Whilst the yen has enjoyed its safe haven status recently, the chances are this is merely temporary. So I am seeking clues for the pending weakness of the yen. Price action on the CHF/JPY may well provide the clues I seek.

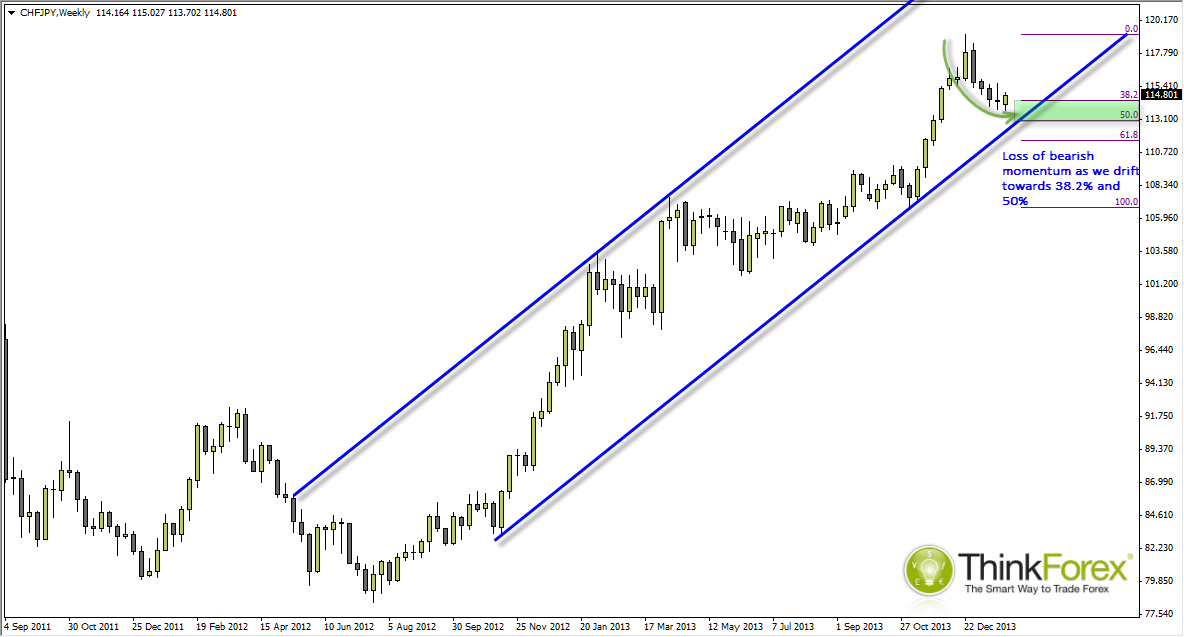

CHF/JPY WEEKLY: Losing bearish momentum

Below we can clearly the primary trend is bullish and are seemingly trading in a bullish channel. Take note however the channel subject to change, and they needn't be perfect anyway - they merely help provide structure to the analysis.

Since the 119.20 swing high a Dark Cloud cover reversal has formed which warned of the subsequent decline - but we can now see the decline is losing momentum, last week produced a Rikshaw Man Doji and we continue to trade within last week's range.

Whilst this does not generate a buy signal within itself it does point towards the potential for a pending turning point in the week/s ahead.

CHF/JPY Weekly Chart" title="CHF/JPY Weekly Chart" width="474" height="242">

CHF/JPY Weekly Chart" title="CHF/JPY Weekly Chart" width="474" height="242">

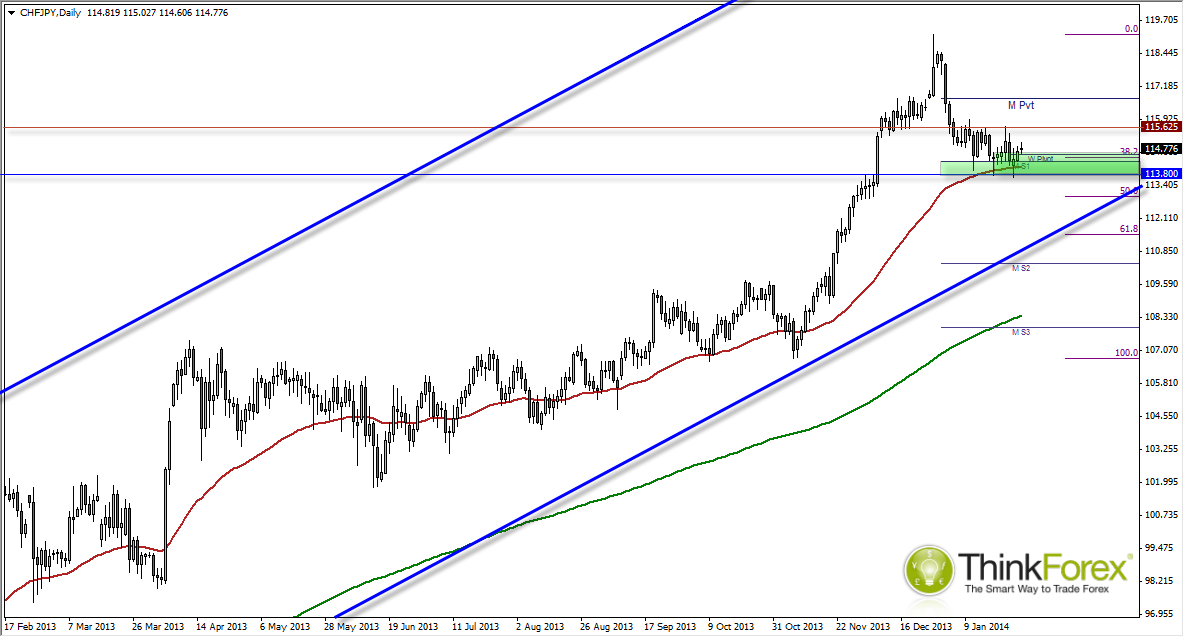

CHF/JPY DAILY: Holding above bed of support

The support is made up of 50 day eMA, swing low, weekly pivot and Monthly S1. As we are approaching the end of the month these pivots will change, however a break above the 115.62 swing high could be taken as a bullish sign and an assumed continuation of the uptrend.

IN the event we see a downside break we have fewer obvious levels of support to choose from (so perhaps refer to next month's pivot levels) but we do have the lower channel line.

Either case the objective here is to identify a turning point in JPY so a bullish signal here could be compared with EURJPY, USDJPY etc. so gauge confidence in the following move. That is the more currencies we see appreciating against JPY the more confidence we have of a trend continuation.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.