I confess that I wasn’t exactly champing at the bit this weekend to look at charts. The grind since February 11th has been very tough on my zeal for trading and charting, and if this keeps up, I might have to rebrand this blog as the Slope of Dope and focus on cannabis cultivation and distribution (a topic I am wholly unqualified to address).

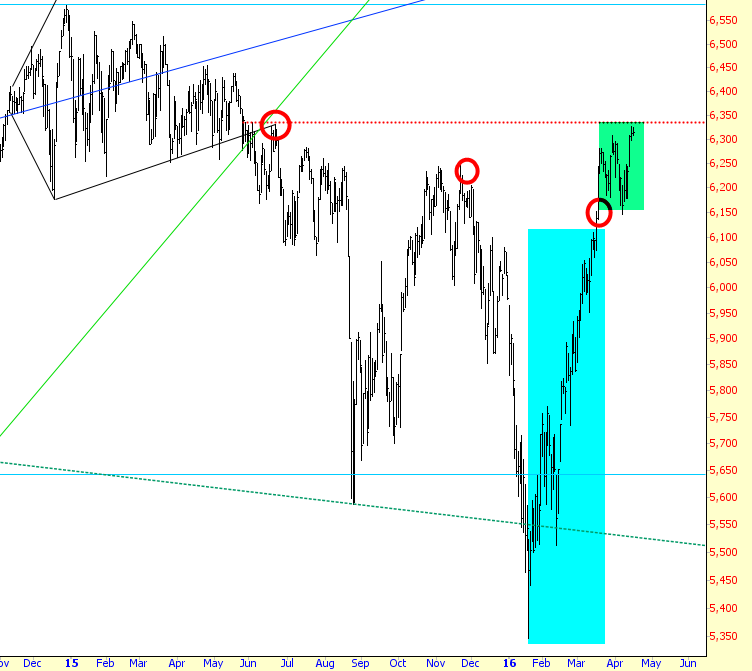

Having said that, let’s look at a few indexes. First, below, there’s the Dow Composite. I’ll be the first to say I was straight-up stupid to hang on to any shorts (let alone a bunch of them) during the rally I’ve tinted in cyan. But, honestly, the market “should” have stopped at that red circle. instead, it caught its breath and pushed into the green tinted area with a persistence that, honestly, I find shocking. If it pushes above the red line, I’ll consider myself wholly screwed.

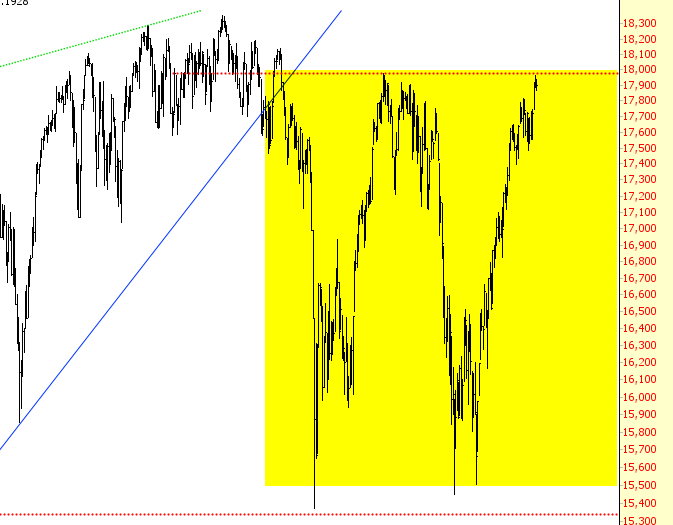

But, frankly, things are really stretched to the upside, and I’m really wondering what all the doe-eyed optimism is about. Take the Dow (please!) It has been, for many months now, in a tremendous multi-thousand point range. Even the most steadfast bull would have to admit that we’re at the top of that range.

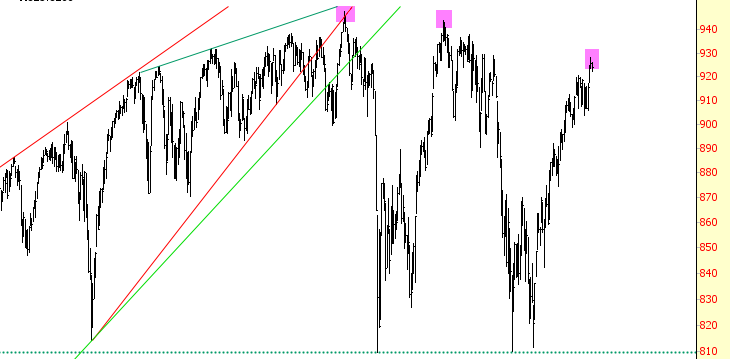

Not all the indexes have almost reached breaking point. The S&P 100, for example still sports a clean series of lower highs.

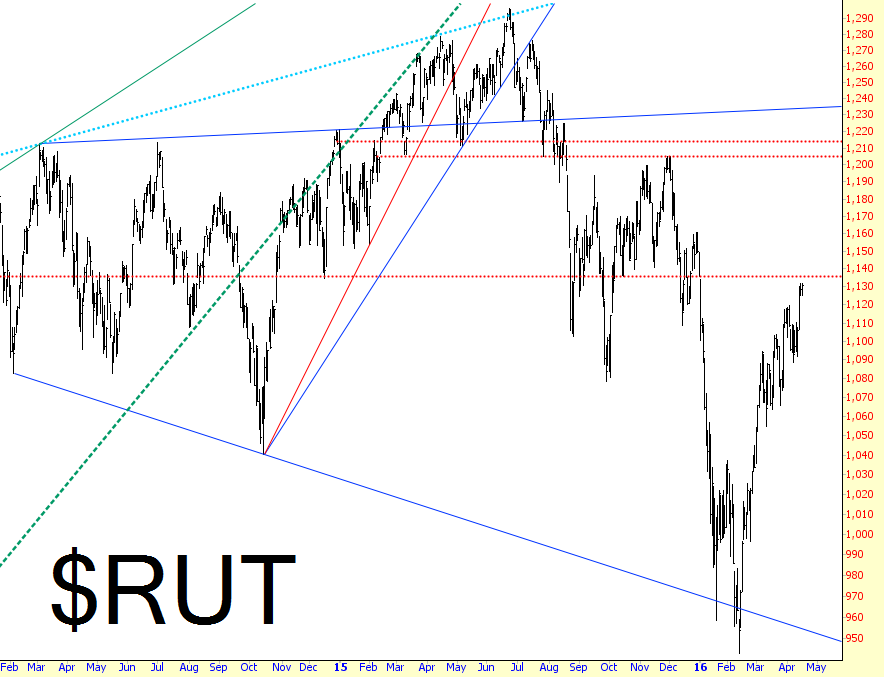

Perhaps my favorite index right now in terms of toppy-ness is the Russell 2000, the small caps. Unlike other indexes, it is nowhere near its lifetime highs, and there is a staggering amount of overhead supply.

The big disappointment for me last week was the ES breaching its trendline (circled below in red). Again, this “should” not have happened, but it has, and it might suggest (God forbid) simply a continuation of strength.