lower-margin business. Moreover, modestly lower merchandise margin on soft traffic conditions and increased promotions hurt gross margin growth.

Adjusted SG&A expenses dropped 5.7% from a year ago period to $115.5 million while as a percentage of net sales, the same rose 20 basis points to 27.5%. The increase in SG&A expenses mainly resulted from a decline in comparable retail sales, offset by better expense management and relatively flat incentive compensations.

Adjusted operating income was $5.8 million, down from $15.7 million a year ago, while adjusted operating margin shriveled 210 bps to 1.4%.

Store Update

As part of store fleet optimization endeavors, the company opened three stores and closed 13 in second-quarter fiscal 2019, thereby ending the quarter with 961 stores. The three stores opened in the reported quarter are in sync with its target of opening about 25 stores in highly productive centers in the next two years. The company plans to open nearly 10 stores in highly productive centers in 2019.

Since the announcement of the store fleet optimization program in 2013, it has shuttered 226 stores. This keeps it on track to close about 300 stores by 2020 as part of the program. Further, the company has closed nearly 15 stores year to date, remaining on track with the planned closure of 40-45 stores in 2019.

Additionally, its international franchise partners opened 18 points of distribution in second-quarter fiscal 2019. Consequently, the company had 225 international points of distribution open and operated by its eight franchise partners in 19 countries, as of Aug 3, 2019.

Other Financial Details

Children's Place ended the quarter with cash and cash equivalents of $65.4 million compared with $106.4 million a year ago. The company exited the quarter with inventories of $386.2 million, up 5.4% year over year. Shareholders’ equity totaled $249.3 million as of Aug 3, 2019. Management incurred capital expenditure of about $11 million in the reported quarter. Further, the company expects capital spending of approximately $65-$75 million in fiscal 2019.

During the fiscal second quarter, the company bought back 270 thousand shares for roughly $27 million and paid out a quarterly dividend worth nearly $9 million. As of Aug 3, 2019, it had about $179 million remaining under its existing share repurchase program. The company remains on track to repurchase shares worth $500 million between 2018 and 2020.

Concurrent to the earnings release, it also declared a quarterly cash dividend of 56 cents per share, which is payable Oct 4 to shareholders of record as of Sep 23.

A Look at Guidance

As already stated, management expects increased promotional activity in the second half of fiscal 2019 despite lower seasonal inventory carryforwards. This, along with the inclusion of the impacts of the incremental tariffs imposed recently, led the company to trim its earnings view for fiscal 2019. Furthermore, it adjusted its sales view to incorporate the promotional environment.

The company now envisions net sales of $1,910-$1,925 million compared with $1,905-$1,925 million stated earlier. Further, the guidance is still lower than sales of $1,938.1 million reported in fiscal 2018. The company continues to forecast comparable retail sales to be flat with the fiscal 2018 level. E-commerce penetration is still projected to increase to 30% of net sales from approximately 28% last year. Further, it envisions adjusted operating margin of 6.1-6.4%, whereas it recorded 6.6% in fiscal 2018.

The company now anticipates adjusted earnings to be $5.40-$5.75 per share for fiscal 2019 versus $5.75-$6.25 stated earlier. This also reflects a decline from earnings of $6.75 reported in fiscal 2018. The guidance includes an impact of nearly 8 cents from the recently enacted tariffs.

For third-quarter fiscal 2019, the company expects net sales of $530-$535 million. Comparable retail sales are expected to increase 3-4% compared with growth of 9.5% in the prior-year period. The company’s comparable retail sales guidance incorporates gains witnessed in the year-ago quarter due to the early arrival of cold weather, which led to strong sales of seasonal products. Meanwhile, adjusted operating margin is projected to be 11.5-12%.

Adjusted earnings are anticipated to be $2.90-$3.05 in the fiscal third quarter, suggesting growth from $3.07 recorded in the prior-year period.

Further, the company is encouraged with the increase in the number of orders for the back-to-school season and anticipates delivering the products ordered on time. It further stated that it anticipates eliminating shipping bottlenecks in the upcoming holiday season by using a third-party logistics provider to fulfill online orders. Consequently, it expects fiscal fourth-quarter comparable retail sales to grow nearly 4%. However, adverse impacts of six less shopping days between Thanksgiving and Christmas in 2019 are likely to hurt fiscal fourth-quarter sales by nearly $5 million (or 1%).

Moreover, the company expects to reduce exposure to imports from China in all categories, including Gymboree, to mid to high-single-digit percent in 2020. This is likely to lower average unit costs (AUC) again in 2020, after witnessing a decline in 2019.

Check 3 Better-Ranked Trending Stocks

Boot Barn Holdings (NYSE:BOOT) presently has a long-term earnings growth rate of 17% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Canada Goose Holdings Inc. (NYSE:GOOS) currently has a long-term earnings growth rate of 28.5% and a Zacks Rank #2 (Buy).

Burberry Group (LON:BRBY) PLC (OTC:BURBY) has a long-term earnings growth rate of 9% and a Zacks Rank of 2 at present.

It’s Illegal in 42 States, But Investors Will Make Billions Legally

In addition to the companies you read about above, today you get details on the newly-legalized industry that’s tapping into a “habit” that Americans spend an estimated $150 billion on every year.

That’s twice as much as they spend on marijuana, legally or otherwise.

Zacks special report revealing how investors can profit from this new opportunity. As more states legalize this activity, the industry could expand by as much as 15X. Zacks’ has just released a Special Report revealing 5 top stocks to watch in this space.

See these 5 “sin stocks” now>>

Burberry Group PLC (BURBY): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research