Forex News and Events

EUR/CHF fell amid strong inflation report (by Arnaud Masset)

The Swiss CPI was released earlier this morning and came in well above market expectations, printing at a solid +0.2%m/m in February versus -0.1% expected and -0.4% in the previous month. This pick-up in inflation is mostly due to a 2%m/m surge in clothing & footwear prices, which coincides with the end of the winter sales. Besides this upside surprise, the other subgroups showed no sign of significant improvement and the inflation outlook remains weak. We therefore believe that the subsequent rise of the Swiss franc against the single currency this morning is absolutely not justified given the temporary nature of this higher CPI read. We expect the pair to recover on the short-term. However, on the medium-term, the risk remains on the downside as traders adjust their positions ahead of Thursday’s ECB meeting.

ECB To Push Gold Higher (by Yann Quelenn)

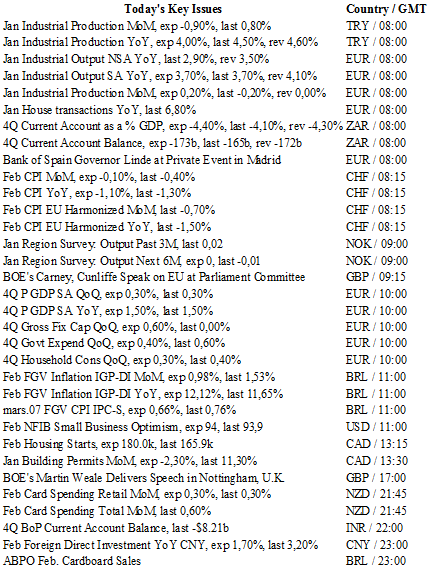

With two days until the ECB meeting, preliminary seasonally adjusted Q4 Eurozone GDP will be released this morning. Consensus expects data to remain unchanged at 0.3% q/q and 1.5% y/y. Eurozone growth is definitely very weak.

We believe that such as low GDP growth rate is not sufficient to trigger larger inflationary pressures. Eurozone CPI fell into negative territory, in January at -0.2%. The fundamentals are somewhat alarming and current monetary policy has yet to prove its efficiency. It is clear that the ECB will lower its deposit rates to -0.4%. In addition, we firmly believe that negative interest rates are set to be adopted, if not this month then this will happen in June.

We also think that Draghi may decide to raise the amount of the bond-buying program to above €60 billion per month. We do not expect much of this strategy and we do not think it will generate enough inflation. This strategy has not proven successful for the U.S. or Japan and therefore we remain skeptical about the possible success this kind of monetary policy will have for Europe. Repeating a strategy that does not work will not make it work. The only winner will be gold, which has simply had the best start to the year.

MXN should recovery on mixed data (by Peter Rosenstreich)

Outside Brazil’s substantial economic schedule, latam traders will be watching economic data from Mexico as yesterday’s release indicates a country in deceleration. Auto production was soft in the start of the year, falling 4.1% y/y and auto exports dropped 1.2% y/y. In addition, consumer confidence February slipped to 88.7 from 95.5, suggesting softer consumption in the future. First up is inflation data, which is expected to increase to 0.49% from 0.38% and core 0.35% from 0.19% on a monthly basis. In annual terms, CPI should continue to rise to 2.92% from 2.61% -- very near to Banxico’s mid-point target rate. Last week's release of Banxico's Quarterly Inflation report (QIR) for Q4 2015 indicated that inflation would temporarily rise above 3.0% due to season factors. Yet overall the inflation outlook remained stable. Industrial production is expected to rise 0.2% from 0.0% on an annual basis. In the underlying details, a fall in construction and continued weakness in mining output will dampen overall gains in manufacturing. In the QIR GDP growth forecasts were lowered 50bp in both 2016 and 2017 to 2.0-3.0% y/y and 2.5%-3.5% respectively. The board acknowledged downside risk to growth from persistently low oil prices, weaker growth in the US and global uncertainty in financial markets. We suspect that their growth projects remain optimistic as a delay in US industrial recovery, slowing national oil production and prolonged demand weakness from China will stymie expansion. The weak MXN should provide some relief of exports yet QIR included an analysis indicating the low sensitivity of low real exchange depreciation to manufacturing exports in the short term. We expect continued improvement of MXN against the USD in the near term and spreads with US rates should not compress further. However, global risk appetite and commodity prices will have a broader effect on the peso then yield spreads. Banxico will stay on the offensive to combat further MXN depreciation (following recent pre-emptive rate hikes) with additional surprise rate hikes. With Banxico figure on the trigger and stability in global markets yield seeking currency traders should be selling into the current USD/MXN recovery for a near term test of 17.50.

USD/JPY – Direction-Less.

The Risk Today

Yann Quelenn

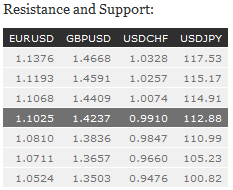

EUR/USD is pushing higher. Yet, the short-term technical structure still suggests a further bearish move. Hourly resistance lies at 1.1068 (26/02/2016 high). Hourly support can be located a 1.0940 (07/03/2016 low) then 1.0810 (29/01/2016 low). Expected to show continued weakness. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD's short-term bullish momentum continues. Major resistance is given at 1.4409 (19/02/2016 high). Hourly resistance lies at 1.4284 (07/03/2016 high) while hourly support can be found at 1.4108 (04/03/2016 low). The technical structure suggests further increase. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is trading mixed without momentum. Strong resistance is given at 114.91 (16/02/2016 high). Hourly support lies at 112.75 (08/03/2016 low). Next support lies at 110.99 (11/02/2016 low). Expected to show continued consolidation. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF is trading slightly lower. An hourly support now lies at 0.9879 (04/03/2016 low), while a key support stands at 0.9847 (16/02/2016 low). Hourly resistance is located at 1.0012 (07/03/2016 high) . In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.