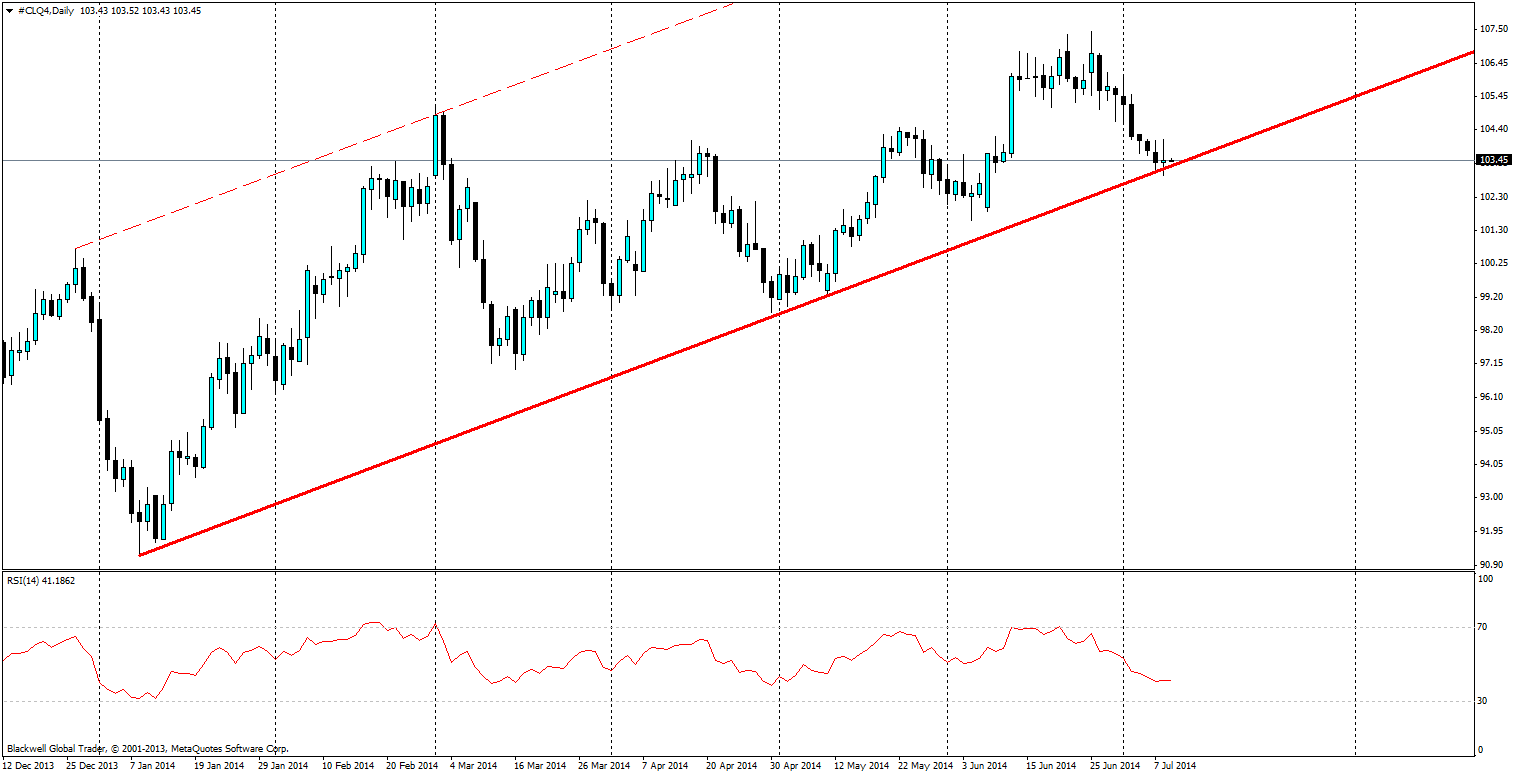

After trending down the charts as global tensions ease, oil might find some respite as of late. Currently oil has been playing of technicals and we have a strong bullish trend line in the play, which has helped to drive prices higher. Markets will look to use this trend line to push higher and long positions should be set higher to catch momentum to resistance levels at 105.50.

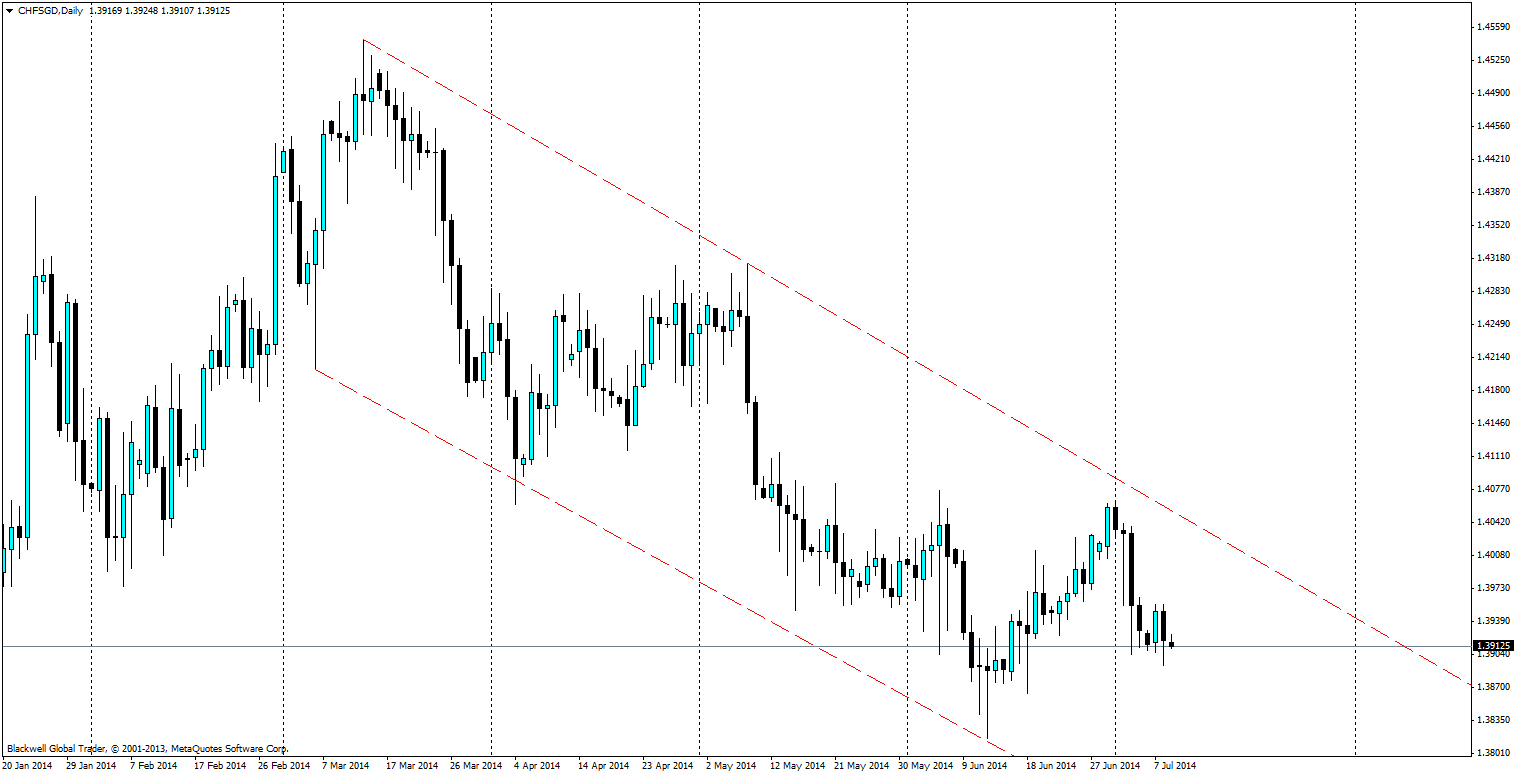

The Swiss Franc has been pushed down against the Singapore Dollar as of late, and it does not look like it’s going to let up anytime soon. Monday morning saw a sharp pullback followed by a double top and the charts now point to further lows as a result of this bearish pattern.

The Pound Yen has been in a bullish channel for some time, but looks to be pulling back on the charts after a spate of bad data from the UK economy, including the recent manufacturing report which showed a contraction in the economy. Either way the push downwards to the trend creates opportunities for traders looking to jump back on the charts as they climb higher. A touch of the trend line would certainly be a good opportunity to catch momentum as it climbs higher again in the short term.