In life you get a confirmation for every transaction you make. Sometimes more than one. A receipt at the grocery store followed by a transaction showing up on a credit card statement. Sometimes it is called a reservation when it is given in advance, and then a receipt after the goods or services are delivered. You even are asked to confirm you want to exit your computer or delete a file. With confirmation so ingrained into our lives why is so hard for traders to wait for confirmation of price action of the stock or Index they are watching before they trade?

I often say to crowds I speak in front of that you will find what you are looking for in a chart of stock prices. By that I mean that if you come to a chart of the market with a view that multiples are too high, or the market is tired, or overbought you will find a reason to draw bearish lines or interpret the price action as bearish. Of course the converse is true as well for those that approach them with a bullish bent. This is why you need confirmation in the stock market as well. Look at the example below.

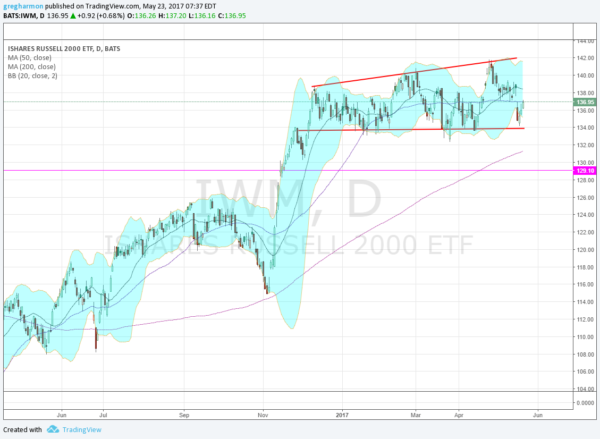

Russell 2000 ETF (iShares Russell 2000 (NYSE:IWM)) with an Expanding Wedge, Topping Pattern

Russell 2000 ETF with a Rising Channel

The two charts above can be assigned very different interpretations. The Expanding Wedge is interpreted by many as a topping pattern. But the Rising Channel, with a series of higher highs and higher lows, defines a trend higher. So which is right? The price action will tell you when it is good and ready. There will either be a break down below the Wedge/Channel or a push up through the top. That is your confirmation. Wait for it.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.