Cheniere Energy, Inc. (NYSE:LNG) , through its subsidiary Cheniere Marketing, LLC, recently inked a deal with a commodity trading company, Trafigura Pte Ltd, spanning 15 years.

Per the deal, Cheniere Energy will provide Trafigura around 1 million tonnes per annum of liquefied natural gas ("LNG") without shipment charges, starting in 2019. Trafigura’s payment to Cheniere Energy will be based on the monthly Henry Hub price, plus a premium.

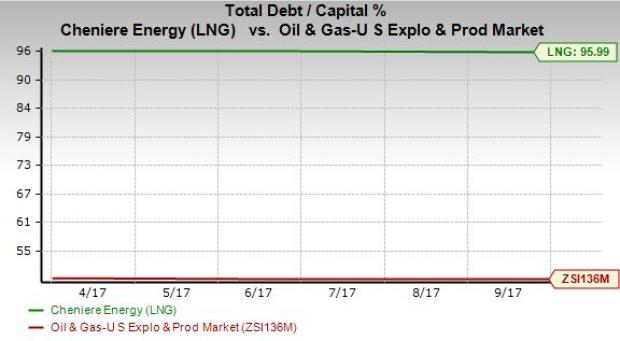

This long-term deal is crucial for this natural gas exporter and is expected to help Cheniere Energy with its development plans. The company is still at the expansion stage, which means high capital spending and cash outflow in the foreseeable future. As Cheniere Energy looks to conclude building its units at Sabine Pass and Corpus Christi, the company is saddled with a substantial burden on its leverage and credit metrics. As of Sep 30, 2017, the company had a debt of $25 billion with a debt to capitalization ratio of 95.99%, much higher than the industry's 49.43%.

About Cheniere Energy

Houston, TX-based Cheniere Energy is primarily engaged in businesses related to liquefied natural gas through its two business segments: LNG terminal, and LNG and natural gas marketing. The company was founded in 1983.

Zacks Rank and Stocks to Consider

Cheniere Energy carries a Zacks Rank #4 (Sell). Cheniere Energy's trailing 12-month return on equity (ROE) undercuts its growth potential. The company’s ROE of -57.4% compares unfavorably with 1.49% for the broader industry, reflecting the fact that it is less efficient in using shareholder funds compared to its peers.

Some better-ranked stocks in the oil and energy sector are Cabot Oil & Gas Corporation (NYSE:COG) , Denbury Resources Inc. (NYSE:DNR) and Royal Dutch Shell (LON:RDSa) plc RDS.A. Both Cabot and Denbury Resources sport a Zacks Rank #1 (Strong Buy) while Shell carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX -based Cabot is an independent energy company. Its sales for fourth-quarter 2017 are expected to grow 39% year over year. Earnings for the year 2017 are expected to be up 357.14%.

Plano, TX -based Denbury Resources is an integrated energy company. Its sales for the fourth quarter of 2017 are expected to increase 11.2% year over year. The company delivered a positive average earnings surprise of 125% in the last four quarters.

Shell, based in The Hague, the Netherlands, is an integrated energy company. Its earnings for 2017 are expected to increase 99.5% year over year. The company delivered a positive earnings surprise of 18.1% in the third quarter of 2017.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG): Free Stock Analysis Report

Denbury Resources Inc. (DNR): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Original post

Zacks Investment Research