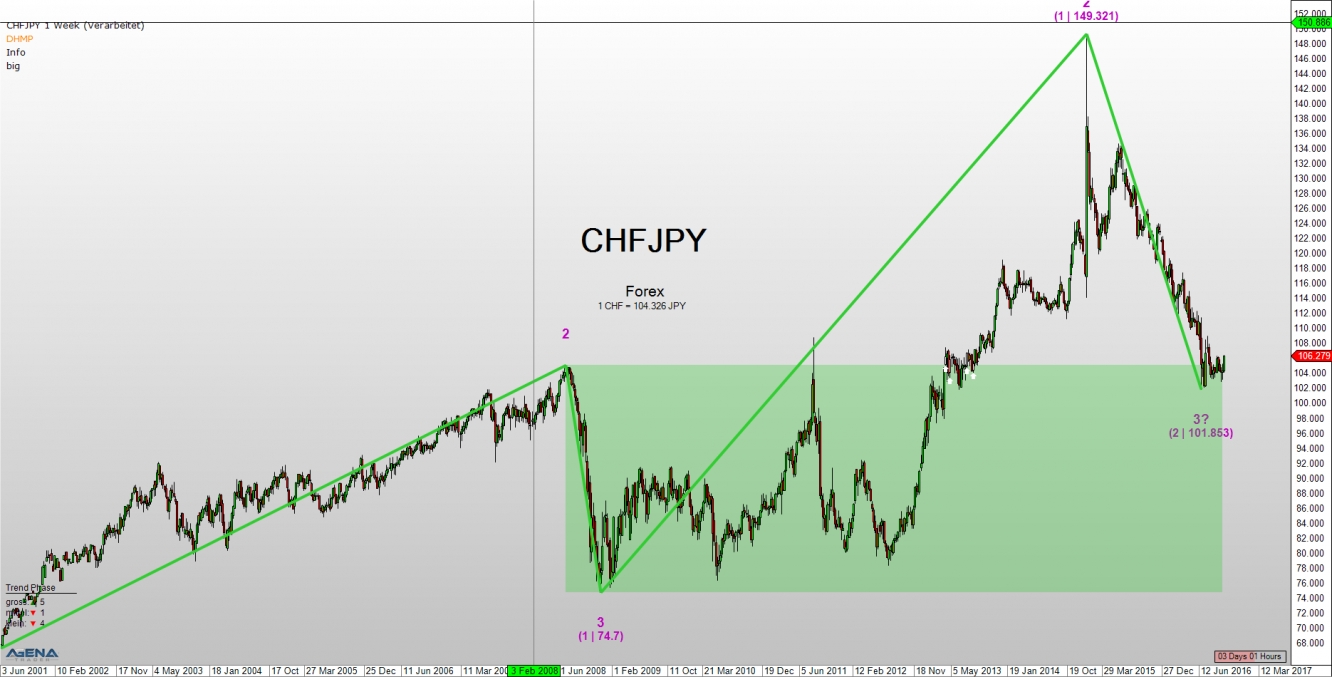

Weekly chart:

In the large trend of the weekly chart, a good investment may offer itself in the long term. After the exaggerated high at 149.321 JPY from January 2015, the price came back to the upper edge of the green correction zone, which extends between 105.03 JPY and 74.70 JPY. Here, a tendency towards stabilization has been apparent for several weeks now, which could be used for a long-term entry. In the case that the correction is extended, the stop should be placed beneath approx. 102 JPY.

Daily chart:

A glance at the daily chart supports the outlook of a longer-term recovery. The small trend came out of its red correction zone at the end of July; however, it was unable to proceed any further with the trend. For that, it would have needed a closing price beneath 101.852 JPY. However, the price was able to stabilize in the area of 103 JPY, and has once more been showing rising tendencies for several days now. Due to the maturity of the trend, one can assume that the price will return back to the red zone once more, and even break this trend.

Hourly chart:

In the small timeframe of the hourly chart, one can see the support zone at approx. 103 JPY even more clearly. Only the fact that the medium trend here is still pretty young, and that the red correction zone is only the second of its kind, dampen the long chances a little. Nevertheless, the bigger capital from the higher timeframes will most likely assert itself here.

IMPORTANT NOTE:

Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer’s investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk.