On Aug 25, we issued an updated research report on Cincinnati, OH-based Chemed Corporation (NYSE:CHE) . The company currently operates two wholly-owned subsidiaries — VITAS Healthcare and Roto-Rooter.

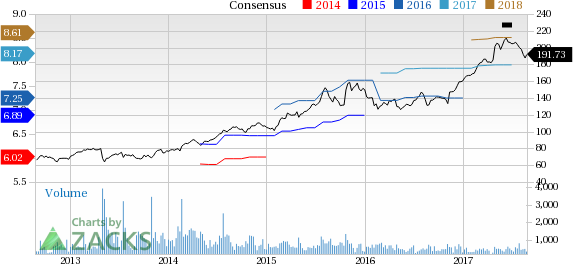

Over the last six months, Chemed has been trading above the broader industry in terms of price. The stock has gained 5.6%, higher than the industry’s loss of 8.6%. This improvement in average net Medicare reimbursement rate and increase in average daily census during the recently reported second quarter were encouraging. The raised outlook for both Roto-Rooter segment and earnings per share is indicative of the company anticipating improved operating results in the upcoming quarters. This boosts investors’ optimism on the stock.

Notably, Chemed’s VITAS business had been in trouble over the past few quarters due to certain admission coding changes initiated by the Centers for Medicare & Medicaid Services (CMS). However, management noted the recent admission trends to be positive and that should continue in the coming quarters as well.

During second-quarter 2017, VITAS performed well, both financially and operationally, surpassing the company’s expectations. The business experienced 2.1% net revenue growth when compared to the prior-year quarter. VITAS also generated admissions growth of 0.81% in the quarter.

In terms of Roto- Rooter business, it displayed a robust performance in core plumbing and drain cleaning service segments during second-quarter 2017, as well as prompted a solid rise in water restoration. Management increased expectations to achieve Roto-Rooter full-year 2017 revenue growth of 12-13%, higher than the earlier expected range of 3-4%. Revenue estimates are based on increased job pricing of approximately 2% and continued growth in water restoration services.

However, headwinds like reimbursement related issues, seasonality in business, a competitive landscape and dependence on government mandate pose challenges for Chemed. Also, a tweaked guidance for Medicare Cap billing limitations is a matter of concern.

Zacks Rank & Key Picks

Chemed currently has a Zacks Rank #2 (Buy). A few other top-ranked medical stocks are Edwards Lifesciences Corporation (NYSE:EW) , Lantheus Holdings, Inc. (NASDAQ:LNTH) and IDEXX Laboratories, Inc. (NASDAQ:IDXX) . Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while Lantheus Holdings and IDEXX Laboratories carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a long-term expected earnings growth rate of 19.1%. The stock has rallied around 20.5% over the last six months.

Lantheus Holdings has a long-term expected earnings growth rate of 12.5%. The stock has surged 32.5% over the last six months.

IDEXX Laboratories has a long-term expected earnings growth rate of 19.8%. The stock has gained roughly 7% over the last six months.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH): Free Stock Analysis Report

Chemed Corp. (CHE): Free Stock Analysis Report

Original post

Zacks Investment Research