Houston, TX-based Cheniere Energy Partners L.P. Holdings LLC (NYSE:CQH) by virtue of its 55.9% ownership in Cheniere Energy Partners L.P. (CQP), primarily operates the Sabine Pass natural gas regasification and liquefaction facilities. Cheniere Energy Partners LP Holdings also operates Creole Trail Pipeline – located in Louisiana.

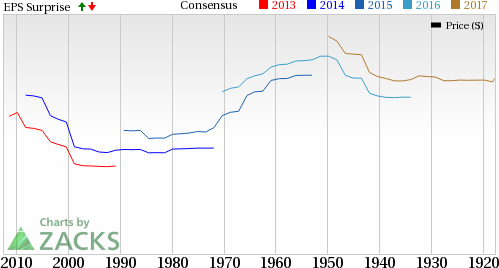

Currently, Cheniere Energy Partners L.P. Holdings has a Zacks Rank #2 (Buy) but that could change following its second quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key details from the just-released announcement below:

Earnings: Cheniere Energy Partnersmeets earnings. Earnings per unit came in at 2 cents, same as the Zacks Consensus Estimate.

Revenue: Revenue (equity income from investment) for the quarter came in at $5.1 million, essentially in line with the Zacks Consensus Estimate.

Key Stats: As per its earnings press release, the company continues to work on its Sabine Pass Liquefaction Project. It is being developed for a maximum of 6 natural gas liquefaction trains, each having an expected yearly production capacity of approximately 4.5 million tons of LNG.

Share Performance

Units of Cheniere Energy Partners LP Holdings have gained 17.0% year to date, significantly outperforming the industry's 4.1% growth.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Cheniere Energy Partners LP Holdings, LLC (CQH): Free Stock Analysis Report

Original post

Zacks Investment Research