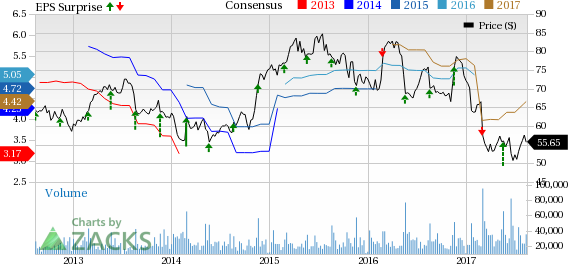

Target Corp. (NYSE:TGT) is scheduled to release second-quarter fiscal 2017 results on Aug 16. Well the obvious question that comes to mind is will this operator of general merchandise stores be able to post positive earnings surprise in the quarter to be reported. In the trailing four quarters, it outperformed the Zacks Consensus Estimate by an average of 16.5%.

The current Zacks Consensus Estimate for the second quarter is $1.20 down from $1.23 reported in the year-ago period. We noted that the Zacks Consensus Estimate has improved by 15 cents in the last 30 days. Analysts polled by Zacks expect revenues of $16,220 million.

Factors at Play

We believe that Target’s initiatives such as the development of omni-channel capacities, diversification and localization of assortments along with emphasis on flexible format stores bode well. Management plans to expand its merchandise assortments with special emphasis on Style, Baby, Kids, and Wellness categories that are performing well and recently rolled out Target Restock program. Moreover, the company has also adopted an aggressive cost reduction strategy, including rationalization of supply chain, technology and process improvements. These initiatives are significant in the light of waning top and bottom lines.

The company now expects to post positive comparable sales for the first time in five quarters and envisions earnings per share to top the upper end of its guidance range of 95 cents to $1.15, when it reports second-quarter results. Improved sales and traffic trends witnessed during the first two months of the quarter, prompted management to raise its forecast, which otherwise had earlier projected low-single digit decline in comparable sales. We noted that comparable sales had decreased 1.3% in the first quarter of fiscal 2017, following declines of 1.5%, 0.2% and 1.1% in the fourth, third and second quarters of fiscal 2016.

What Does the Zacks Model Unveils?

Our proven model does not conclusively show that Target is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Target has an Earnings ESP of 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate both are pegged at $1.20. Although, Target’s Zacks Rank #2 increases the predictive power of ESP, we need to have a positive ESP to be confident about an earnings beat.

Stocks with Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

The Gap, Inc. (NYSE:GPS) has an Earnings ESP of +3.85% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wal-Mart Stores, Inc. (NYSE:WMT) has an Earnings ESP of +0.94% and a Zacks Rank #2.

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +6.00% and a Zacks Rank #2.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research