CHF/JPY

The CHF/JPY pair is relatively low volume in terms of trading, but it's not one to be overlooked, as the most obvious opportunities are generally in the pairs which are a little less active. And the Yen pairs are certainly the hottest trades currently out there.

The CHF/JPY pair has been trending upwards for some time now, and that should come as no surprise for a lot of market watchers. Switzerland is a moderately stable economy, and economic data coming out of there is – relatively speaking – very straightforward.

When compared to Japan, we can see slight differences on the surface; unemployment, GDP, CPI, all very similar. The difference though is found in comparing the two political systems and their central banks. Japan is currently very aggressive in its attempt to fight deflation, and their central bank is part of the war on deflation. The aggressive policies that have been enacted in order to fight deflation have led to large scale volatile moves in the currency, and many coining the phrase “currency wars” to describe the recent actions of Japan in devaluing its currency to get the result it wants.

Either way the two economies on the surface may look similar and stable, but Japan is anything but given the current economic climate.

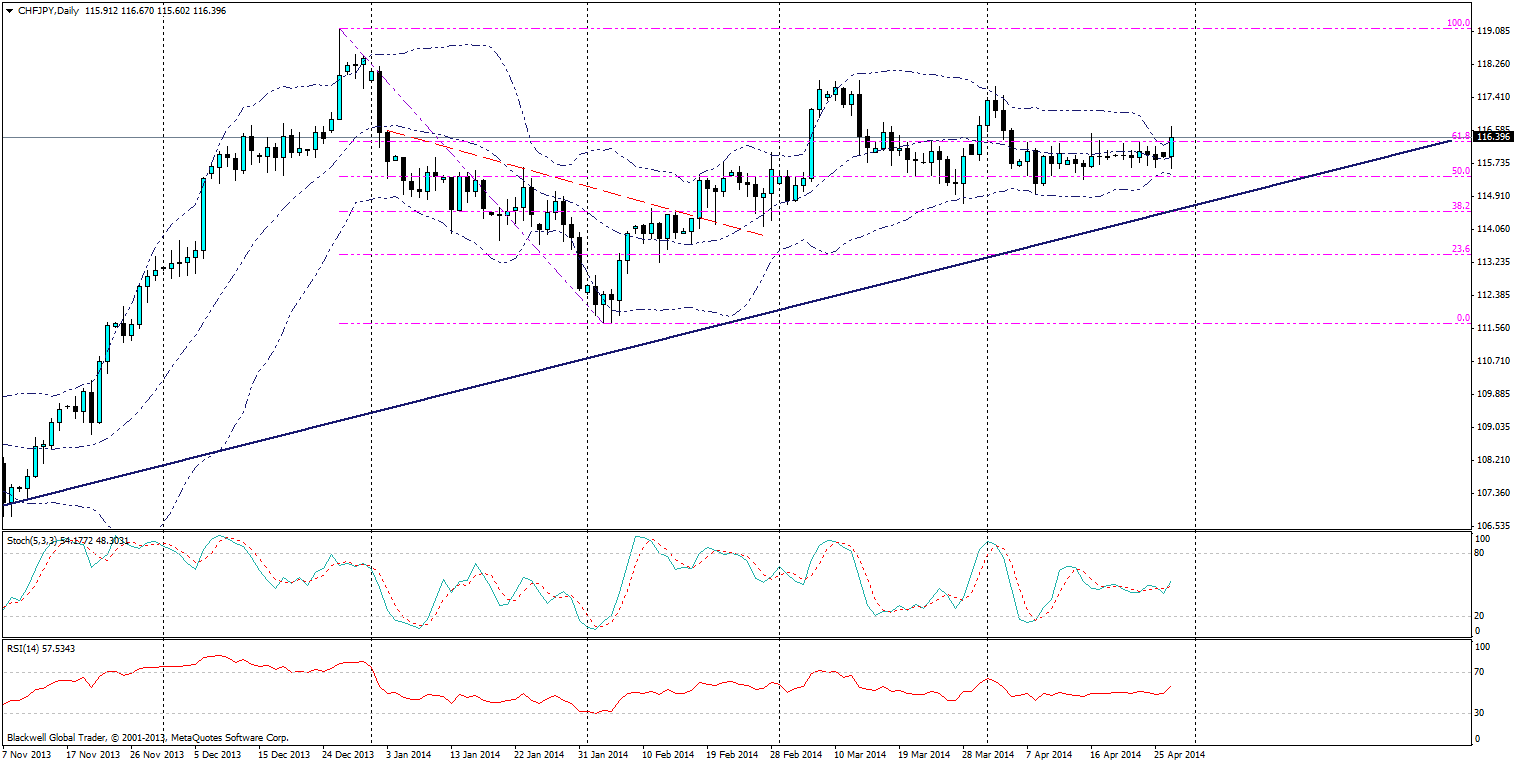

Over the last week we saw the currency tighten heavily and the Bollinger band come together as it waits for the next big move. That move has happened now, and it looks likely we will see further moves higher as it begins its trend back upwards after going through a period of consolidation. The daily chart shows the pair breaking through resistance at the 61.8 fib level, supporting this is the stoch which show momentum has since swung upwards; with the RSI also showing a swing towards buying the Swiss Franc over the Yen.

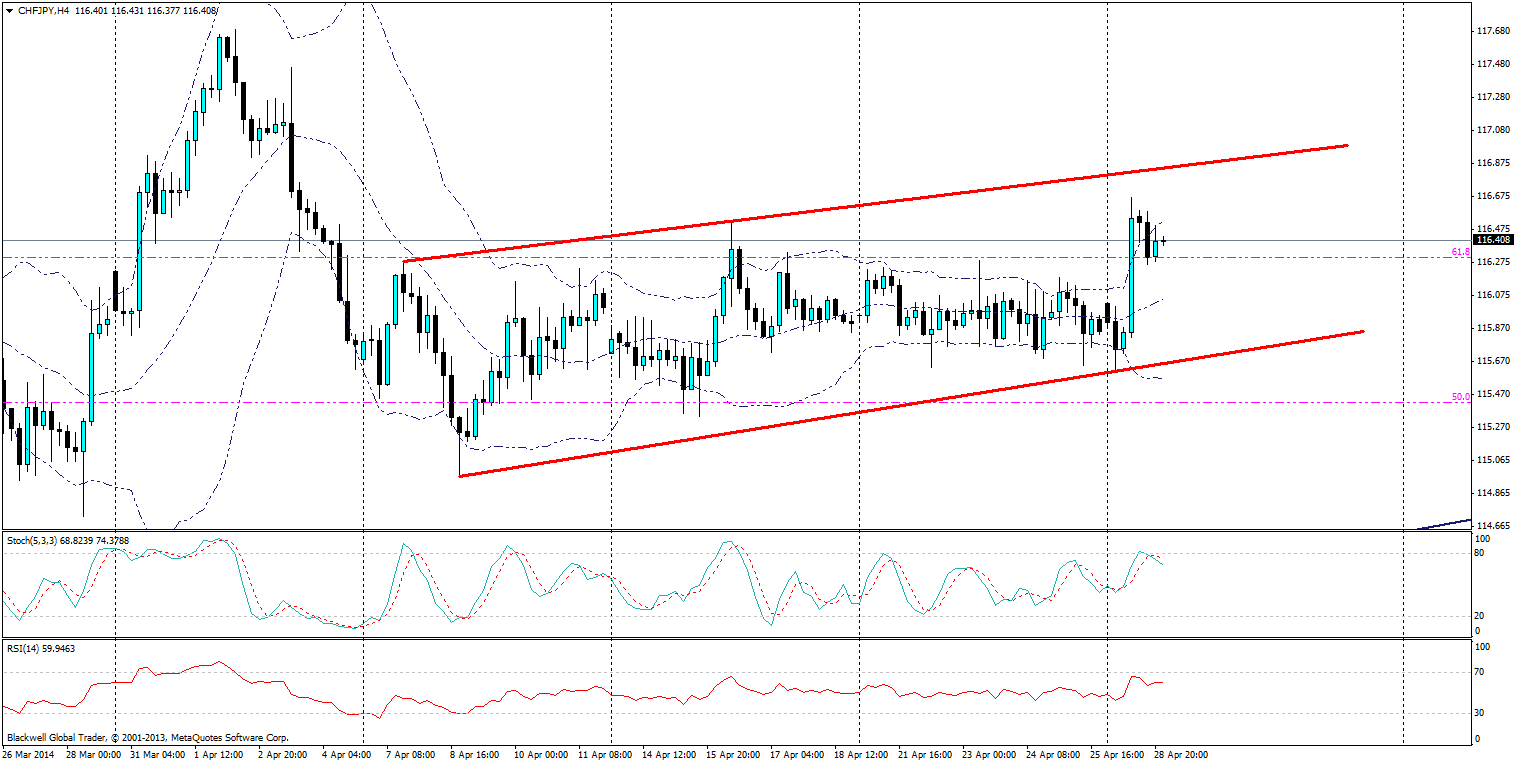

The four hour chart also shows upward momentum currently for the CHF/JPY pair, with a minor pullback after the breakout followed by the 61.8 fib level being used as support for the pullback, before markets looked to bounce back upwards. After this breakout, it looks likely that the 61.8 fib level will act as serious support for the medium term.

The parting of the Bollinger bands® also points to a possible trend forming, as such a wide band is only seen when markets are starting to turn and become more volatile; something which is very much overdue for the CHF/JPY pair.

Overall, there is certainly a case for a higher CHF/JPY, especially in the long term. The short term could certainly be more volatile, but I feel a buy stop above the current market price and catching the price on the way up would be beneficial for trading this pair. While Switzerland’s economy won't change much, the Japanese one will, as they go through the ropes of one of the greatest economic experiments of the 21st century. It also looks certain that Japan will have to act further and probably provide more stimulus. Markets will certainly be paying close attention though to the upcoming preliminary industrial production data due out on Wednesday morning, as this could help stoke the fires for further help and a higher CHF/JPY much sooner.