Chevron Corporation (NYSE:CVX) , a leading integrated energy player, declared the suspension of production from its Gorgon liquefied natural gas (LNG) development – located off the coast of Australia – following a gas leakage. With the leakage, LNG prices in Asia rose to the highest level since February.

It is to be noted that this is for the second time in 2016 that Chevron has halted its production activities from its $54-billion worth project after it shut down production from the LNG project in April owing to technical problems. The company added that the site was evacuated although the gas leakage was minor. Most importantly, despite the suspension of production, the company is on track to ship its second LNG cargo.

Chevron is the operator of the Gorgon LNG project with a 47.3% ownership. Exxon Mobil Corporation (NYSE:XOM) – the largest U.S. oil company by market value – and Royal Dutch Shell (LON:RDSa) plc RDS.A have a 25% stake each in the development. The remaining stake is held by Osaka Gas, Tokyo Gas and Chubu Electric Power.

Investors should know that the Gorgon LNG development holds the key to Chevron's becoming one of the largest LNG suppliers globally over the next four years. Notably, 15.6 million metric tons of LNG will likely be produced every year from the three production lines once the Gorgon project is completed. The development is also expected to generate sufficient natural gas that will be able to provide electricity to 2.5 million homes in Australia.

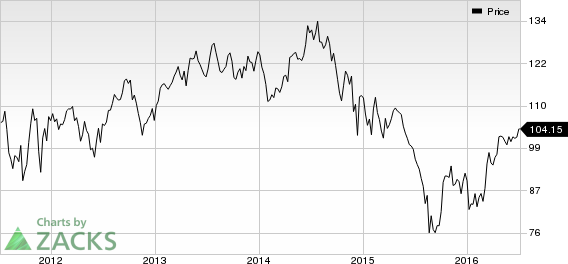

CHEVRON CORP Price

San Ramon, CA-based Chevron is one of the largest publicly traded oil and gas companies in the world, based on proved reserves. It is engaged in oil and gas exploration and production, refining and marketing of petroleum products, manufacturing of chemicals, and other energy-related businesses. It is to be noted that the weakness in the commodity markets for the last two years has severely impacted the financials of the company like other energy majors that include BP plc (NYSE:BP) . However, the scenario is now getting better since oil is walking on the bullish path after recovering from multiyear low marks in February.

BP PLC (BP): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

ROYAL DTCH SH-A (RDS.A): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

Original post

Zacks Investment Research