San Ramon, CA-based Chevron Corp. (NYSE:CVX) is one of the largest publicly traded oil and gas companies in the world, based on proved reserves. It is engaged in oil and gas exploration and production, refining and marketing of petroleum products, manufacturing of chemicals, and other energy-related businesses.

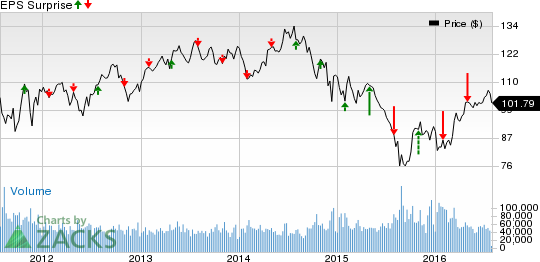

Currently, Chevron has a Zacks Rank #2 (Buy) but that could change following its second quarter 2016 earnings report which has just released. Coming to earnings surprise history, the company has a poor record: its missed estimates in 3 of the last four quarters, resulting in an average negative surprise of 82.37%.

We have highlighted some of the key details from the just-released announcement below:

Earnings: Chevron beats on earnings. Earnings per share (excluding special items) came in at 49 cents, higher than the Zacks Consensus Estimate of 31 cents.

Revenue: Revenues below expectations. Revenues of $29,282 million were just under the Zacks Consensus Estimate of $29,799 million.

Key Stats: Chevron’s total production of crude oil and natural gas edged down 2.6% from the year-earlier level to 2,528 thousand oil-equivalent barrels per day (MBOE/d). The U.S. output decreased 6.6% year over year to 682 MBOE/d, while the company’s international operations (accounting for 73% of the total) fell 1.1% to 1,846 MBOE/d. Moreover, decline on the production front were accompanied by the sharp downfall in oil and gas prices, the net effect resulting in a huge loss for the upstream division – to the tune of $2,462 million.

Chevron’s downstream segment achieved earnings of $1,278 million, 56.8% lower than the profit of $2,956 million last year. The results were dragged down by lower margins on refined product sales.

Costs & Expenses: Exploration costs nosedived from $1,075 million in the second quarter of 2015 to just $214 million. Chevron spent $5,523 million in capital expenditures during the quarter, a considerable decline from the $8,724 million incurred a year ago.

Check back later for our full write up on this Chevron earnings report later!

CHEVRON CORP (CVX): Free Stock Analysis Report

Original post

Zacks Investment Research