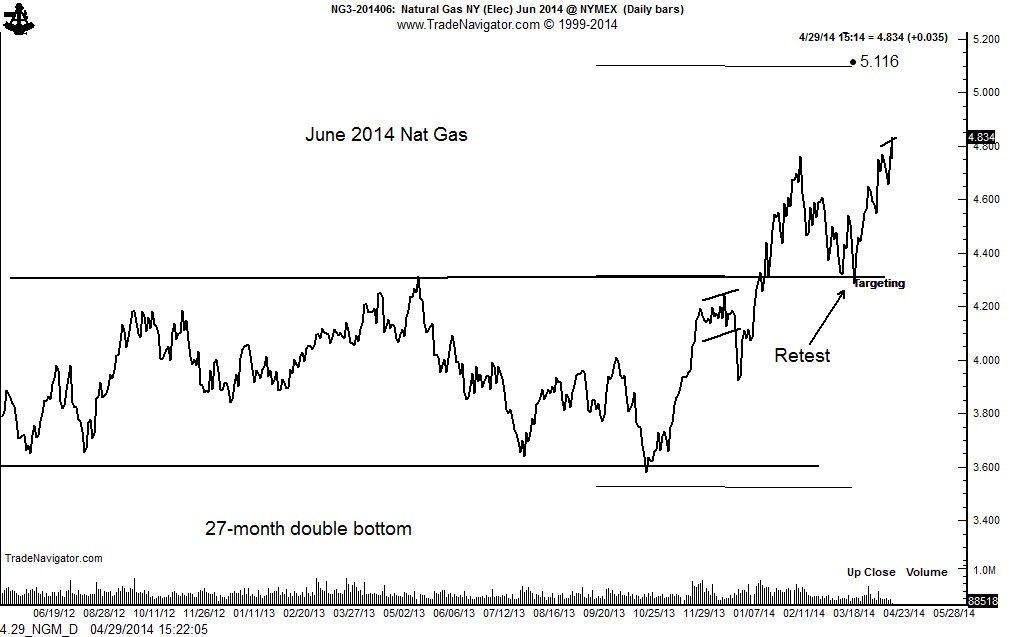

Daily chart confirms continuation of bull trend

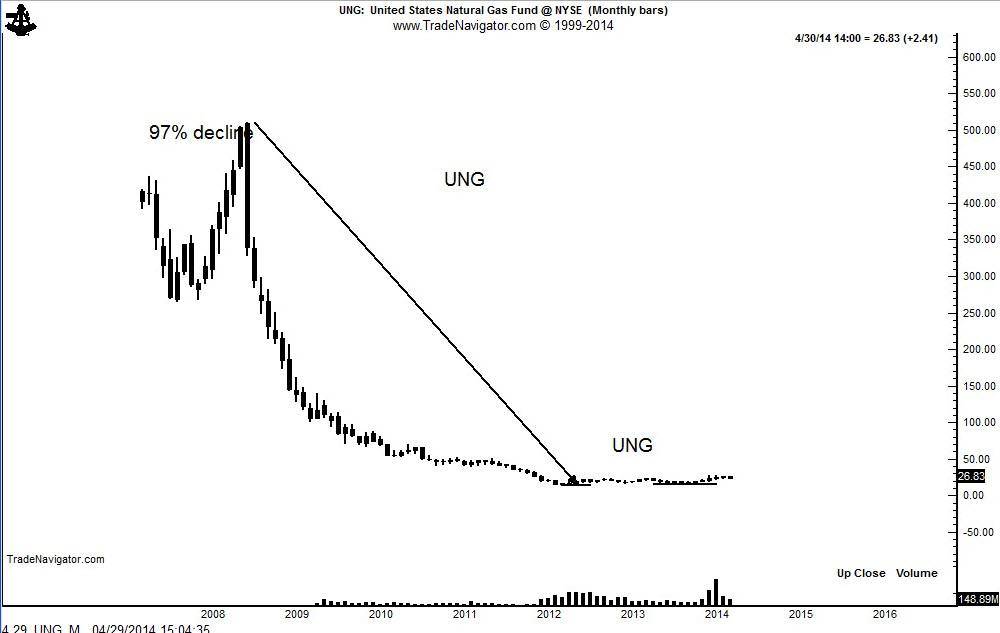

The monthly chart of the US Natural Gas Fund (ARCA:UNG) is a pictorial for the suffering endured by Natural Gas ETF bulls from July 2008 through mid-2012. During this time the price of UNG declined by 97%. However, there is some strong evidence that the Natural Gas market has bottomed and that a bullish cycle is upon us.

The daily chart of UNG shows that the advance in January completed a 24-month double bottom with a target of 33.50. Note the diminishing volume during the 2012 and 2013 bottoming process and the sharp expansion of volume in 2014. This is characteristic of a healthy bull trend.

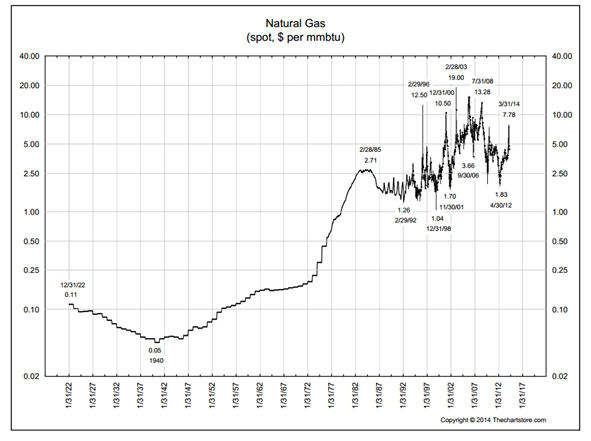

The 90-year chart of Nat Gas provides a broad perspective of the market. Typical of the majority of raw materials, Natural Gas has gained in value as expressed in all fiat currencies. In fact, the argument can be made in the commodity markets that long-term ownership positions are actually a short bet against paper currencies.

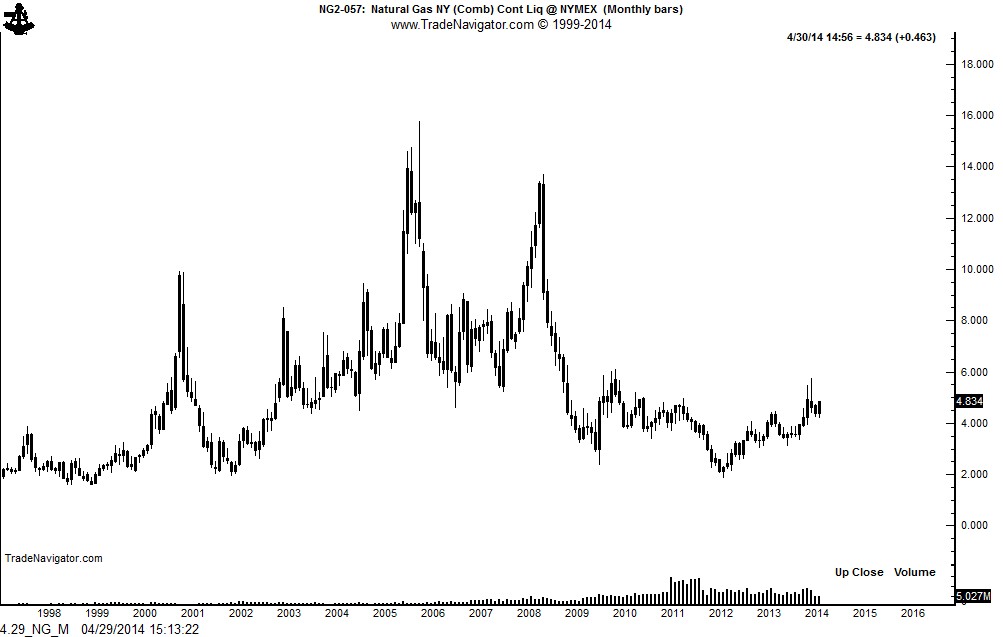

Compared to UNG (the ETF), the monthly chart of Natural Gas futures shows a similar, but much less severe, decline from the 2008 high through the 2013 low. Importantly, the inter-delivery spreads in Natural Gas have gone from more than a full-carrying structure of mid 2008 to a present price inversion whereby the near contracts carry a premium to the deferred contracts. This pricing structure is typical of raw material bull trends.

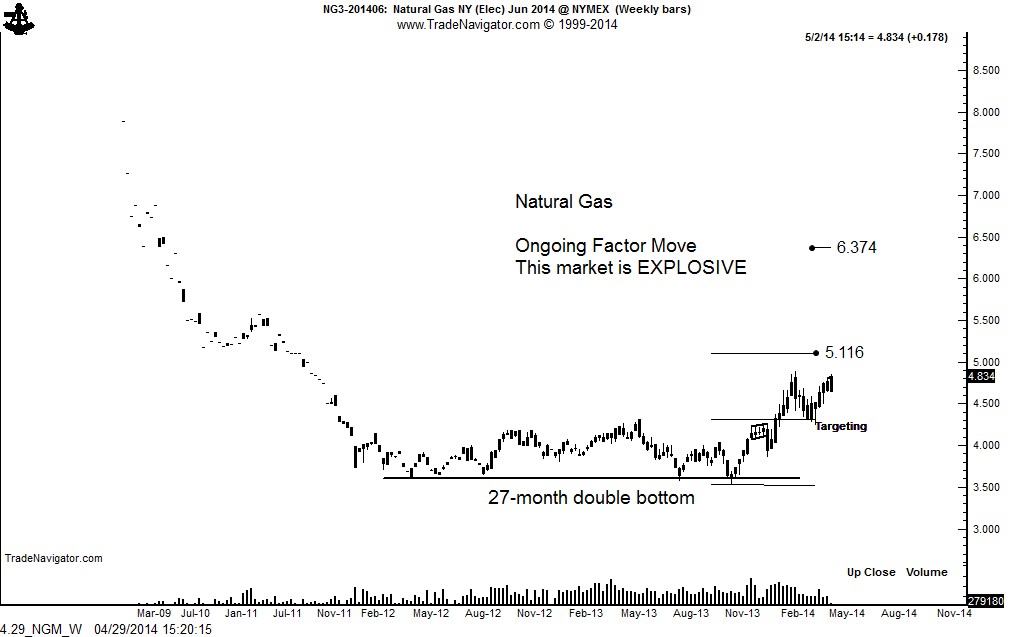

The weekly chart of the June 2014 contract displays a 27-month double bottom pattern with an initial target of 5.10. This pattern was completed in January and retested in April, as better shown on the daily closing price graph. A target of 5.10 is quite realistic given the fact that the March 2014 contract reached a high of 5.73.

I would anticipate that the Nat Gas market will work substantially higher during the next year or two, perhaps reaching the 7.00 level.