Have you been eager to see how U.S. energy giant Chevron Corp. (NYSE:CVX) performed in Q2 in comparison with the market expectations? Let’s quickly scan through the key facts from this San Ramon, CA-based company’s earnings release this morning:

About Chevron: Chevron is one of the largest publicly traded oil and gas companies in the world, based on proved reserves. It is engaged in oil and gas exploration and production, refining and marketing of petroleum products, manufacturing of chemicals, and other energy-related businesses.

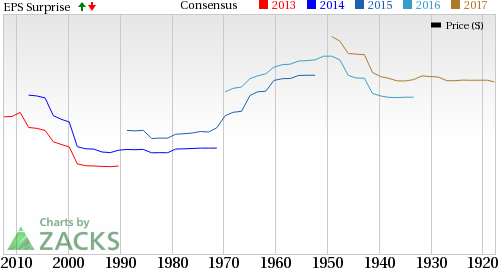

Zacks Rank & Surprise History: Currently, Chevron has a Zacks Rank #4 (Sell) but that could change following its second quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Coming to earnings surprise history, the company has a good record: its beaten estimates in 3 of the last four quarters resulting in an average positive surprise of 32.36%.

We have highlighted some of the key details from the just-released announcement below:

A Larger-than-Expected Profit: Earnings per share (excluding special items) came in at 91 cents, higher than the Zacks Consensus Estimate of 89 cents. Better commodity price realizations and strength in production led to the outperformance.

Revenue Came in Higher than Expected: Chevron posted revenues of $34,480 million, above the Zacks Consensus Estimate of $31,181.9 million.

Key Stats: Chevron’s total production of crude oil and natural gas increased 10% compared with last year’s corresponding period to 2,780 thousand oil-equivalent barrels per day (MBOE/d). The U.S. output increased 3% year over year to 701 MBOE/d, while the company’s international operations (accounting for 75% of the total) was up 13% to 2,079 MBOE/d.

The rise in production was supported by higher realizations, the result being a massive turnaround in Chevron’s upstream segment – from a loss of $2,462 million in the year-earlier quarter to a profit of $853 million.

Chevron’s downstream segment achieved earnings of $1,195 million, 6% less than the profit of $1,278 million last year. The fall primarily underlined the absence of net gains from asset sales.

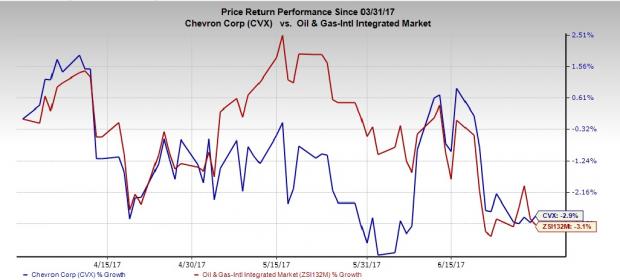

Share Performance: Shares of Chevron have lost 2.8% during the second quarter versus the 3.1% decline of the Zacks categorized Oil & Gas - International Integrated industry.

Check back later for our full write up on this Chevron earnings report later!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Chevron Corporation (CVX): Free Stock Analysis Report

Original post

Zacks Investment Research