CHF/JPY: We expect a further fall to 38.2% fibo of last-year rally

Macroeconomic overview

Bank of Japan board member Takako Masai said large swings in exchange rates can be a concern for Japan's economy as it could hurt business sentiment.

Masai said risks to Japan's economy have subsided compared with the second half of last year, as a tightening job market supported household confidence and consumption.

But the BOJ stands ready to expand stimulus if necessary, as consumption and wage growth still lack momentum, she said.

Masai added that there is no change to the BOJ's commitment to continue with its large-scale government bond purchases even under a new policy framework targeting interest rates.

North Korea fired four ballistic missiles into the sea off Japan's northwest coast on Monday, angering South Korea and Japan, days after it promised retaliation over U.S.-South Korea military drills it sees as preparation for war.

U.S. President Donald Trump told Japanese Prime Minister Shinzo Abe that the United States was with Japan "100 percent" over phone talks they held to discuss North Korea's latest missile launches.

USD/JPY investors shrugged off geopolitical tensions after the North Korean missile tests.

Japan’s fourth-quarter GDP will be published tomorrow. We expect a slight upward revision, which should support the JPY.

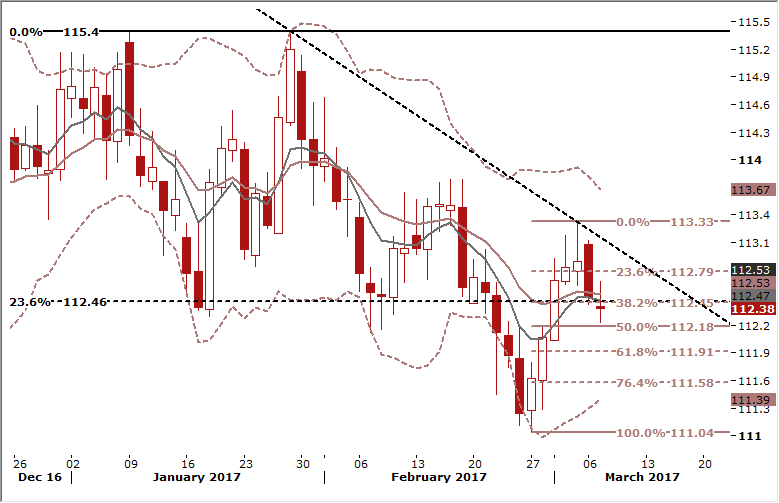

Technical analysis

After a rejection of upward CHF/JPY move on Friday, the JPY started to appreciate against the Swiss currency. The CHF/JPY broke below the 112.45 (38.2% fibo of February-March rise) today. A close below 112.18 will open the way to full retracement of February-March move. We think the downward move will be continued to 110.64 (38.2% fibo of September-January rally).

Trading strategy

We opened a short CHF/JPY position at 112.90 with the target at 110.60.