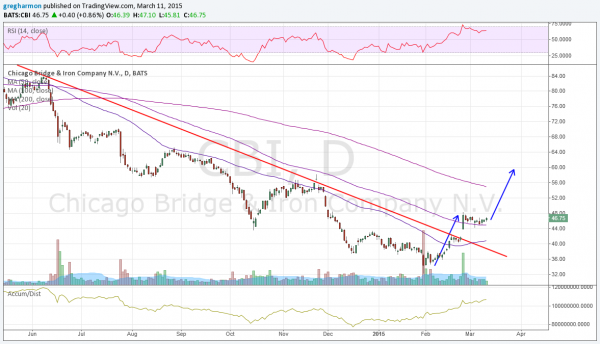

Chicago Bridge & Iron Company NV (NYSE:CBI) is one of those stocks that a lot of investors pay attention to because of their big holders. Warren Buffett’s Berkshire Hathaway reportedly owns more than 5% of this company. But shortly after he announced that purchase the stock started lower, losing over 60% of its market cap at the bottom at the end of January. But the chart is showing several signs of strength. Maybe it is time own a Warren Buffett stock at a substantial discount.

There are at least 4 positive signals in the chart above. The first, is the stock price broke above the falling trend resistance in late February and has held that for two weeks, sitting over the 100 day SMA. Next, the stock has been under accumulation since late December with no signs of it letting up. The momentum indicator RSI is bullish and strong as well. The price is starting to move up from the consolidation of the leg higher in February. A continuation would target a move to 60.

One could use the 100 day SMA area as a stop loss for a very good reward to risk ratio. Or protect your stock for the next month with a April 10 Expiry 46/41 Put Spread ($1.50 as I write) and sell an April 50 Covered Call to recoup two thirds of that protection cost.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.