Yesterday’s Trading:

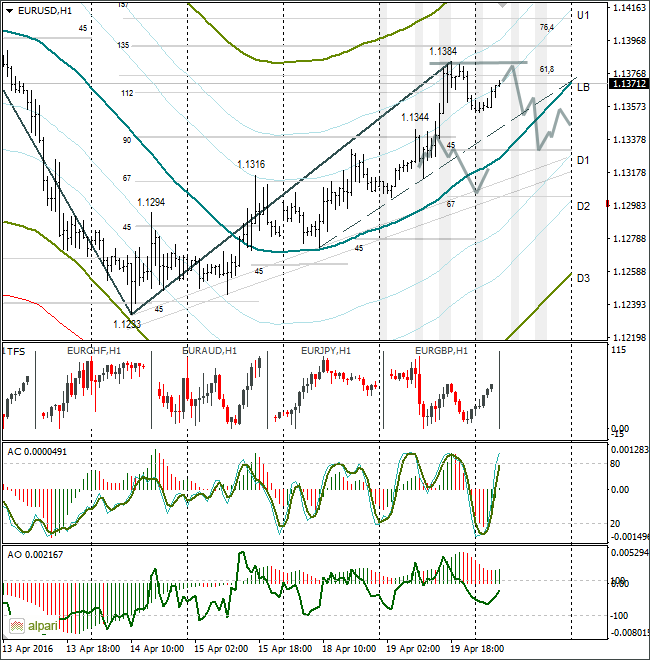

The euro/dollar broke through the 1.1340 marker due to a revival of the euro/pound cross and weak US stats. Data on construction in the US turned out worse than expected, provoking renewed speculation as to whether the Fed will decline to lift interest rates in the coming time.

The euro/dollar reached 1.1384. The strengthening of the euro against the dollar stopped between the 112th and 135th degrees at the 61.8% fibo level from the downward wave, with a 1.1464 maximum to 1.1233.

Market Expectations:

On Thursday the ECB is set to convene and Draghi will hold a press conference. As this event approached, yesterday I expected the euro to weaken to 1.1330. I looked at a depart of the price down through the double peak, but it seems there will be no repeat touch of 1.1384.

US oil reserve data from the API came out last night. Reserves were up 3.1 million barrels against an expected 1.6 million rise. Brent in Asia fell 1.9% to $43.09. Other than the API report, in Kuwait the workers’ strike, which has been supporting oil quotes since Monday, came to an end.

Oil is falling in price, and with it the euro. I reckon that a return of the rate to 1.1300-1.1330 before the ECB convenes will be an excellent scenario.

Day’s News (EET):

09:00, German March PMI;

11:30, UK average wage changes and number of unemployment benefit applications in March. Unemployment level for February.

17:00, US data on sales in the secondary housing market for March.

17:30, US changes in oil reserves from the ministry for energy.

Technical Analysis:

At 07:11 EET, the euro/dollar was trading at 1.1363. Taking the rise of the euro/pound into account, I expect a weakening of the euro from 1.1380-1.1384. The euro will receive support from the fall in oil via the euro/Canadian and euro/Australian crosses. If the USD in Europe switches into attack, these crosses will not help the euro strengthen. As soon as 1.1350 is broken, pressure on the euro will compound.

In yesterday’s analysis I wrote that the 90th degree isn’t an important support. The euro often disappoints from the 112-135 zone. The 135th degree passes through 1.1393. If demand for the euro remains high in the crosses, it’s likely that there will be a growth of the euro/dollar to 1.1393. I’ve no intention of buying euro before Draghi’s press conference.