Have you been eager to see how U.S. energy giant Chevron Corp. (NYSE:CVX) performed in Q3 in comparison with the market expectations? Let’s quickly scan through the key facts from this San Ramon, CA-based company’s earnings release this morning:

About Chevron: Chevron is one of the largest publicly traded oil and gas companies in the world, based on proved reserves. It is engaged in oil and gas exploration and production, refining and marketing of petroleum products, manufacturing of chemicals, and other energy-related businesses.

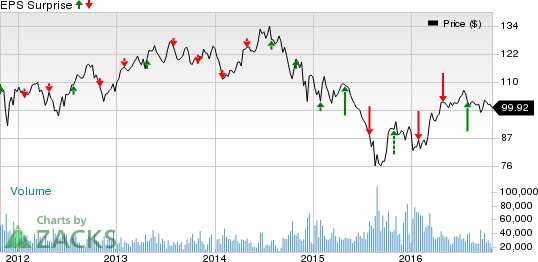

Zacks Rank & Surprise History: Currently, Chevron has a Zacks Rank #2 (Buy) but that could change following its third quarter 2016 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Coming to earnings surprise history, the company has a mixed record: its missed estimates in 2 of the last four quarters resulting in an average negative surprise of 50.30%.

Estimate Revision Trend: Investors should note that the earnings estimate revisions for Chevron depicted pessimism prior to the earnings release. The Zacks Consensus Estimate fell 9% over the last 30 days.

We have highlighted some of the key details from the just-released announcement below:

A Higher-than-Expected Profit: Earnings per share came in at 68 cents, higher than the Zacks Consensus Estimate of 39 cents. Lower costs led to the outperformance.

Revenue Came in Higher than Expected: Chevron posted revenues of $30,140 million, just ahead of the Zacks Consensus Estimate of $30,057 million.

Key Stats: Chevron’s total production of crude oil and natural gas edged down 1% from the year-earlier level to 2,513 thousand oil-equivalent barrels per day (MBOE/d). The U.S. output decreased 4% year over year to 698 MBOE/d, while the company’s international operations (accounting for 72% of the total) remained essentially flat at 1,815 MBOE/d.

However, the marginal decline on the production front and lower commodity prices were more than offset by a leaner cost structure, the net effect resulting in a huge jump in upstream segment earnings – from $59 million in the year-earlier quarter to $454 million.

Chevron’s downstream segment achieved earnings of $1,065 million, 52% lower than the profit of $2,211 million last year. The results were dragged down by lower margins on refined product sales.

Dividend Hiked: Earlier this week, the company announced a 1% increase in its quarterly dividend to $1.08 per share, or $4.32 per share annualized. The dividend is payable on Dec 12 to shareholders of record on Nov 18, 2016.

Check back later for our full write up on this Chevron earnings report later!

Confidential from Zacks

Beyond this Tale of the Tape, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

CHEVRON CORP (CVX): Free Stock Analysis Report

Original post

Zacks Investment Research