Leading U.S. oil behemoths Chevron Corporation (NYSE:CVX) and Exxon Mobil Corporation (NYSE:XOM) , along with their partners, announced plans to invest around $36.8 billion to boost oil output in a Kazakhstan oil field.

Tengizchevroil will continue with the development of its Future Growth and Wellhead Pressure Management Project. Chevron owns 50% of the entity, while 25%, 20% and 5% is held by Exxon, Kazakhstan's KazMunayGas and Russia's Lukoil, respectively. The project is expected to bolster production in the Tengiz oil field by 260,000 barrels per day. Upon completion, the oil field is expected to generate about 1 million barrels of oil per day, with the first oil production planned for 2022.

Tengizchevroil will spend $27.1 billion in facilities, $3.5 billion in wells and $6.2 billion for contingency and escalation.

In 1993, Chevron was awarded the rights to develop Tengiz. According to the company, the Tengiz oil field's reservoir is located 12,000 feet below ground level, which makes it the world's deepest operating super-giant oil field.

Management believes that with the massive increase in oil production, the Tengiz expansion project will create value for Chevron and its stockholders by generating significant cash flows for the company. Moreover, the investment is viewed as a profitable one based on the optimism raised by the recent improvement in oil prices from the multi-year low touched in February.

San Ramon, CA-based Chevron is one of the largest publicly traded oil and gas companies in the world in terms of proved reserves. It is engaged in oil and gas exploration and production, refining and marketing of petroleum products, manufacturing of chemicals, and other energy-related businesses.

ExxonMobil, on the other hand, is the world’s best run integrated oil company in terms of high return on capital employed. Approximately 83% of Exxon’s earnings are generated from its operations outside the U.S.

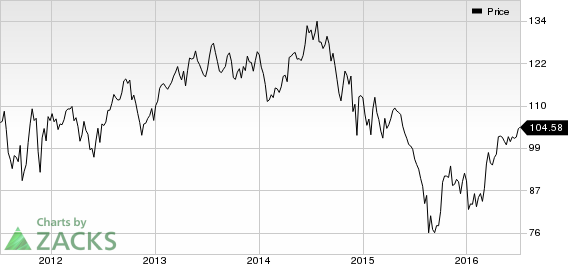

Currently, Chevron carries a Zacks Rank #3 (Hold), whereas Exxon holds a Zacks Rank #2 (Buy). Investors interested in the energy sector may consider players like McDermott International Inc. (NYSE:MDR) and Braskem S.A. (NYSE:BAK) . Both of these stocks sport a Zacks Rank #1 (Strong Buy).

MCDERMOTT INTL (MDR): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

BRASKEM SA (BAK): Free Stock Analysis Report

Original post

Zacks Investment Research