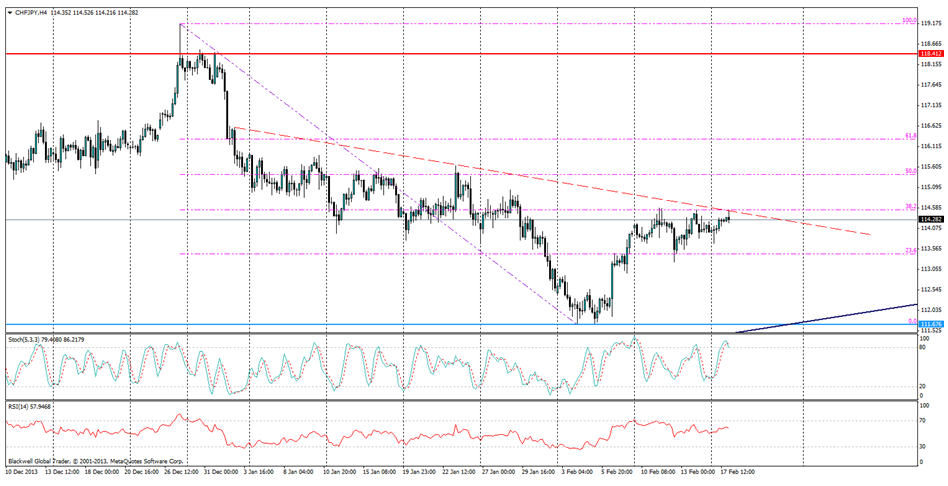

The CHF/JPY is starting to look more and more likely to break out, or at least move lower aggressively.

CHF/JPY" title="CHF/JPY" height="242" width="474">

CHF/JPY" title="CHF/JPY" height="242" width="474">

Unlike the AUD/JPY which is very volatile, the CHF/JPY is very stable and is steady enough for many traders’ risk profiles, and provides easy trending to take advantage of.

Currently,the CHF/JPY is touching its long term bearish trend line, which is pointing to a bounce of the dynamic resistance line and to move lower. This presents an interesting opportunity as the CHF/JPY likes to push up and then retract just as easily before ranging lower towards its bullish daily long term trend line.

In this case, it has touched the trend line, and the Stoch is signalling a move lower, while the RSI is starting to show the heavy buying pressure is starting to taper off. The Fibonacci retracement levels also support a pullback as the 38.2 level looks to hold as it has done in the past three instances when it has touched. It’s also worth noting that the 50.0 fib level has also acted as resistance for the pair and is likely to continue so in the event of a breakout.

Support can also be found at the 23.6 level, and market participants will be looking to find some ground as the pair moves lower.

With news out of Japan and Switzerland relatively light, it's unlikely we will see fundamental moves take precedence in this climate, and instead technicals are likely to be in control and play out best for the CHFJPYpair.

Overall, strong signals are pointing to a move lower, and markets will want to take advantage of the outcomes of technical movements for the Yen, especially the clear trend line crossing with the fib level to provide a level of heavy resistance, helping to push the pair lower.