Chicago Bridge & Iron Company N.V. (NYSE:CBI) won a contract from Técnicas Reunidas, S.A. for new product storage tanks for Saudi Aramco's refinery in Ras Tanura, Saudi Arabia.

The new tanks will be part of a clean fuels expansion project. Chicago Bridge & Iron work will encompassthe engineering, procurement, fabrication and construction of nine flat bottom tanks, as well as modifications to numerous existing tanks (which were all originally supplied by Chicago Bridge & Iron). This continues a long-working relationship (nearly 80 years) as the company has provided almost all of the product storage at the Ras Tanura facility, since 1938.

Chicago Bridge & Iron has been treading rough waters, of late. The company plunged to eight-year lows, following dreary Q2 results. Investors are abandoning the stock in droves, in light of the miserable guidance and a dividend suspension. The stock has lost 64.8% of its value year to date, much worse than the industry’s decline of 13.5%.

This energy infrastructure services firm was forced to take desperate actions to shore up its financial position after reporting an immense drop in revenue and a huge loss in second-quarter 2017.

Revenues for the second quarter fell 40.9% year over year on declines across the board, with a particularly weak engineering and construction business. The company’s total backlog also fell 7.5% year over year.

With respect to earnings, the company reported a colossal GAAP loss of $3.02 per share, as a dismal top line, and escalating operating expenses and interest expense hurt profits. The company’s margins were deeply affected by a rise in cost in two gas turbine projects and two LNG export facility projects.

The company also booked substantial charges (roughly $548 million pretax) in relation to four Engineering projects. Lower-than-expected labor productivity, elevated costs for fabrication, and craft labor, weather-related delays, subcontractor and indirect costs were responsible for the cost overruns.

In a shocking move, the company announced that it will discontinue paying its dividend with immediate effect. Its dividend had carried a yield of roughly 1.75% for the stock and there’s no doubt that this move antagonized investors gravely. Also, the step reflects severe balance-sheet weakness, as the company said that the dividend cut was apparently necessary in order to satisfy creditors and ensure compliance with certain debt covenants at end of June. The suspension of the dividend is expected to result in annual cash savings of $28-$30 million.

Concurrent with the earnings report, Chicago Bridge & Iron released a new guidance for the remainder of the year. It now expects second-half earnings of $1.00-$1.25 a share on revenues of $3.7-$4.0 billion. Combined with revenues of $3.11 billion in the first half, the guidance implies 2017 expected sales of $6.81-$7.11 billion — which is well below the previous projection of $9.5-$10.5 billion for the year.

The company’s new CEO, Patrick Mullen, declared a flurry of measures to address its chronically poor project execution, improve efficiency and strengthen the balance sheet. To unlock hidden value, Chicago Bridge & Iron intends to sell its crown jewel Technology licensing business for roughly $2 billion or more (net proceeds are likely to exceed the company’s entire net debt of about $1.5 billion). The company is also implementing a comprehensive corporate and operating cost-reduction program, which, it expects, will generate savings of $100 million on an annualized basis.

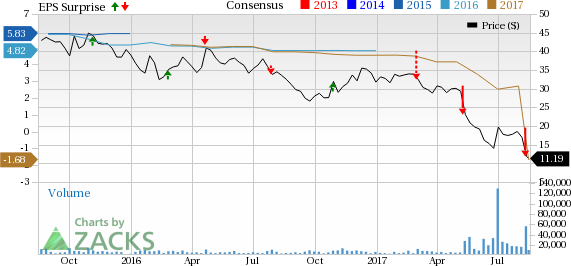

Not surprisingly, the analyst community has also been distinctly bearish on the stock in recent times. Chicago Bridge & Iron’s earnings estimates have moved south sharply in the past 60 days, with the Zacks Consensus Estimate for 2017 plunging from earnings of $3.41 to a loss of $1.68, on the back of three downward estimate revisions versus none upward.

Chicago Bridge & Iron Company N.V. Price, Consensus and EPS Surprise

With slumping revenues, bleak guidance, distress sale of a key operating unit and the need for extreme strategic action, we believe the future looks exceedingly uncertain for Chicago Bridge & Iron. In light of the numerous headwinds that have been plaguing the company and the miserable analyst outlook for earnings, we have a Zacks Rank #5 (Strong Sell) on the company.

Stocks to Consider

A few better-ranked stocks in the broader sector include KB Home (NYSE:KBH) , EMCOR Group, Inc. (NYSE:EME) and Beazer Homes USA, Inc. (NYSE:BZH) . While KB Home sports a Zacks Rank #1 (Strong Buy), EMCOR Group and Beazer Homes USA carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

KB Home has a positive average earnings surprise of 12.5% for the last four quarters, having surpassed estimates all through.

EMCOR Group has a strong earnings beat history, having surpassed estimates thrice over the trailing four quarters. It has a positive average surprise of 11.7%.

Beazer Homes USA managed to beat earnings twice over the trailing four quarters. It has an impressive positive average surprise of 103.5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Chicago Bridge & Iron Company N.V. (CBI): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH): Free Stock Analysis Report

Original post